Region:Global

Author(s):Shubham

Product Code:KRAB0689

Pages:82

Published On:August 2025

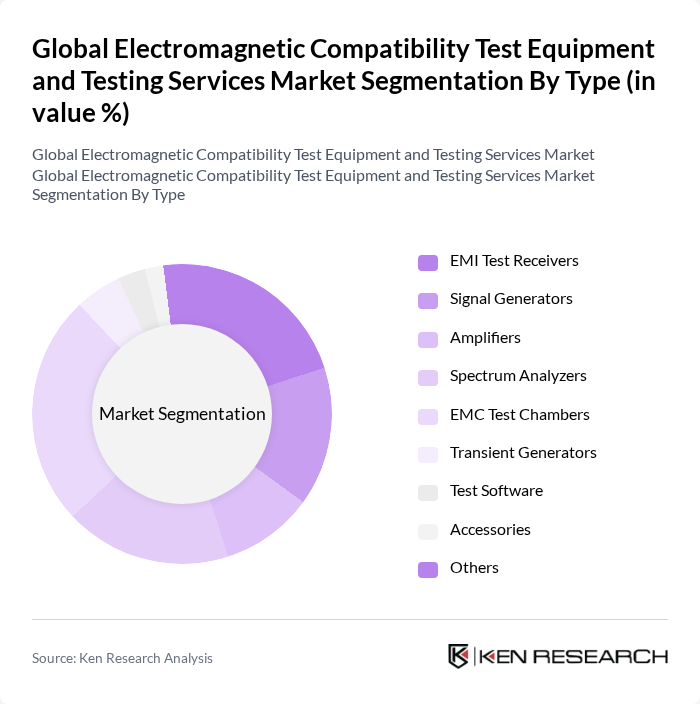

By Type:The market is segmented into various types of equipment and services that address different testing requirements. The primary subsegments include EMI Test Receivers, Signal Generators, Amplifiers, Spectrum Analyzers, EMC Test Chambers, Transient Generators, Test Software, Accessories, and Others. Each subsegment is essential for ensuring that electronic devices meet required EMC standards, with EMC Test Chambers and Spectrum Analyzers being particularly critical for comprehensive compliance testing .

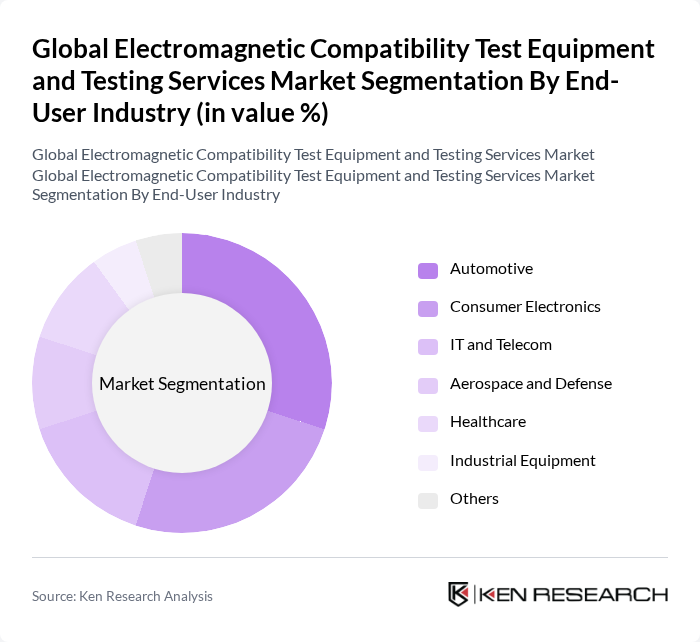

By End-User Industry:The market is also segmented by end-user industries utilizing EMC testing services and equipment. The primary subsegments include Automotive, Consumer Electronics, IT and Telecom, Aerospace and Defense, Healthcare, Industrial Equipment, and Others. Each industry segment has unique electromagnetic compatibility requirements, with the automotive and consumer electronics sectors representing the largest shares due to rapid technological integration and regulatory compliance needs .

The Global Electromagnetic Compatibility Test Equipment and Testing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Keysight Technologies, Inc., Rohde & Schwarz GmbH & Co. KG, Tektronix, Inc., Intertek Group plc, SGS S.A., Bureau Veritas S.A., TÜV Rheinland AG, ETS-Lindgren, Inc., AMETEK, Inc., National Instruments Corporation, UL LLC, DARE!! Instruments, Anritsu Corporation, Compliance Engineering Pty Ltd, and 3M Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electromagnetic compatibility testing market appears promising, driven by the increasing integration of IoT devices and the growth of electric vehicles. As industries prioritize compliance and safety, the demand for advanced testing solutions will likely escalate. Furthermore, the shift towards automated testing processes and AI-driven methodologies will enhance efficiency, enabling companies to meet stringent regulatory requirements while reducing time-to-market for new products.

| Segment | Sub-Segments |

|---|---|

| By Type | EMI Test Receivers Signal Generators Amplifiers Spectrum Analyzers EMC Test Chambers Transient Generators Test Software Accessories Others |

| By End-User Industry | Automotive Consumer Electronics IT and Telecom Aerospace and Defense Healthcare Industrial Equipment Others |

| By Application | Pre-Compliance Testing Compliance Testing Certification Testing Research & Development Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa Australia and New Zealand Others |

| By Service Type | Testing Services Consulting Services Certification Services Training Services Others |

| By Price Range | Low Range Mid Range High Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Testing | 100 | Quality Assurance Managers, Compliance Officers |

| Automotive EMC Compliance | 80 | Automotive Engineers, Regulatory Affairs Specialists |

| Telecommunications Equipment Testing | 70 | Network Engineers, Product Development Managers |

| Medical Device EMC Testing | 50 | Medical Device Engineers, Quality Control Managers |

| Industrial Equipment EMC Compliance | 90 | Manufacturing Engineers, Safety Compliance Officers |

The Global Electromagnetic Compatibility Test Equipment and Testing Services Market is valued at approximately USD 7.6 billion, driven by the increasing adoption of electronic devices and stringent regulatory requirements across various industries.