Region:Global

Author(s):Dev

Product Code:KRAC0389

Pages:96

Published On:August 2025

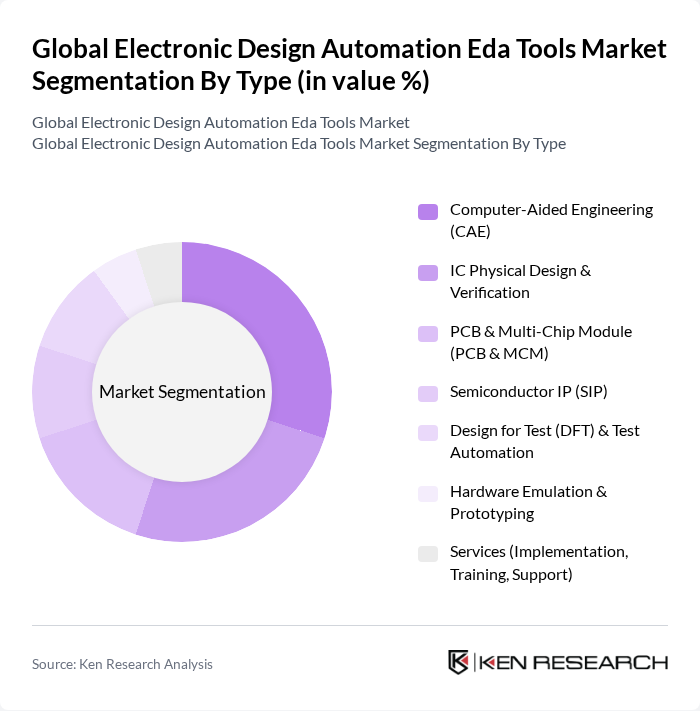

By Type:The EDA tools market can be segmented into various types, including Computer-Aided Engineering (CAE), IC Physical Design & Verification, PCB & Multi-Chip Module (PCB & MCM), Semiconductor IP (SIP), Design for Test (DFT) & Test Automation, Hardware Emulation & Prototyping, and Services (Implementation, Training, Support). Among these, Computer-Aided Engineering (CAE) is the leading sub-segment, driven by its critical role in simulating and analyzing designs to ensure functionality and performance before physical production. The increasing complexity of electronic systems and the need for rapid prototyping further bolster the demand for CAE tools. Recent industry coverage highlights expanding use of AI/ML in simulation and verification, and growing adoption of cloud-based EDA, reinforcing CAE’s centrality across advanced node and system design flows .

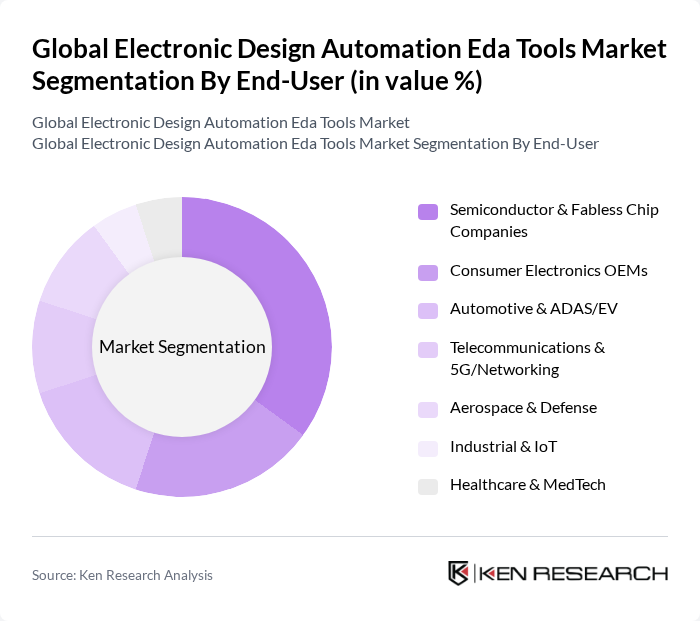

By End-User:The end-user segmentation of the EDA tools market includes Semiconductor & Fabless Chip Companies, Consumer Electronics OEMs, Automotive & ADAS/EV, Telecommunications & 5G/Networking, Aerospace & Defense, Industrial & IoT, and Healthcare & MedTech. The Semiconductor & Fabless Chip Companies segment is the most significant, driven by rapid advancements in chip technology, AI/ML workloads, and high-performance computing. Persistent growth drivers include escalating IC complexity, verification demands, and cloud-accessible design environments that accelerate tape-outs for fabless firms and IDMs .

The Global Electronic Design Automation Eda Tools Market is characterized by a dynamic mix of regional and international players. Leading participants such as Synopsys, Inc., Cadence Design Systems, Inc., Siemens EDA (Mentor Graphics), Ansys, Inc., Keysight Technologies, Inc. (PathWave, ADS), Altium Limited, Zuken Inc., NI (National Instruments), Silvaco Group, Inc., AWR (now part of Cadence), Xilinx (AMD Adaptive Computing), Empyrean Technology, Altair Engineering Inc. (PollEx, PSIM), Agnisys, Inc., Keysight EDA (formerly ASD/Agilent EEsof) contribute to innovation, geographic expansion, and service delivery in this space. Industry trackers emphasize AI- and cloud-enabled design flows, verification scalability, and system co-design across IC, package, and PCB as current competitive vectors .

The future of the EDA tools market is poised for transformative growth, driven by technological advancements and evolving industry needs. As companies increasingly adopt cloud-based solutions, the accessibility and scalability of EDA tools will improve, enabling smaller firms to compete. Additionally, the integration of machine learning will enhance design processes, allowing for more efficient and optimized outcomes. These trends indicate a dynamic landscape where innovation and collaboration will be key to success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Computer-Aided Engineering (CAE) IC Physical Design & Verification PCB & Multi-Chip Module (PCB & MCM) Semiconductor IP (SIP) Design for Test (DFT) & Test Automation Hardware Emulation & Prototyping Services (Implementation, Training, Support) |

| By End-User | Semiconductor & Fabless Chip Companies Consumer Electronics OEMs Automotive & ADAS/EV Telecommunications & 5G/Networking Aerospace & Defense Industrial & IoT Healthcare & MedTech |

| By Application | Integrated Circuit (IC) Design System-on-Chip (SoC) Design FPGA Design ASIC Design Analog/Mixed-Signal & RF D IC & Advanced Packaging (2.5D/Chiplets) |

| By Component | Software (License & Subscription) Services (Consulting, Integration) Hardware (Emulators, Prototyping Boards) |

| By Sales Channel | Direct (Enterprise Sales) Value-Added Resellers (VARs) Online/Marketplace |

| By Deployment Mode | Cloud-Based On-Premises Hybrid |

| By Pricing/License Model | Perpetual License Term/Subscription Token/Flex-Based Licensing Usage-Based/Cloud Credits |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Design Firms | 120 | Design Engineers, Project Managers |

| Consumer Electronics Manufacturers | 100 | Product Development Managers, R&D Directors |

| Automotive Electronics Suppliers | 80 | Systems Engineers, Compliance Officers |

| Telecommunications Equipment Providers | 70 | Network Architects, Technical Leads |

| Academic Institutions and Research Labs | 60 | Research Scientists, Professors in Electrical Engineering |

The Global Electronic Design Automation (EDA) Tools Market is valued at approximately USD 15.5 billion, reflecting sustained demand driven by advanced nodes, AI/ML-enabled design, and cloud-based EDA workflows.