Region:Global

Author(s):Shubham

Product Code:KRAC0805

Pages:80

Published On:August 2025

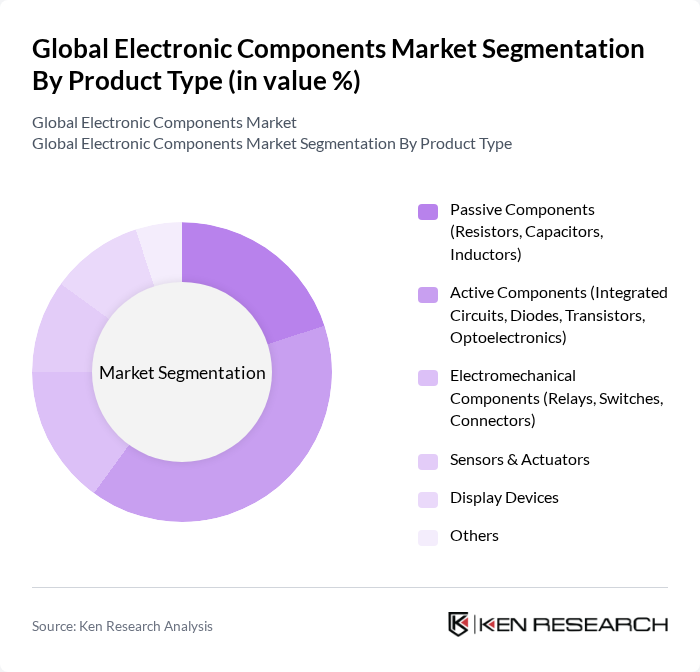

By Product Type:The electronic components market is segmented into various product types, including passive components, active components, electromechanical components, sensors & actuators, display devices, and others. Among these, active components—particularly integrated circuits—dominate the market due to their essential role in modern electronics, enabling functionalities in a wide range of applications from consumer electronics to automotive systems. The increasing complexity of electronic devices, demand for higher performance, and the proliferation of connected and smart technologies are driving the growth of this segment.

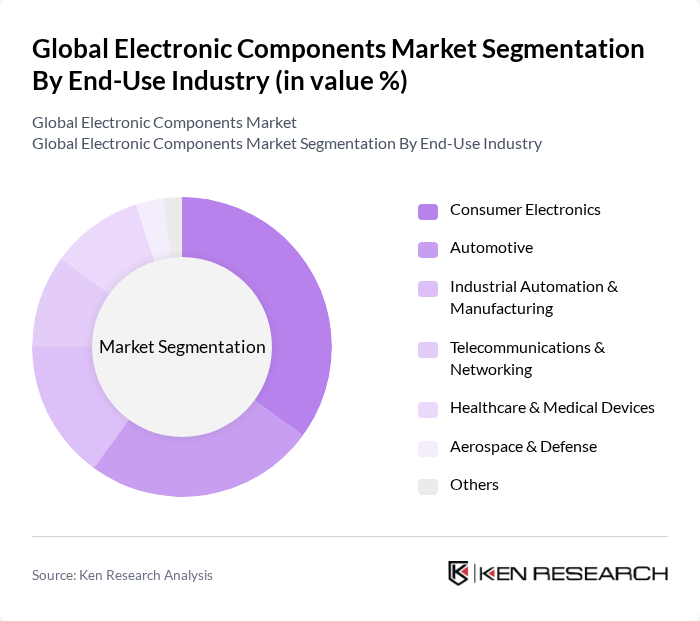

By End-Use Industry:The electronic components market is also segmented by end-use industries, including consumer electronics, automotive, industrial automation & manufacturing, telecommunications & networking, healthcare & medical devices, aerospace & defense, and others. The consumer electronics segment holds a significant share, driven by the continuous demand for smartphones, laptops, and smart home devices. The automotive sector is also witnessing substantial growth due to the increasing integration of electronic components in vehicles for enhanced safety, electrification, and connectivity features. The healthcare sector is experiencing notable growth as well, with increased adoption of electronic components in medical devices and diagnostic equipment.

The Global Electronic Components Market is characterized by a dynamic mix of regional and international players. Leading participants such as Texas Instruments Incorporated, Intel Corporation, Analog Devices, Inc., NXP Semiconductors N.V., STMicroelectronics N.V., Infineon Technologies AG, onsemi (ON Semiconductor Corporation), Microchip Technology Incorporated, Broadcom Inc., Qualcomm Incorporated, Renesas Electronics Corporation, Murata Manufacturing Co., Ltd., TDK Corporation, Vishay Intertechnology, Inc., Panasonic Holdings Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electronic components market appears promising, driven by technological advancements and increasing consumer demand. As industries continue to embrace automation and connectivity, the integration of artificial intelligence and machine learning into electronic devices is expected to enhance functionality and efficiency. Furthermore, the push for sustainability will likely lead to the development of eco-friendly components, aligning with global environmental goals and consumer preferences for greener products, thus shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Passive Components (Resistors, Capacitors, Inductors) Active Components (Integrated Circuits, Diodes, Transistors, Optoelectronics) Electromechanical Components (Relays, Switches, Connectors) Sensors & Actuators Display Devices Others |

| By End-Use Industry | Consumer Electronics Automotive Industrial Automation & Manufacturing Telecommunications & Networking Healthcare & Medical Devices Aerospace & Defense Others |

| By Application | Communication Equipment Computing Devices Home Appliances Automotive Systems Industrial Automation Medical Devices Others |

| By Distribution Channel | Direct Sales Authorized Distributors Online Retail Wholesalers Others |

| By Component Size | Micro Components Mini Components Standard Components Large Components Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing | 100 | Manufacturing Engineers, Production Managers |

| Passive Components Market | 80 | Product Development Engineers, Supply Chain Analysts |

| Connectors and Interconnects | 60 | Design Engineers, Quality Assurance Managers |

| Consumer Electronics Components | 90 | Product Managers, Market Analysts |

| Automotive Electronics | 70 | Automotive Engineers, Procurement Specialists |

The Global Electronic Components Market is valued at approximately USD 600 billion, driven by the increasing demand for consumer electronics, automotive applications, industrial automation, and telecommunications, among other factors.