Region:Global

Author(s):Shubham

Product Code:KRAD0732

Pages:100

Published On:August 2025

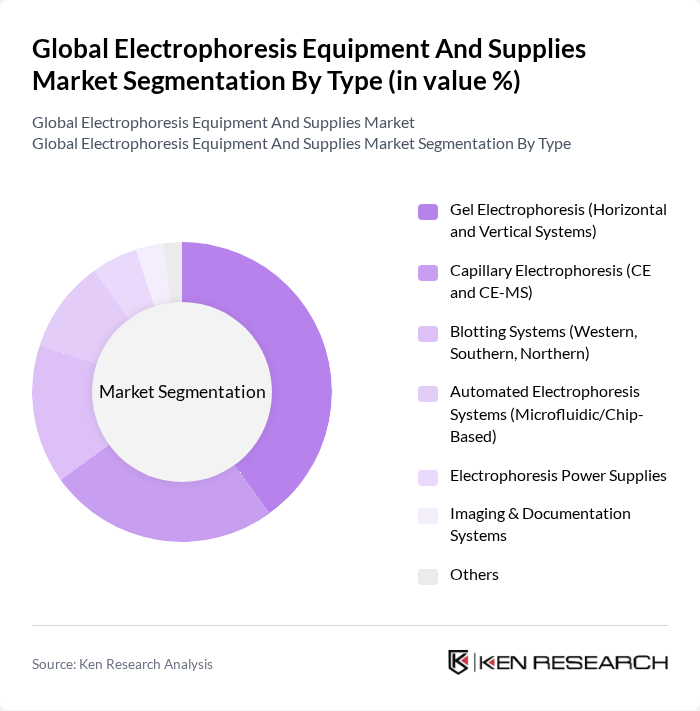

By Type:The electrophoresis equipment and supplies market can be segmented into various types, including Gel Electrophoresis, Capillary Electrophoresis, Blotting Systems, Automated Electrophoresis Systems, Electrophoresis Power Supplies, Imaging & Documentation Systems, and Others. Among these, Gel Electrophoresis systems, which include both horizontal and vertical systems, are widely used for routine nucleic acid and protein separations due to versatility and cost-effectiveness, while capillary electrophoresis is favored for higher-resolution, automated, and quantitative applications in research and clinical workflows.

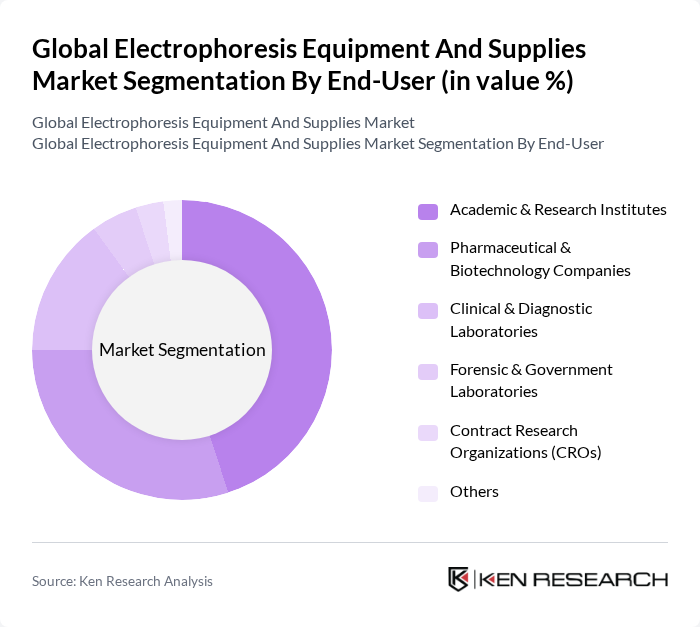

By End-User:The market can also be segmented by end-user categories, which include Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Clinical & Diagnostic Laboratories, Forensic & Government Laboratories, Contract Research Organizations (CROs), and Others. Academic and research institutes remain major users for basic molecular biology workflows, while pharmaceutical and biotechnology companies represent a substantial share given expanding R&D, bioprocessing quality control, and biomarker work; clinical labs adopt electrophoresis for protein electrophoresis, hemoglobin analysis, and confirmatory tests.

The Global Electrophoresis Equipment And Supplies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., GE HealthCare Technologies Inc., Merck KGaA (Merck Life Science), QIAGEN N.V., Revvity, Inc. (formerly PerkinElmer, Inc.), Sebia, Lonza Group Ltd., Cleaver Scientific Ltd., Avantor, Inc. (including VWR International), Eppendorf SE, New England Biolabs, Inc., Promega Corporation, Takara Bio Inc., Danaher Corporation (Beckman Coulter Life Sciences; SCIEX), Shimadzu Corporation, Analytik Jena GmbH+Co. KG (Endress+Hauser Group), Syngene (a division of Synoptics Ltd.), Bio-Techne Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electrophoresis equipment market appears promising, driven by ongoing technological advancements and increasing applications in personalized medicine. As laboratories continue to adopt automation and miniaturization trends, the demand for efficient and compact electrophoresis systems is expected to rise. Furthermore, the integration of artificial intelligence in data analysis will enhance the accuracy and speed of electrophoresis results, positioning the market for significant growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Gel Electrophoresis (Horizontal and Vertical Systems) Capillary Electrophoresis (CE and CE-MS) Blotting Systems (Western, Southern, Northern) Automated Electrophoresis Systems (Microfluidic/Chip-Based) Electrophoresis Power Supplies Imaging & Documentation Systems Others |

| By End-User | Academic & Research Institutes Pharmaceutical & Biotechnology Companies Clinical & Diagnostic Laboratories Forensic & Government Laboratories Contract Research Organizations (CROs) Others |

| By Application | DNA Analysis (Genotyping, Fragment Analysis) Protein Analysis (SDS-PAGE, Native PAGE, IEF) RNA Analysis Forensic and Clinical Diagnostics (Hemoglobin/Electrophoretic Profiling) Quality Control in Bioprocessing Others |

| By Component | Electrophoresis Instruments Consumables (Gels, Buffers, Reagents, Stains) Software & Analysis Tools Accessories (Cassettes, Trays, Combs, Cuvettes) Others |

| By Distribution Channel | Direct Sales Distributors/Resellers E-commerce/Online Sales Tender/Institutional Procurement Others |

| By Price Range | Entry-Level Mid-Range Premium/High-End Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biotechnology Research Labs | 120 | Lab Managers, Research Scientists |

| Clinical Diagnostics Laboratories | 100 | Laboratory Technicians, Quality Control Managers |

| Academic Institutions | 80 | Professors, Graduate Researchers |

| Pharmaceutical Companies | 70 | R&D Directors, Product Development Managers |

| Government Research Facilities | 60 | Research Administrators, Research Coordinators |

The Global Electrophoresis Equipment and Supplies Market is valued at approximately USD 2.3 billion, reflecting a comprehensive analysis of equipment and supplies focused on gel, capillary, blotting, and related systems within the electrophoresis category.