Region:Global

Author(s):Dev

Product Code:KRAD0518

Pages:98

Published On:August 2025

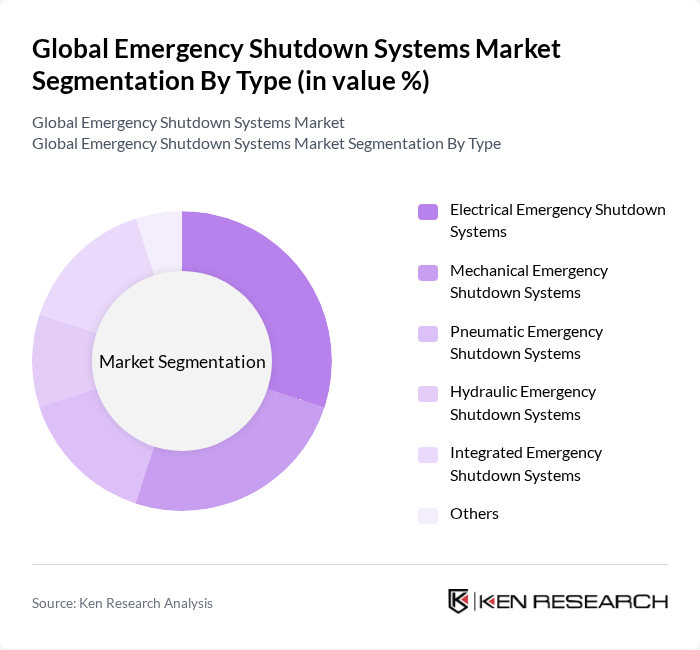

By Type:

The Electrical Emergency Shutdown Systems segment is currently leading due to reliability in critical applications and integration with programmable safety systems and logic solvers used in oil and gas and chemicals. Increased industrial automation, remote monitoring, and diagnostics are key adoption drivers; OEMs increasingly embed safety-certified sensors, safety PLCs, and emergency stop devices aligned with IEC 61508/61511. Additionally, digitalization trends—such as IoT connectivity, edge analytics, and AI-assisted anomaly detection—are enhancing shutdown decision speed and system availability, raising safety performance in hazardous environments.

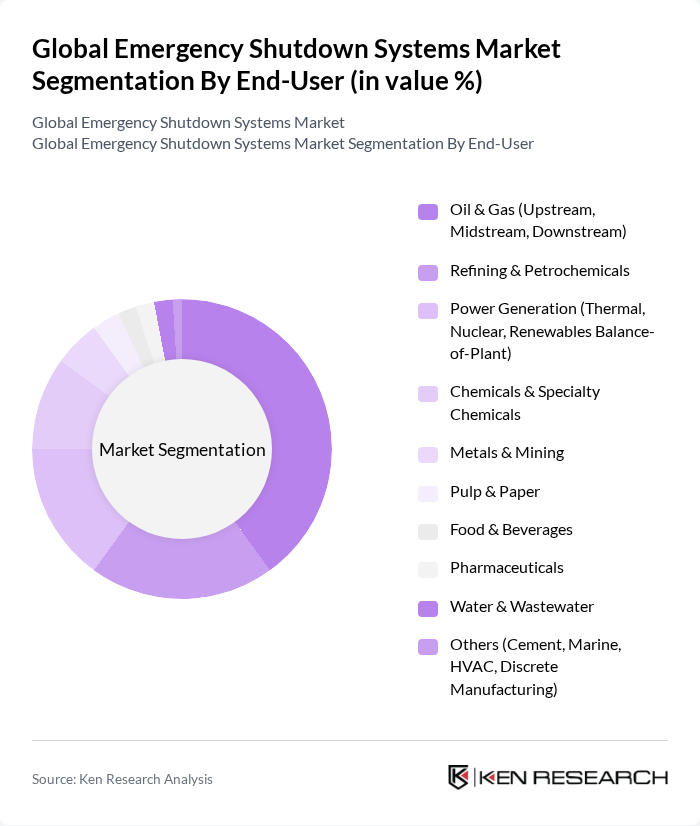

By End-User:

The Oil & Gas sector remains the dominant end-user owing to high process risks, strict functional safety compliance requirements (IEC 61511 for process industries), and frequent deployment of safety instrumented systems for shutdown and blowdown functions. Sustained activity in upstream and downstream operations and regulatory pressure for major accident hazard prevention underpin ESD demand across onshore plants and offshore assets.

The Global Emergency Shutdown Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Siemens AG, Emerson Electric Co., Schneider Electric SE, Rockwell Automation, Inc., Yokogawa Electric Corporation, ABB Ltd., General Electric Company, Mitsubishi Electric Corporation, Kongsberg Gruppen ASA, HIMA Paul Hildebrandt GmbH, Schneider Electric Triconex, NOV Inc., Versa Products Company, Inc., Winn-Marion Companies contribute to innovation, geographic expansion, and service delivery in this space.

The future of emergency shutdown systems in the None region is poised for growth, driven by technological advancements and increasing regulatory pressures. As industries prioritize safety and efficiency, the adoption of smart systems that leverage IoT and AI will become more prevalent. Additionally, the focus on sustainability will encourage the development of energy-efficient solutions, aligning with global trends. Companies that invest in innovative technologies and comply with evolving regulations will likely gain a competitive edge in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Electrical Emergency Shutdown Systems Mechanical Emergency Shutdown Systems Pneumatic Emergency Shutdown Systems Hydraulic Emergency Shutdown Systems Integrated Emergency Shutdown Systems Others |

| By End-User | Oil & Gas (Upstream, Midstream, Downstream) Refining & Petrochemicals Power Generation (Thermal, Nuclear, Renewables Balance-of-Plant) Chemicals & Specialty Chemicals Metals & Mining Pulp & Paper Food & Beverages Pharmaceuticals Water & Wastewater Others (Cement, Marine, HVAC, Discrete Manufacturing) |

| By Application | Process Safety and High-Integrity Pressure Protection Systems (HIPPS) Fire & Gas Shutdown Wellhead and Pipeline ESD Compressor, Boiler, and Turbine Trip Systems Storage Tanks, LNG/LPG Terminals, and Loading Racks Utilities and Balance-of-Plant Others |

| By Component | Sensors (Gas, Flame, Smoke, Pressure, Temperature) Logic Solvers/Programmable Safety Systems (PLC, Safety Controllers) Valves & Actuators (Shutdown Valves, Solenoids) Emergency Stop Devices & Switches Software (Safety Lifecycle, Configuration, Diagnostics) Others (Relays, Modules, Accessories) |

| By Sales Channel | Direct Sales Distributors/Systems Integrators Online Sales Others |

| By Distribution Mode | Offline Distribution Online Distribution Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Safety Improvements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Emergency Shutdown Systems | 120 | Safety Engineers, Plant Managers |

| Oil & Gas Industry Safety Protocols | 90 | Compliance Officers, Operations Managers |

| Chemical Processing Safety Systems | 75 | Process Safety Managers, Risk Assessment Specialists |

| Power Generation Emergency Protocols | 60 | Safety Compliance Managers, Technical Directors |

| Transportation Sector Emergency Shutdown Procedures | 80 | Logistics Coordinators, Safety Inspectors |

The Global Emergency Shutdown Systems Market is valued at approximately USD 2.4 billion, reflecting a five-year historical analysis. This growth is driven by increasing safety regulations and technological advancements in hazardous industries such as oil and gas, chemicals, and power generation.