Region:Global

Author(s):Dev

Product Code:KRAA2565

Pages:99

Published On:August 2025

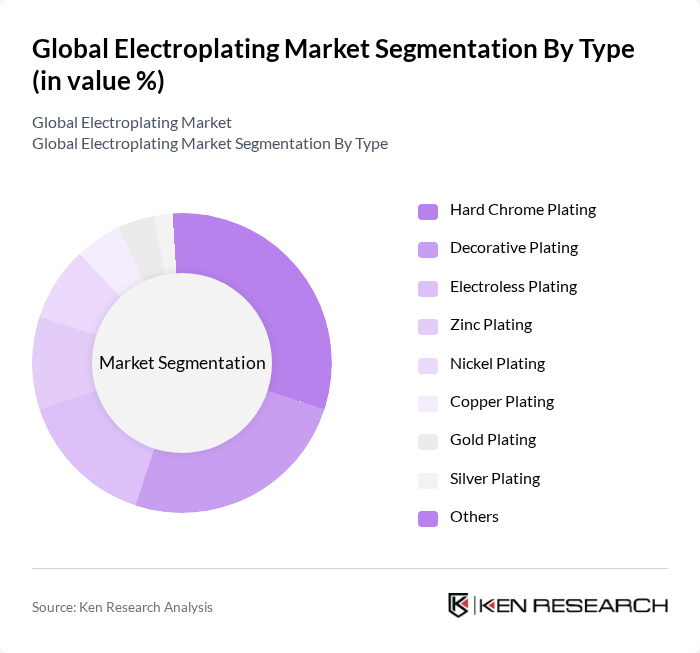

By Type:The electroplating market is segmented into Hard Chrome Plating, Decorative Plating, Electroless Plating, Zinc Plating, Nickel Plating, Copper Plating, Gold Plating, Silver Plating, and Others. Hard Chrome Plating remains dominant due to its critical use in automotive and aerospace for high wear resistance and durability. Decorative Plating also holds a significant share, driven by consumer demand for visually appealing products and the growing use of advanced decorative finishes in consumer electronics and appliances .

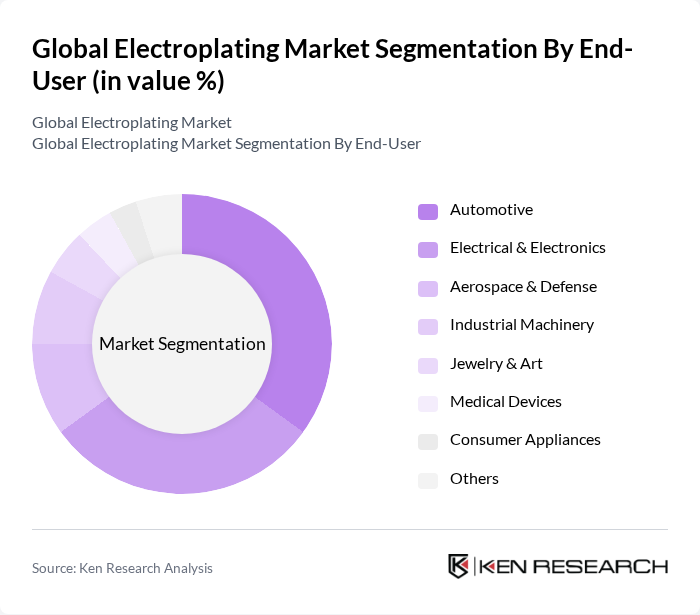

By End-User:The end-user segments of the electroplating market include Automotive, Electrical & Electronics, Aerospace & Defense, Industrial Machinery, Jewelry & Art, Medical Devices, Consumer Appliances, and Others. The Automotive sector is the largest end-user, driven by the need for durable, corrosion-resistant, and decorative components. The Electrical & Electronics sector follows, benefiting from the essential role of electroplating in enhancing conductivity, miniaturization, and surface finishing of electronic devices and components .

The Global Electroplating Market is characterized by a dynamic mix of regional and international players. Leading participants such as Atotech Ltd. (MKS Instruments Inc.), Coventya, MacDermid Enthone Industrial Solutions, Advanced Chemical Company, Umicore, Heraeus, KCH Services Inc., DOW Inc., SurTec International GmbH, Electroplating Corporation of India, Allied Finishing Inc., Cherng Yi Hsing Plastic Plating Factory Co. Ltd., Jing Mei Industrial Ltd., Klein Plating Works Inc., Peninsula Metal Finishing Inc., Precision Plating Company Inc. (Aalberts N.V.), Sharretts Plating Company Inc., Summit Plating, Toho Zinc Co. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electroplating market appears promising, driven by increasing demand for sustainable practices and technological innovations. As industries prioritize eco-friendly solutions, the adoption of green electroplating technologies is expected to rise. Additionally, the integration of IoT in manufacturing processes will enhance operational efficiency and monitoring capabilities. These trends indicate a shift towards more sustainable and efficient electroplating practices, positioning the industry for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Chrome Plating Decorative Plating Electroless Plating Zinc Plating Nickel Plating Copper Plating Gold Plating Silver Plating Others |

| By End-User | Automotive Electrical & Electronics Aerospace & Defense Industrial Machinery Jewelry & Art Medical Devices Consumer Appliances Others |

| By Application | Decorative Applications Functional Applications Corrosion Resistance Wear Resistance Electrical Conductivity Others |

| By Material | Metals Plastics Glass Others |

| By Process Type | Barrel Plating Rack Plating Continuous Plating Line Plating Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Electroplating Applications | 100 | Manufacturing Engineers, Quality Control Managers |

| Electronics Component Plating | 80 | Product Managers, R&D Specialists |

| Decorative Plating Market | 70 | Design Engineers, Marketing Executives |

| Aerospace Coating Solutions | 50 | Procurement Managers, Compliance Officers |

| Industrial Plating Services | 60 | Operations Managers, Facility Supervisors |

The Global Electroplating Market is valued at approximately USD 21.5 billion, driven by increasing demand in sectors such as automotive, electronics, and aerospace, which require products with enhanced durability, corrosion resistance, and aesthetic appeal.