Region:Global

Author(s):Rebecca

Product Code:KRAB0221

Pages:94

Published On:August 2025

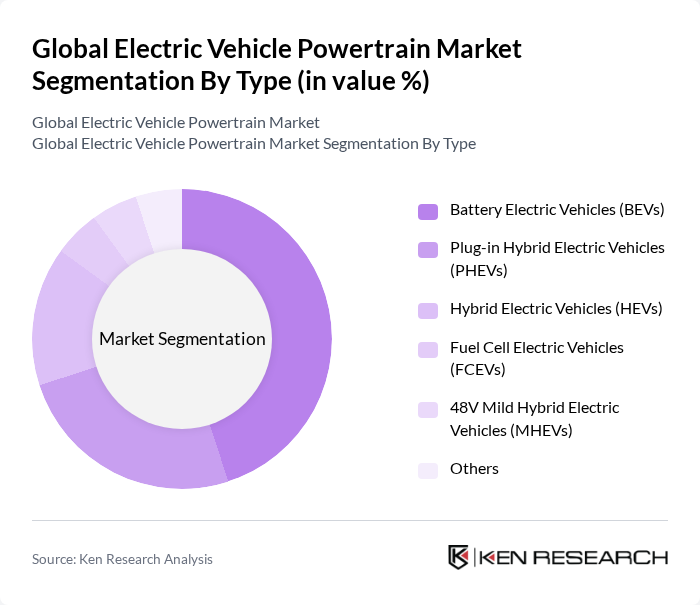

By Type:The market is segmented into various types of electric vehicles, each catering to different consumer needs and preferences. The primary subsegments include Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs), Fuel Cell Electric Vehicles (FCEVs), 48V Mild Hybrid Electric Vehicles (MHEVs), and others. Among these, BEVs are leading the market due to their fully electric nature, zero emissions, and growing consumer acceptance. The increasing availability of charging infrastructure and advancements in battery technology further bolster the demand for BEVs.

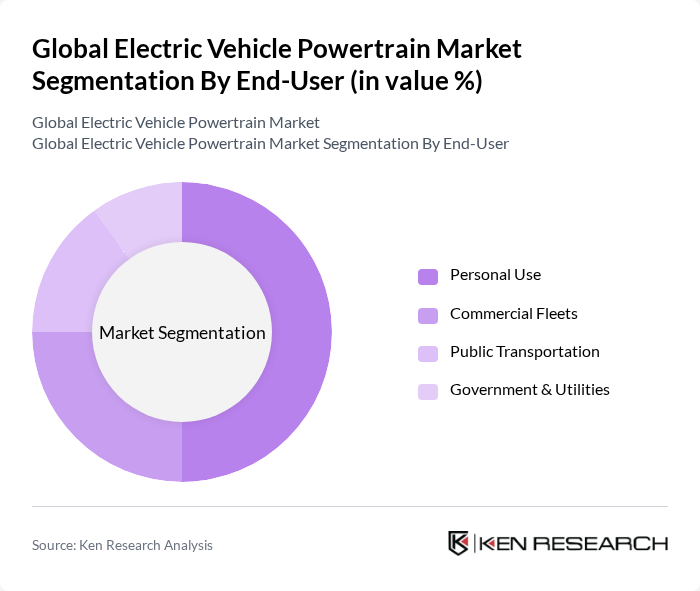

By End-User:The market is segmented based on end-users, including Personal Use, Commercial Fleets, Public Transportation, and Government & Utilities. The Personal Use segment is currently dominating the market, driven by increasing consumer awareness of environmental issues and the desire for cost-effective transportation solutions. The rise in urbanization and the need for sustainable commuting options are also contributing to the growth of this segment.

The Global Electric Vehicle Powertrain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., BYD Company Limited, Nissan Motor Corporation, BMW AG, Ford Motor Company, General Motors Company, Volkswagen AG, Hyundai Motor Company, Kia Corporation, Audi AG, Rivian Automotive, Inc., Lucid Motors, Inc., Polestar Automotive Holding UK PLC, Fisker Inc., Xpeng Inc., SAIC Motor Corporation Limited, Stellantis N.V., Toyota Motor Corporation, Robert Bosch GmbH, ZF Friedrichshafen AG, Magna International Inc., Denso Corporation, Valeo S.A., Schaeffler AG, Vitesco Technologies Group AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric vehicle powertrain market appears promising, driven by technological advancements and increasing consumer demand for sustainable transportation. As battery technology continues to improve, the cost of electric vehicles is expected to decrease, making them more accessible. Additionally, the expansion of charging infrastructure will alleviate range anxiety, further encouraging adoption. With a growing emphasis on renewable energy integration, the market is poised for significant transformation, fostering innovation and investment in electric vehicle technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Hybrid Electric Vehicles (HEVs) Fuel Cell Electric Vehicles (FCEVs) V Mild Hybrid Electric Vehicles (MHEVs) Others |

| By End-User | Personal Use Commercial Fleets Public Transportation Government & Utilities |

| By Component | Electric Motors Batteries Power Electronics (Inverter, Converter, Controller) Transmission Systems (e.g., e-axles, gearboxes) Thermal Management Systems On-board Chargers Battery Management Systems Others |

| By Application | Passenger Vehicles Commercial Vehicles Two-Wheelers Three-Wheelers Buses & Coaches |

| By Sales Channel | Direct Sales Dealerships Online Sales Others |

| By Distribution Mode | Retail Distribution Wholesale Distribution Direct-to-Consumer Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Electric Vehicles | 120 | Product Managers, R&D Engineers |

| Commercial Electric Vehicles | 90 | Fleet Managers, Operations Directors |

| Battery Technology Providers | 60 | Technical Experts, Business Development Managers |

| Charging Infrastructure Companies | 50 | Infrastructure Planners, Sales Executives |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

The Global Electric Vehicle Powertrain Market is valued at approximately USD 185 billion, driven by increasing consumer demand for sustainable transportation, advancements in battery technology, and supportive government policies promoting electric vehicle adoption.