Region:Global

Author(s):Shubham

Product Code:KRAD0800

Pages:83

Published On:August 2025

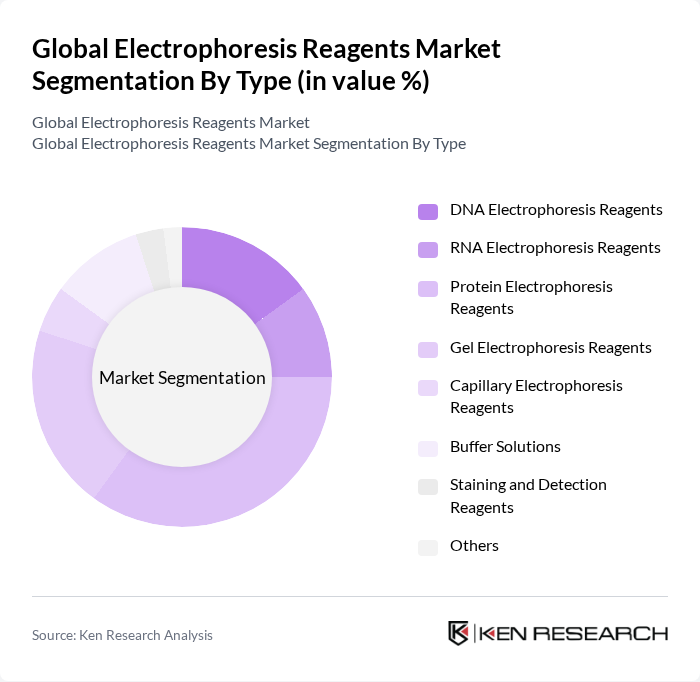

By Type:The electrophoresis reagents market can be segmented into various types, including DNA electrophoresis reagents, RNA electrophoresis reagents, protein electrophoresis reagents, gel electrophoresis reagents, capillary electrophoresis reagents, buffer solutions, staining and detection reagents, and others. Among these, protein electrophoresis reagents hold the largest share due to their extensive use in research and clinical laboratories for protein analysis and characterization. The increasing prevalence of diseases requiring protein analysis, such as cancer and metabolic disorders, drives demand for these reagents. Gel electrophoresis reagents and buffer solutions also represent significant segments, reflecting their critical role in molecular separation and analysis .

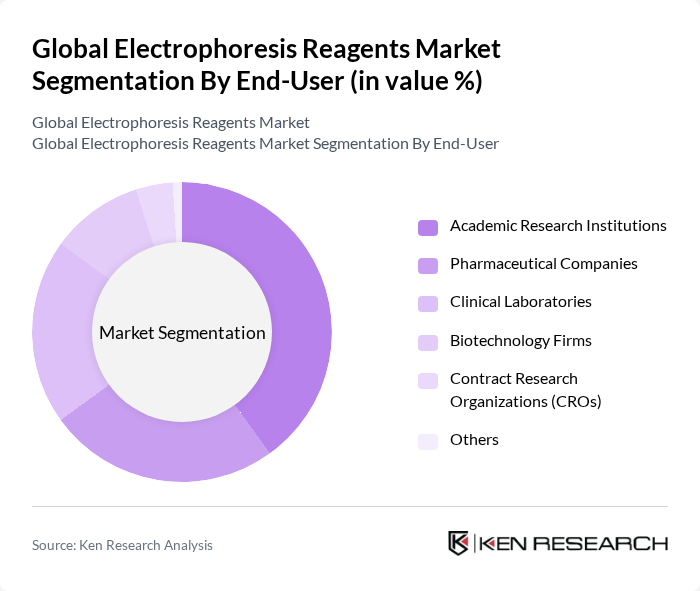

By End-User:The market can also be segmented based on end-users, which include academic research institutions, pharmaceutical companies, clinical laboratories, biotechnology firms, contract research organizations (CROs), and others. Pharmaceutical and biotechnology companies together represent the largest end-user segment, reflecting the ongoing expansion of drug discovery and molecular diagnostics. Academic research institutions and clinical laboratories also contribute significantly, driven by increased research funding and the growing need for advanced molecular analysis in healthcare and diagnostics .

The Global Electrophoresis Reagents Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., GE Healthcare (now Cytiva), Merck KGaA (MilliporeSigma in US/Canada), Agilent Technologies, Inc., Sigma-Aldrich Corporation (now part of Merck KGaA), Promega Corporation, QIAGEN N.V., Roche Diagnostics, Takara Bio Inc., New England Biolabs, Inc., Eppendorf AG, PerkinElmer, Inc. (now Revvity, Inc.), Lonza Group AG, VWR International, LLC (Avantor, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electrophoresis reagents market appears promising, driven by technological advancements and increasing applications in various fields. As laboratories continue to adopt automation and integrate artificial intelligence into their workflows, the efficiency and accuracy of electrophoresis processes will improve. Furthermore, the growing focus on personalized medicine will likely expand the use of electrophoresis in clinical settings, enhancing diagnostic capabilities and patient outcomes in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | DNA Electrophoresis Reagents RNA Electrophoresis Reagents Protein Electrophoresis Reagents Gel Electrophoresis Reagents Capillary Electrophoresis Reagents Buffer Solutions (e.g., TAE, TBE, SDS-PAGE buffers) Staining and Detection Reagents (e.g., Ethidium Bromide, SYBR Green, Coomassie Brilliant Blue) Others |

| By End-User | Academic Research Institutions Pharmaceutical Companies Clinical Laboratories Biotechnology Firms Contract Research Organizations (CROs) Others |

| By Application | Genetic Research Proteomics Diagnostics Forensic Science Drug Discovery & Development Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Pharmacies Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Russia, Netherlands, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA) |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Packaging Type | Bulk Packaging Single-use Packaging Multi-use Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Academic Research Laboratories | 100 | Lab Directors, Research Scientists |

| Biotechnology Firms | 60 | Procurement Managers, R&D Managers |

| Pharmaceutical Companies | 70 | Quality Control Managers, Regulatory Affairs Specialists |

| Clinical Diagnostics Labs | 50 | Laboratory Technicians, Operations Managers |

| Manufacturers of Electrophoresis Equipment | 40 | Product Managers, Sales Managers |

The Global Electrophoresis Reagents Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased demand for electrophoresis techniques in genetic research, diagnostics, and drug discovery.