Region:Global

Author(s):Geetanshi

Product Code:KRAA2787

Pages:97

Published On:August 2025

By Product Category:The product category segmentation includes Consumer Electronics, Home Appliances, Mobile Devices, Wearable Technology, Computing Devices, Gaming Devices, and Other Electronics. Among these, Consumer Electronics—encompassing TVs, audio systems, and cameras—remains the leading subsegment. This is driven by ongoing innovation in smart home devices, increased consumer interest in home entertainment systems, and the surge in demand for high-definition televisions and advanced audio equipment. The integration of IoT and AI technologies into consumer electronics further accelerates growth in this segment .

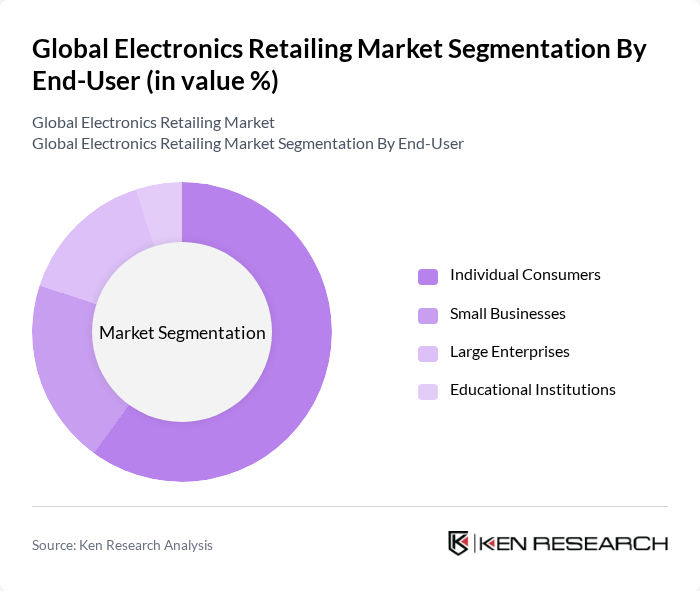

By End-User:The end-user segmentation comprises Individual Consumers, Small Businesses, Large Enterprises, and Educational Institutions. Individual Consumers constitute the largest segment, propelled by the widespread adoption of smart devices, increased disposable income, and the growing preference for online shopping. The convenience of digital purchasing and the desire for the latest technology continue to drive demand among individual consumers. Small businesses and enterprises are also increasing their investments in electronics to support digital transformation and remote work infrastructure .

The Global Electronics Retailing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Best Buy Co., Inc., Amazon.com, Inc., Walmart Inc., Target Corporation, Alibaba Group Holding Limited, JD.com, Inc., MediaMarktSaturn Retail Group, Dixons Carphone plc (Currys), Croma (Infiniti Retail Ltd.), Boulanger SA, Samsung Electronics Co., Ltd., Sony Group Corporation, LG Electronics Inc., Panasonic Corporation, Apple Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electronics retailing market in None appears promising, driven by the increasing integration of technology in everyday life and the growing preference for online shopping. As consumers become more tech-savvy, retailers will need to adapt by enhancing their digital presence and offering personalized shopping experiences. Additionally, the focus on sustainability and eco-friendly products is expected to shape consumer choices, prompting retailers to innovate and align their offerings with these emerging trends.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Consumer Electronics (TVs, Audio, Cameras) Home Appliances (Refrigerators, Washing Machines, Microwaves) Mobile Devices (Smartphones, Tablets) Wearable Technology (Smartwatches, Fitness Bands) Computing Devices (Laptops, Desktops, Monitors) Gaming Devices (Consoles, Accessories) Other Electronics (Drones, Smart Home Devices) |

| By End-User | Individual Consumers Small Businesses Large Enterprises Educational Institutions |

| By Sales Channel | Online Retail (E-commerce Platforms, Brand Websites) Brick-and-Mortar Stores (Specialty Electronics Retailers, Hypermarkets) Wholesale Distributors Direct Sales (Brand Outlets, Pop-up Stores) |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Models |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers |

| By Product Lifecycle Stage | New Products Growth Stage Products Mature Products Declining Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Purchases | 150 | General Consumers, Tech Enthusiasts |

| Retail Store Operations | 100 | Store Managers, Sales Associates |

| Online Electronics Sales | 120 | E-commerce Managers, Digital Marketing Specialists |

| Supply Chain Management in Electronics | 80 | Logistics Coordinators, Supply Chain Analysts |

| Consumer Feedback on Electronics | 140 | End Users, Product Reviewers |

The Global Electronics Retailing Market is valued at approximately USD 1.1 trillion, reflecting significant growth driven by increasing consumer demand for electronics, technological advancements, and the rise of e-commerce platforms.