Region:Global

Author(s):Shubham

Product Code:KRAB0787

Pages:84

Published On:August 2025

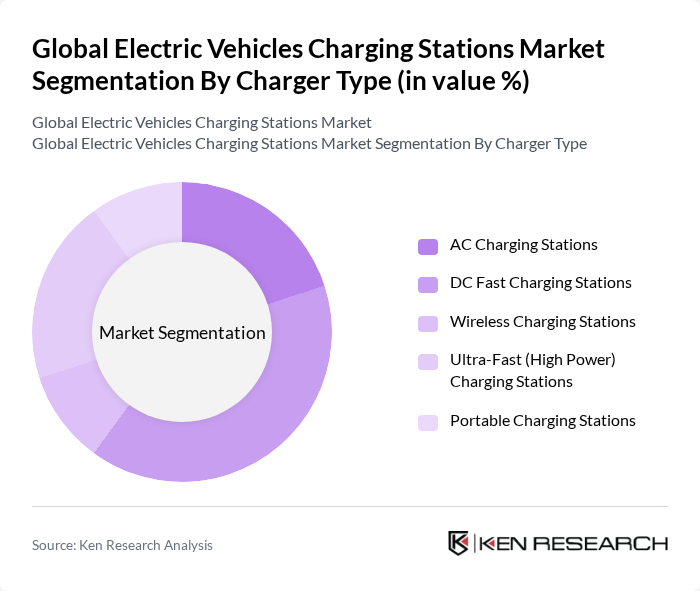

By Charger Type:The charger type segmentation includes various types of charging stations that cater to different consumer needs and preferences. The subsegments are AC Charging Stations, DC Fast Charging Stations, Wireless Charging Stations, Ultra-Fast (High Power) Charging Stations, and Portable Charging Stations. Among these, DC Fast Charging Stations are currently dominating the market due to their ability to charge vehicles rapidly, making them ideal for long-distance travel and reducing downtime for EV users. The increasing number of electric vehicles on the road and the demand for quick charging solutions are driving the growth of this segment. Fast and ultra-fast chargers are seeing accelerated deployment, especially in urban corridors and highway networks, supported by both public and private investments.

By Installation Type:The installation type segmentation includes Fixed Charging Stations and Portable Charging Stations. Fixed Charging Stations are primarily installed in public areas, workplaces, and residential complexes, while Portable Charging Stations offer flexibility for users who need charging solutions on the go. The Fixed Charging Stations segment is currently leading the market due to the growing infrastructure development in urban areas and the increasing number of EVs requiring dedicated charging points. This trend is reinforced by government initiatives and private sector investments to expand charging networks and enhance accessibility.

The Global Electric Vehicles Charging Stations Market is characterized by a dynamic mix of regional and international players. Leading participants such as ChargePoint, Inc., Tesla, Inc., Blink Charging Co., EVBox B.V., Siemens AG, ABB Ltd., Schneider Electric SE, Ionity GmbH, Electrify America, LLC, Shell Recharge Solutions (formerly Greenlots, Inc.), Webasto SE, Noodoe, Inc., Tritium DCFC Limited, ClipperCreek, Inc. (a division of Enphase Energy, Inc.), Enel X Way S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric vehicle charging station market in None appears promising, driven by technological advancements and increasing environmental awareness. The integration of smart charging solutions is expected to enhance user experience and optimize energy consumption. Additionally, as more renewable energy sources are incorporated into the grid, charging stations will likely become more sustainable. The collaboration between charging infrastructure providers and automotive manufacturers will further accelerate the development of innovative solutions, ensuring a robust market growth trajectory.

| Segment | Sub-Segments |

|---|---|

| By Charger Type | AC Charging Stations DC Fast Charging Stations Wireless Charging Stations Ultra-Fast (High Power) Charging Stations Portable Charging Stations |

| By Installation Type | Fixed Charging Stations Portable Charging Stations |

| By Connector Type | CHAdeMO CCS (Combined Charging System) Type 2 Tesla Connector Others |

| By Application | Public Charging Private Charging Fleet Charging Commercial Charging Residential Charging |

| By Charging Speed | Level 1 Charging (Slow) Level 2 Charging (Medium) Level 3 Charging (Fast/DC Fast Charging) Ultra-Fast Charging |

| By Deployment | Private Public |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Investment Source | Private Investment Public Funding Joint Ventures Others |

| By Policy Support | Government Subsidies Tax Incentives Grants and Loans Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Charging Infrastructure | 120 | Charging Station Operators, Municipal Planners |

| Residential Charging Solutions | 90 | Homeowners, Electric Vehicle Owners |

| Commercial Fleet Charging | 60 | Fleet Managers, Logistics Coordinators |

| Fast Charging Technology | 50 | Technology Developers, Electrical Engineers |

| Government Policy Impact | 40 | Policy Makers, Regulatory Affairs Specialists |

The Global Electric Vehicles Charging Stations Market is valued at approximately USD 32 billion, driven by the increasing adoption of electric vehicles, government incentives, and advancements in charging technology.