Region:Global

Author(s):Geetanshi

Product Code:KRAB0050

Pages:82

Published On:August 2025

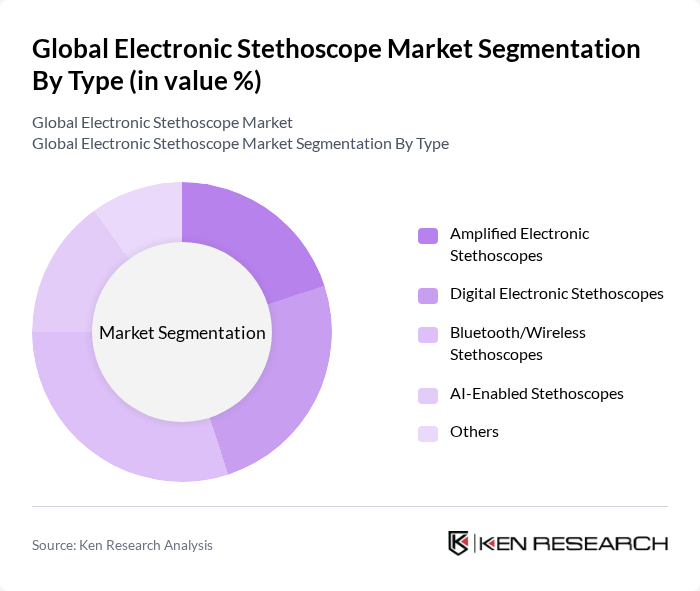

By Type:The electronic stethoscope market is segmented into various types, including Amplified Electronic Stethoscopes, Digital Electronic Stethoscopes, Bluetooth/Wireless Stethoscopes, AI-Enabled Stethoscopes, and Others. Bluetooth/Wireless Stethoscopes are gaining significant traction due to their convenience and ability to connect with mobile devices for enhanced functionality, particularly in telemedicine and remote monitoring applications. The demand for AI-Enabled Stethoscopes is also rising as healthcare providers seek advanced diagnostic tools that leverage artificial intelligence for improved accuracy and data analytics.

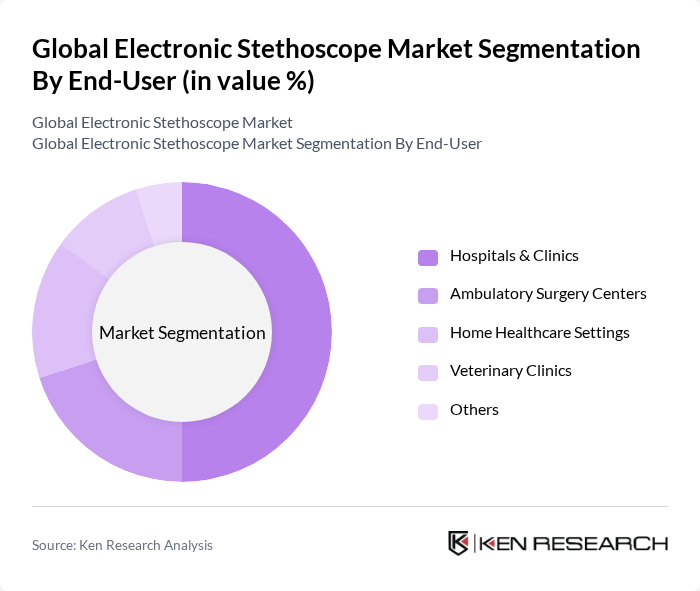

By End-User:The market is segmented by end-users, including Hospitals & Clinics, Ambulatory Surgery Centers, Home Healthcare Settings, Veterinary Clinics, and Others. Hospitals & Clinics dominate the market due to the high volume of patient interactions and the need for accurate diagnostic tools. The increasing trend of home healthcare and telemedicine is also contributing to the growth of electronic stethoscopes, as patients and providers seek reliable solutions for remote health monitoring.

The Global Electronic Stethoscope Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Health Care, Littmann Stethoscopes, Eko Health, Welch Allyn (Hillrom/Baxter International), Thinklabs Medical LLC, American Diagnostic Corporation (ADC), Cardionics (3B Scientific), Stethoscope.com, Medline Industries, LP, Omron Healthcare, Inc., Philips Healthcare, Siemens Healthineers, GE HealthCare, Drägerwerk AG & Co. KGaA, SensiCardiac contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electronic stethoscope market appears promising, driven by technological advancements and increasing healthcare demands. As telemedicine continues to gain traction, the integration of electronic stethoscopes with mobile health applications will enhance remote patient monitoring capabilities. Furthermore, the development of AI-driven diagnostic tools is expected to revolutionize the healthcare landscape, providing healthcare professionals with advanced analytics and decision-making support, ultimately improving patient outcomes and driving market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Amplified Electronic Stethoscopes Digital Electronic Stethoscopes Bluetooth/Wireless Stethoscopes AI-Enabled Stethoscopes Others |

| By End-User | Hospitals & Clinics Ambulatory Surgery Centers Home Healthcare Settings Veterinary Clinics Others |

| By Application | Cardiology Pediatrics General Practice Pulmonology Others |

| By Distribution Channel | Offline Retail & Distributors Online Marketplaces Direct Institutional Tenders Others |

| By Region | North America United States Canada Mexico Europe Germany United Kingdom France Italy Spain Rest of Europe Asia-Pacific China Japan India South Korea Australia Rest of Asia-Pacific Middle East & Africa GCC South Africa Rest of Middle East & Africa South America Brazil Argentina Rest of South America |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Established Brands Emerging Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Directors |

| General Practitioners | 60 | Family Physicians, General Practitioners |

| Cardiology Clinics | 50 | Cardiologists, Clinic Managers |

| Telemedicine Providers | 40 | Telehealth Coordinators, IT Managers |

| Medical Device Distributors | 70 | Sales Representatives, Product Managers |

The Global Electronic Stethoscope Market is valued at approximately USD 491 million, reflecting a significant growth trend driven by advancements in medical technology and increasing demand for remote patient monitoring.