Region:Global

Author(s):Shubham

Product Code:KRAA3145

Pages:94

Published On:August 2025

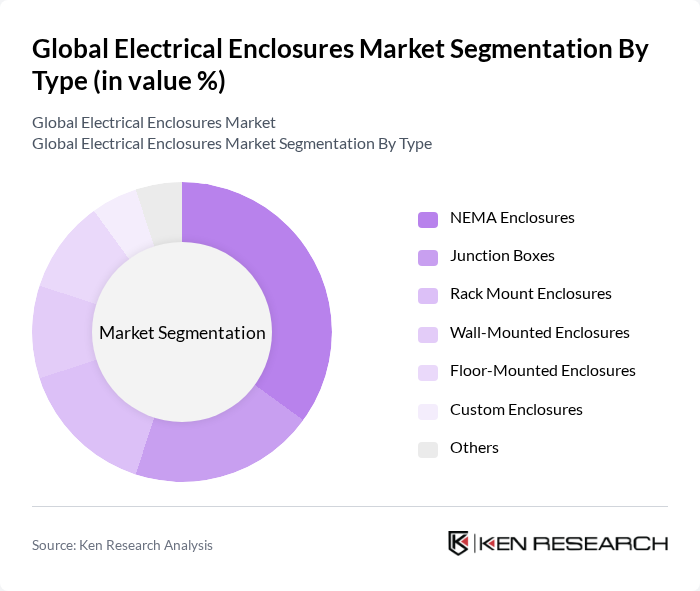

By Type:The market is segmented into various types of enclosures, each serving specific applications and industries. The primary types include NEMA Enclosures, Junction Boxes, Rack Mount Enclosures, Wall-Mounted Enclosures, Floor-Mounted Enclosures, Custom Enclosures, and Others. Among these,NEMA Enclosuresare particularly dominant due to their widespread use in industrial applications, providing essential protection against environmental factors such as dust, moisture, and mechanical impact. The increasing focus on safety, compliance with international standards, and adoption of corrosion-proof materials in water treatment, renewable energy, and manufacturing sectors have further solidified their market position .

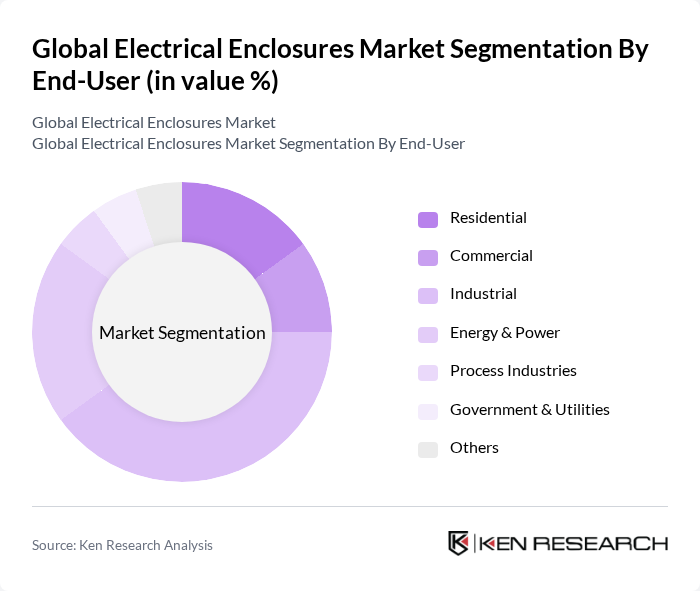

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Energy & Power, Process Industries, Government & Utilities, and Others. TheIndustrial segmentis the leading end-user, driven by the increasing need for electrical safety and protection in manufacturing and processing facilities. The growth of automation, smart technologies, and the expansion of power distribution systems in industrial applications has further propelled the demand for electrical enclosures. Energy & Power and Utilities segments are also experiencing strong growth due to investments in grid modernization and renewable energy infrastructure .

The Global Electrical Enclosures Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schneider Electric SE, ABB Ltd., Eaton Corporation plc, Siemens AG, Rittal GmbH & Co. KG, Pentair plc, Hammond Manufacturing Co. Ltd., Legrand S.A., Adalet (a Scott Fetzer Company), Bison ProFab, Inc., Allied Moulded Products, Inc., Thomas & Betts Corporation (a member of ABB Group), Emerson Electric Co., NEMA Enclosures, Inc., AMETEK, Inc., Hubbell Incorporated, Saginaw Control and Engineering, Eldon Holding AB (nVent Electric plc) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electrical enclosures market appears promising, driven by technological advancements and increasing environmental awareness. The integration of IoT technology into enclosures is expected to enhance functionality and monitoring capabilities, while the shift towards sustainable materials will align with global sustainability goals. Additionally, the growing demand for energy-efficient solutions will further stimulate innovation and investment in the sector, positioning it for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | NEMA Enclosures Junction Boxes Rack Mount Enclosures Wall-Mounted Enclosures Floor-Mounted Enclosures Custom Enclosures Others |

| By End-User | Residential Commercial Industrial Energy & Power Process Industries Government & Utilities Others |

| By Application | Power Distribution Telecommunications Renewable Energy Automation and Control Data Centers Industrial Machinery |

| By Material | Metallic Non-Metallic (Plastic, Composite) |

| By Size | Small Medium Large |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Price Range | Low Medium High |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, U.K., Italy, Spain, Rest of Europe) Asia Pacific (China, Japan, India, Australia, South Korea, Rest of Asia Pacific) Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA) Latin America (Brazil, Mexico, Rest of Latin America) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Electrical Enclosures | 120 | Manufacturing Engineers, Plant Managers |

| Commercial Electrical Enclosures | 90 | Facility Managers, Electrical Contractors |

| Residential Electrical Enclosures | 60 | Home Builders, Electrical Installers |

| Custom Electrical Enclosures | 50 | Product Designers, R&D Engineers |

| Smart Electrical Enclosures | 70 | IoT Specialists, Technology Developers |

The Global Electrical Enclosures Market is valued at approximately USD 8.1 billion, driven by increasing demand for electrical safety and protection across various industries, including energy, telecommunications, and manufacturing.