Region:Global

Author(s):Rebecca

Product Code:KRAB0256

Pages:98

Published On:August 2025

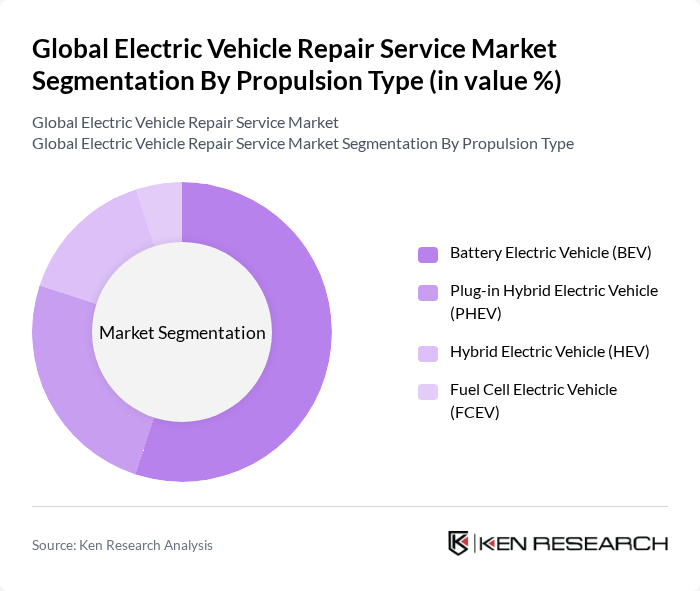

By Propulsion Type:The propulsion type segmentation includes Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), Hybrid Electric Vehicles (HEV), and Fuel Cell Electric Vehicles (FCEV). Among these, Battery Electric Vehicles (BEV) are leading the market due to their growing popularity and the increasing number of models available. The shift towards fully electric vehicles is driven by consumer preferences for sustainability and lower operating costs. As a result, BEVs are expected to dominate the repair service market, necessitating specialized knowledge and tools for maintenance and repair. The market share distribution aligns with the rising adoption of BEVs, which are supported by expanding charging infrastructure and favorable regulatory policies , .

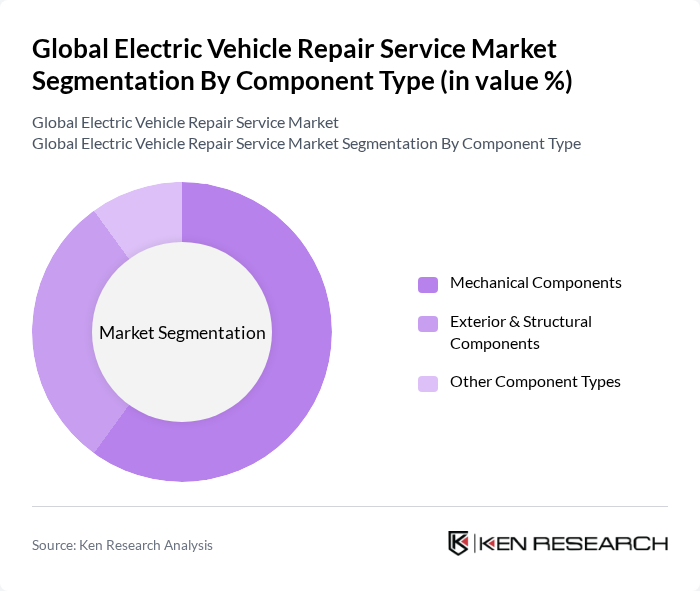

By Component Type:The component type segmentation encompasses Mechanical Components, Exterior & Structural Components, and Other Component Types. Mechanical Components are currently the most significant segment, as they include essential parts such as motors, batteries, and drivetrains that require specialized repair services. The increasing complexity of EV technology necessitates skilled technicians who can handle these components, making this segment crucial for the overall repair service market. The segment's dominance is reinforced by the high frequency of battery and powertrain maintenance needs, and the growing adoption of predictive diagnostics for mechanical systems , .

The Global Electric Vehicle Repair Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla Service Centers, Rivian Automotive, Inc., ChargePoint, Inc., NIO Inc., Lucid Motors, Inc., BYD Company Limited, BMW AG, Ford Motor Company, General Motors Company, Volkswagen AG, Hyundai Motor Company, Kia Corporation, Audi AG, Mercedes-Benz AG, Polestar Automotive Holding UK PLC, AutoNation, Inc., Penske Automotive Group, Inc., Bosch Car Service, Pep Boys – Manny, Moe & Jack, Kwik Fit contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric vehicle repair service market appears promising, driven by ongoing technological advancements and increasing consumer acceptance of electric vehicles. As the market matures, we can expect a rise in specialized repair facilities equipped to handle complex EV systems. Additionally, partnerships with EV manufacturers will likely enhance service offerings, ensuring that repair services keep pace with evolving vehicle technologies and consumer expectations, ultimately fostering a robust repair ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Propulsion Type | Battery Electric Vehicle (BEV) Plug-in Hybrid Electric Vehicle (PHEV) Hybrid Electric Vehicle (HEV) Fuel Cell Electric Vehicle (FCEV) |

| By Component Type | Mechanical Components Exterior & Structural Components Other Component Types |

| By Service Provider | Franchise General Repairs OEM Authorized Service Centers Other Service Providers |

| By Vehicle Type | Passenger Car Commercial Vehicle Two-Wheeled Electric Vehicle |

| By End-User | Individual Consumers Fleet Operators Insurance Companies Automotive OEMs Electric Vehicle Charging Infrastructure Providers |

| By Geography | North America Europe Asia-Pacific South America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Service Centers | 100 | Service Managers, Technicians |

| Electric Vehicle Owners | 120 | Individual Consumers, Fleet Managers |

| Automotive Parts Suppliers | 80 | Procurement Managers, Sales Representatives |

| Industry Experts and Analysts | 40 | Market Analysts, Automotive Consultants |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Global Electric Vehicle Repair Service Market is valued at approximately USD 35 billion, reflecting significant growth driven by the increasing adoption of electric vehicles, advancements in EV technology, and rising demand for specialized repair services.