Region:Global

Author(s):Dev

Product Code:KRAC0473

Pages:91

Published On:August 2025

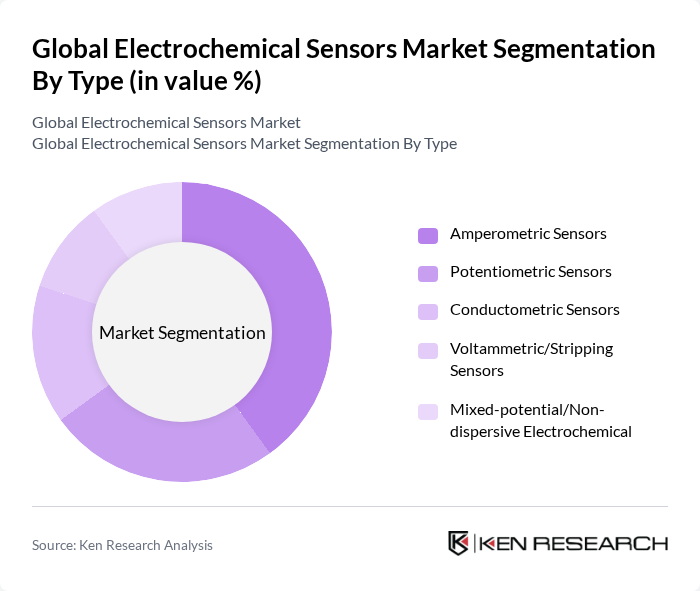

By Type:The electrochemical sensors market can be segmented into various types, including Amperometric Sensors, Potentiometric Sensors, Conductometric Sensors, Voltammetric/Stripping Sensors, and Mixed-potential/Non-dispersive Electrochemical Sensors. Among these,Amperometric Sensorsare widely used in glucose monitoring and gas detection due to high sensitivity and suitability for continuous and point-of-care measurements, supporting their leading adoption in medical diagnostics and environmental monitoring .

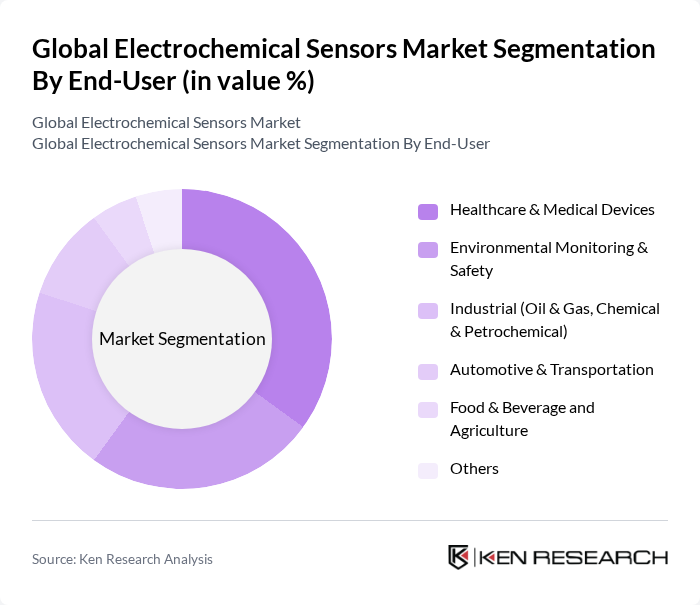

By End-User:The market can also be segmented based on end-users, which include Healthcare & Medical Devices, Environmental Monitoring & Safety, Industrial (Oil & Gas, Chemical & Petrochemical), Automotive & Transportation, Food & Beverage and Agriculture, and Others. TheHealthcare & Medical Devicessegment is currently dominant, underpinned by high utilization of electrochemical sensing in glucose testing and growing point-of-care diagnostics adoption .

The Global Electrochemical Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Drägerwerk AG & Co. KGaA, ABB Ltd., Emerson Electric Co., Teledyne Technologies Incorporated, Alphasense Ltd., Sensirion AG, City Technology Ltd. (a Honeywell company), Yokogawa Electric Corporation, HORIBA, Ltd., Xylem Inc. (incl. YSI, Aanderaa), Endress+Hauser Group Services AG, MSA Safety Incorporated, Figaro Engineering Inc., Nova Biomedical Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the electrochemical sensors market appears promising, driven by technological advancements and increasing regulatory pressures. The integration of artificial intelligence and machine learning into sensor systems is expected to enhance data analysis capabilities, leading to more informed decision-making. Additionally, the push for sustainable practices will likely accelerate the development of eco-friendly sensors, aligning with global environmental goals and creating new avenues for growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Amperometric Sensors Potentiometric Sensors Conductometric Sensors Voltammetric/Stripping Sensors Mixed-potential/Non-dispersive Electrochemical |

| By End-User | Healthcare & Medical Devices Environmental Monitoring & Safety Industrial (Oil & Gas, Chemical & Petrochemical) Automotive & Transportation Food & Beverage and Agriculture Others |

| By Application | Gas Detection (CO, H2S, NOx, O2, VOCs) Water & Wastewater Quality (pH, DO, ORP, ions) Industrial Process Control & Safety Medical Diagnostics & Point-of-Care Wearables & Consumer Health Others |

| By Component | Electrodes/Sensing Elements Membranes & Electrolytes Transducers & Housings Signal Conditioning/Analog Front-End Calibration & Consumables Others |

| By Sales Channel | Direct OEM Sales Distributors/Systems Integrators Online & E-commerce Others |

| By Distribution Mode | Retail Wholesale E-commerce Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Applications | 100 | Biomedical Engineers, Lab Managers |

| Environmental Monitoring | 80 | Environmental Scientists, Regulatory Affairs Specialists |

| Automotive Sensors | 70 | Automotive Engineers, Quality Control Managers |

| Industrial Applications | 90 | Process Engineers, Operations Managers |

| Consumer Electronics | 60 | Product Development Managers, Market Analysts |

The Global Electrochemical Sensors Market is valued at approximately USD 10 billion, based on a five-year historical analysis. This valuation reflects the demand for real-time monitoring across various sectors, including healthcare, environmental, and industrial applications.