Region:Global

Author(s):Geetanshi

Product Code:KRAA1197

Pages:100

Published On:August 2025

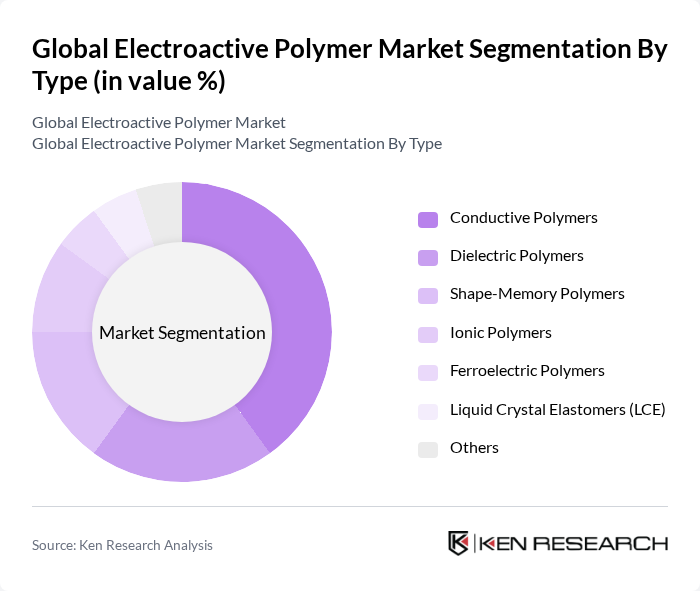

By Type:The electroactive polymer market is segmented into Conductive Polymers, Dielectric Polymers, Shape-Memory Polymers, Ionic Polymers, Ferroelectric Polymers, Liquid Crystal Elastomers (LCE), and Others. Among these,Conductive Polymerslead the market due to their extensive use in electronics, sensors, and energy storage devices. The growing demand for lightweight, flexible, and energy-efficient electronic components is a key driver for this segment, with applications expanding in next-generation displays, actuators, and wearable technologies .

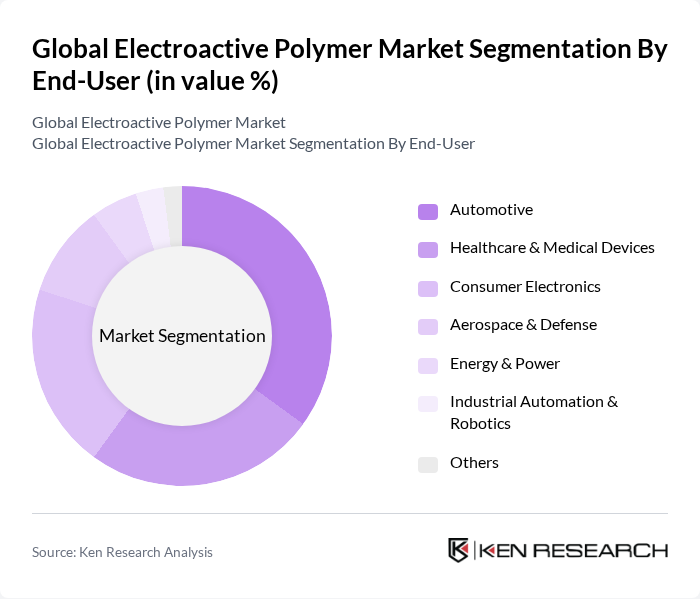

By End-User:The market is also segmented by end-user industries, including Automotive, Healthcare & Medical Devices, Consumer Electronics, Aerospace & Defense, Energy & Power, Industrial Automation & Robotics, and Others. TheAutomotivesector remains the leading end-user, driven by the increasing adoption of electric vehicles and the need for lightweight materials that enhance fuel efficiency and enable advanced electronic features. Healthcare & Medical Devices is another rapidly growing segment, with electroactive polymers being used in prosthetics, drug delivery systems, and implantable devices .

The Global Electroactive Polymer Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont de Nemours, Inc., 3M Company, BASF SE, Covestro AG, Mitsubishi Chemical Corporation, Heraeus Holding GmbH, Solvay S.A., LG Chem Ltd., Huntsman Corporation, Eastman Chemical Company, Parker Hannifin Corporation, RTP Company, SABIC, Teijin Limited, and Kaneka Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electroactive polymer market appears promising, driven by increasing investments in research and development, particularly in sustainable materials. As industries prioritize eco-friendly solutions, the demand for biodegradable electroactive polymers is expected to rise. Additionally, the integration of these materials with IoT devices will likely enhance their functionality, leading to innovative applications across various sectors, including healthcare and consumer electronics, thereby expanding market reach and potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Conductive Polymers Dielectric Polymers Shape-Memory Polymers Ionic Polymers Ferroelectric Polymers Liquid Crystal Elastomers (LCE) Others |

| By End-User | Automotive Healthcare & Medical Devices Consumer Electronics Aerospace & Defense Energy & Power Industrial Automation & Robotics Others |

| By Application | Actuators Sensors Energy Harvesting Devices Smart Textiles & Wearables Drug Delivery Systems Artificial Muscles Coatings & Antistatic Films Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, ASEAN, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Low Medium High |

| By Technology | Conventional Electroactive Polymers Advanced Electroactive Polymers Hybrid Electroactive Polymers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Engineers, Design Managers |

| Aerospace Sector Utilization | 60 | Materials Scientists, Aerospace Engineers |

| Healthcare Device Integration | 50 | Biomedical Engineers, Regulatory Affairs Specialists |

| Consumer Electronics Adoption | 70 | Product Development Managers, Market Analysts |

| Energy Harvesting Solutions | 40 | Renewable Energy Engineers, Project Managers |

The Global Electroactive Polymer Market is valued at approximately USD 5.4 billion, driven by the increasing demand for lightweight and flexible materials across various sectors, including automotive, healthcare, and consumer electronics.