Region:Global

Author(s):Dev

Product Code:KRAD0397

Pages:93

Published On:August 2025

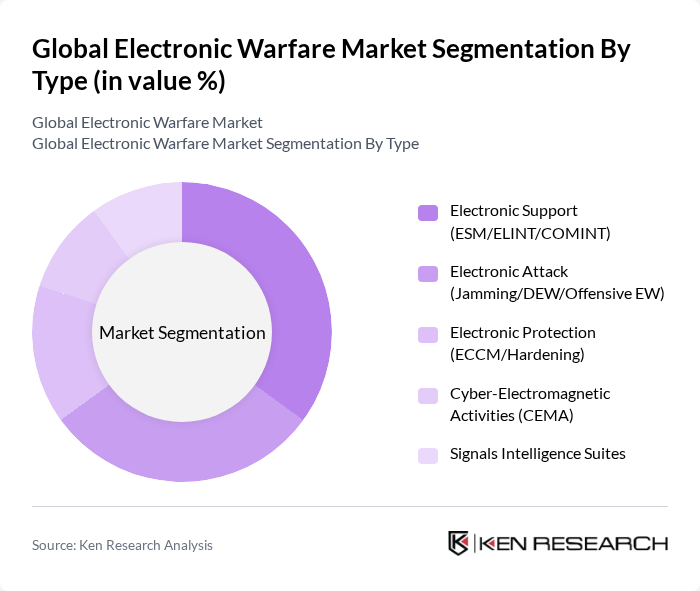

By Type:The electronic warfare market is segmented into various types, including Electronic Support (ESM/ELINT/COMINT), Electronic Attack (Jamming/DEW/Offensive EW), Electronic Protection (ECCM/Hardening), Cyber-Electromagnetic Activities (CEMA), and Signals Intelligence Suites. Among these, Electronic Support is currently the leading subsegment due to its critical role in intelligence gathering and situational awareness in military operations.

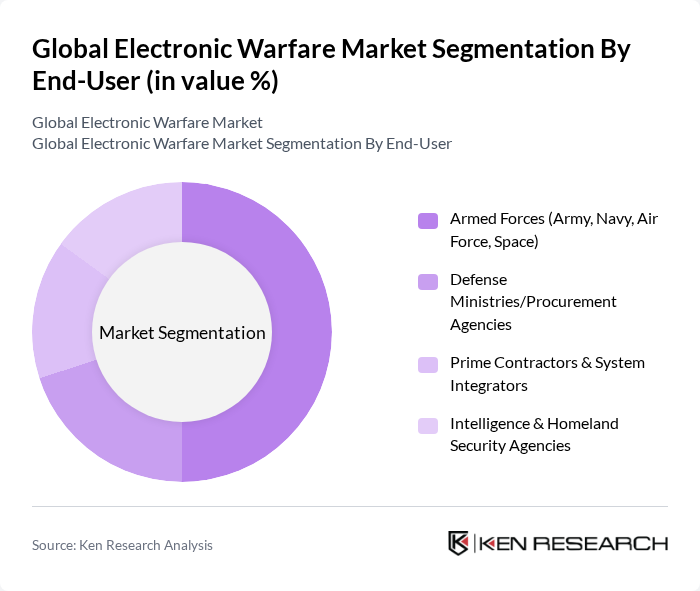

By End-User:The end-user segmentation includes Armed Forces (Army, Navy, Air Force, Space), Defense Ministries/Procurement Agencies, Prime Contractors & System Integrators, and Intelligence & Homeland Security Agencies. The Armed Forces segment dominates the market, driven by the increasing need for advanced electronic warfare capabilities to enhance operational effectiveness and counter emerging threats.

The Global Electronic Warfare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Northrop Grumman Corporation, RTX Corporation (formerly Raytheon Technologies), Lockheed Martin Corporation, BAE Systems plc, Thales Group, L3Harris Technologies, Inc., Leonardo S.p.A., Elbit Systems Ltd., Saab AB, General Dynamics Corporation, HENSOLDT AG, Israel Aerospace Industries (IAI), Mercury Systems, Inc., Teledyne FLIR LLC, Cobham Limited (including Ultra Electronics) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electronic warfare market appears promising, driven by increasing defense budgets and the urgent need to address rising cybersecurity threats. As nations prioritize military modernization, investments in advanced EW systems are expected to accelerate. Additionally, the integration of artificial intelligence and machine learning into electronic warfare capabilities will enhance operational effectiveness. The collaboration between governments and private sectors is likely to foster innovation, ensuring that electronic warfare solutions remain at the forefront of defense strategies in an evolving geopolitical landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Electronic Support (ESM/ELINT/COMINT) Electronic Attack (Jamming/DEW/Offensive EW) Electronic Protection (ECCM/Hardening) Cyber-Electromagnetic Activities (CEMA) Signals Intelligence Suites |

| By End-User | Armed Forces (Army, Navy, Air Force, Space) Defense Ministries/Procurement Agencies Prime Contractors & System Integrators Intelligence & Homeland Security Agencies |

| By Application | Airborne EW (Pods, Self-Protection Suites) Naval EW (Shipborne ESM/ECM, Decoys) Land EW (Tactical Jammers, Ground ESM) Space & Space-support EW (Space ISR, SATCOM EW) |

| By Component | Hardware (RF Front-Ends, Antennas, DRFMs, Receivers) Software (Signal Processing, AI/ML, EWOS) Services (Integration, Testing, Training, MRO) |

| By Sales Channel | Direct Government Procurement (FMS/DCS) OEM/Prime Contractor Sales System Integrators & Tier-1 Partnerships |

| By Distribution Mode | B2G B2B |

| By Price Range | Subsystem-Level (< USD 1 million) System-Level (USD 1–20 million) Platform-Integrated Solutions (> USD 20 million) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Departments | 120 | Procurement Officers, Defense Budget Analysts |

| Defense Technology Developers | 90 | R&D Managers, Product Development Engineers |

| Military Strategy and Operations | 80 | Military Strategists, Operations Commanders |

| Government Defense Agencies | 60 | Policy Makers, Defense Analysts |

| Industry Experts and Consultants | 70 | Defense Consultants, Market Analysts |

The Global Electronic Warfare Market is valued at approximately USD 30 billion, driven by increasing demand for advanced military capabilities, geopolitical tensions, and technological advancements in electronic warfare systems.