Region:Global

Author(s):Shubham

Product Code:KRAD0709

Pages:95

Published On:August 2025

By Type:The segmentation by type includes various categories of electronic warfare aircraft, each serving distinct operational roles. The subsegments are Fixed-Wing Electronic Warfare Aircraft, Rotary-Wing Electronic Warfare Aircraft, Unmanned Aerial Vehicles (UAVs) with EW Payloads, and Special Mission/ISR Aircraft with Integrated EW Suites. Among these, Fixed-Wing Electronic Warfare Aircraft dominate the market due to their extensive range, payload capacity, and versatility in various combat scenarios. The increasing complexity of modern warfare necessitates the use of these aircraft for effective electronic attack and support operations.

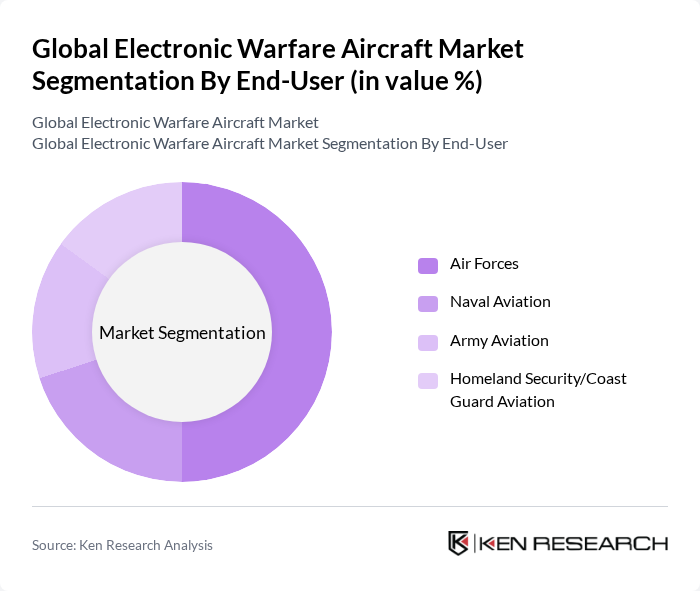

By End-User:The end-user segmentation encompasses various military branches, including Air Forces, Naval Aviation, Army Aviation, and Homeland Security/Coast Guard Aviation. The Air Forces segment is the largest, driven by the need for advanced electronic warfare capabilities to maintain air superiority and conduct strategic operations. The increasing focus on joint operations among military branches further enhances the demand for integrated electronic warfare solutions across all end-user categories.

The Global Electronic Warfare Aircraft Market is characterized by a dynamic mix of regional and international players. Leading participants such as Northrop Grumman Corporation, Raytheon (RTX Corporation), The Boeing Company, Lockheed Martin Corporation, BAE Systems plc, Thales Group, Leonardo S.p.A., Elbit Systems Ltd., L3Harris Technologies, Inc., General Dynamics Mission Systems, Inc., Saab AB, Indra Sistemas, S.A., Collins Aerospace (an RTX business), Airbus Defence and Space, Israel Aerospace Industries (IAI) – ELTA Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electronic warfare aircraft market appears promising, driven by ongoing technological advancements and increasing defense budgets. As nations prioritize modernization and readiness, investments in next-generation electronic warfare systems are expected to rise significantly. Additionally, the integration of artificial intelligence and machine learning into these systems will enhance operational effectiveness, making them indispensable in modern warfare. The focus on cyber warfare capabilities will further shape the market landscape, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-Wing Electronic Warfare Aircraft (e.g., EA-18G, EC-37B, RC-135 variants) Rotary-Wing Electronic Warfare Aircraft (e.g., EH-101/CH-47 EW-configured, MH-60 EW variants) Unmanned Aerial Vehicles (UAVs) with EW Payloads (e.g., MQ-9 with EW pods, ISR/EW UAS) Special Mission/ISR Aircraft with Integrated EW Suites (e.g., Gulfstream/Global Express platforms) |

| By End-User | Air Forces Naval Aviation Army Aviation Homeland Security/Coast Guard Aviation |

| By Application | Electronic Attack (EA)/Jamming Electronic Support (ESM)/SIGINT Electronic Protection (EP)/Self-Protection SEAD/DEAD Support and Escort Jamming |

| By Component | Electronic Support Measures (ESM)/Radar Warning Receivers (RWR) Electronic Countermeasures (ECM)/Jammers (DRFM, DEW-ready) Countermeasures & Self-Protection (DIRCM, MAWS, dispensers) Communications EW/COMINT and Data Links |

| By Sales Channel | Government-to-Government (FMS/Direct Commercial Sales) OEM Direct (Airframe Primes) Tier-1/Tier-2 Integrators MRO/Upgrade and Retrofit Programs |

| By Distribution Mode | New-Build Procurement Retrofit/Modernization Lease/Service-Based EW Training Support Contractor-Owned, Contractor-Operated (COCO) Aggressor/Jammer Services |

| By Price Range | Light/Trainer-Based EW Platforms Medium (Rotary/UAV/ISR-EW) Heavy (Dedicated EA/Strategic ISR-EW) Mission Kit-Only (Pods/Suites for Existing Aircraft) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Departments | 100 | Procurement Officers, Defense Budget Analysts |

| Aerospace Engineering Firms | 80 | Lead Engineers, Project Managers |

| Defense Contractors | 70 | Business Development Managers, Technical Directors |

| Government Defense Agencies | 90 | Policy Makers, Strategic Planners |

| Military Technology Experts | 60 | Research Scientists, Defense Analysts |

The Global Electronic Warfare Aircraft Market is valued at approximately USD 17 billion, reflecting a significant portion of the broader electronic warfare market, driven by increased defense budgets and advancements in electronic warfare technologies.