Region:Global

Author(s):Rebecca

Product Code:KRAD0230

Pages:85

Published On:August 2025

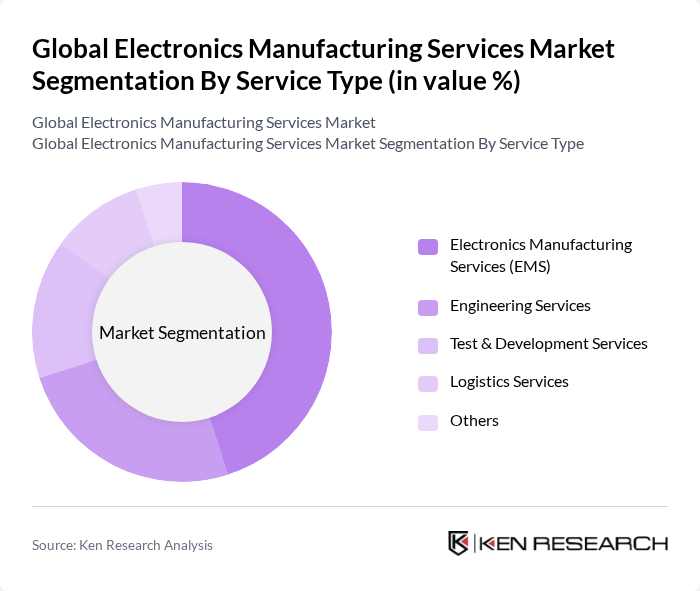

By Service Type:The service type segmentation includes Electronics Manufacturing Services (EMS), Engineering Services, Test & Development Services, Logistics Services, and Others. Among these, Electronics Manufacturing Services (EMS) is the leading sub-segment, driven by the increasing demand for outsourced manufacturing solutions, especially for high-volume and high-mix production. Companies are increasingly relying on EMS providers to enhance production efficiency, accelerate time-to-market, and reduce operational costs. Engineering Services are critical for product design, prototyping, and innovation, while Logistics Services are essential for managing complex global supply chains and ensuring timely delivery of components and finished products.

By Application:The application segmentation encompasses Consumer Electronics, Industrial Electronics, Automotive Electronics, Medical & Healthcare Electronics, Telecommunications Equipment, Aerospace & Defense Electronics, Computer & IT Hardware, and Others. The Consumer Electronics segment is the dominant application area, fueled by the growing demand for smartphones, tablets, wearables, and smart home devices. Automotive Electronics is also witnessing significant growth due to the increasing integration of electronics in vehicles, driven by trends such as electric vehicles, advanced driver-assistance systems (ADAS), and connected car technologies. Industrial Electronics is expanding as factories adopt automation, robotics, and industrial IoT solutions.

The Global Electronics Manufacturing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Foxconn Technology Group (Hon Hai Precision Industry Co., Ltd.), Jabil Inc., Flex Ltd., Celestica Inc., Sanmina Corporation, Pegatron Corporation, Wistron Corporation, Benchmark Electronics, Inc., New Kinpo Group, Zollner Elektronik AG, Key Tronic Corporation, Lite-On Technology Corporation, Vexos Inc., UMC Electronics Co., Ltd., Asteelflash (part of USI/ASE Technology Holding), Plexus Corp., Venture Corporation Limited, Kimball Electronics, Inc., Elbit Systems Ltd., Creation Technologies LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electronics manufacturing services market appears promising, driven by technological advancements and evolving consumer preferences. As manufacturers increasingly adopt Industry 4.0 principles, the integration of AI and IoT will enhance operational efficiency and product customization. Additionally, the focus on sustainability will shape production practices, with companies investing in eco-friendly technologies. These trends indicate a dynamic market landscape, where adaptability and innovation will be key to success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Electronics Manufacturing Services (EMS) Engineering Services Test & Development Services Logistics Services Others |

| By Application | Consumer Electronics Industrial Electronics Automotive Electronics Medical & Healthcare Electronics Telecommunications Equipment Aerospace & Defense Electronics Computer & IT Hardware Others |

| By End-User Industry | Consumer Electronics Manufacturers Automotive Manufacturers Industrial Equipment Manufacturers Medical Device Manufacturers Telecommunications Providers Aerospace and Defense Computer & IT Companies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturing | 100 | Production Managers, Quality Assurance Leads |

| Telecommunications Equipment Production | 80 | Supply Chain Directors, Operations Executives |

| Automotive Electronics Manufacturing | 60 | Engineering Managers, Procurement Specialists |

| Industrial Electronics Production | 50 | Plant Managers, R&D Directors |

| Medical Electronics Manufacturing | 40 | Regulatory Affairs Managers, Product Development Leads |

The Global Electronics Manufacturing Services Market is valued at approximately USD 505 billion, driven by the increasing demand for consumer electronics and advancements in technologies such as IoT and AI, along with a trend towards outsourcing manufacturing processes.