Region:Global

Author(s):Geetanshi

Product Code:KRAA1199

Pages:100

Published On:August 2025

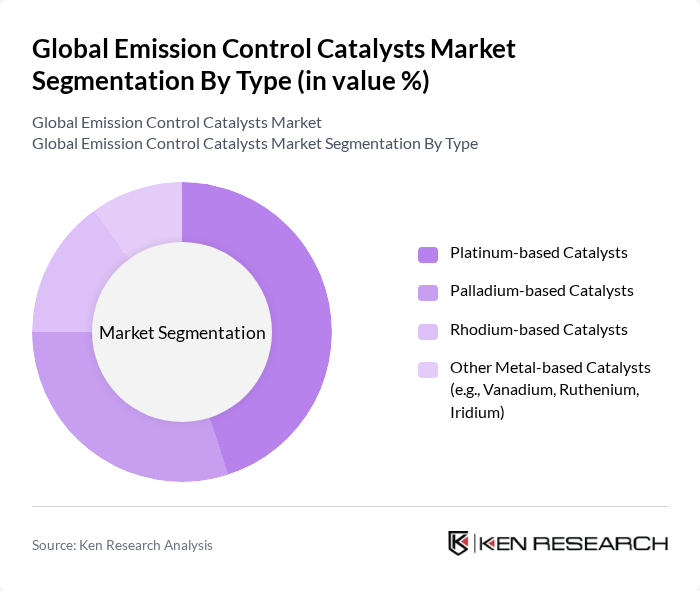

By Type:The emission control catalysts market is segmented into four main types: Platinum-based Catalysts, Palladium-based Catalysts, Rhodium-based Catalysts, and Other Metal-based Catalysts (e.g., Vanadium, Ruthenium, Iridium). Among these,Platinum-based Catalystscontinue to dominate due to their high efficiency in converting harmful emissions into less harmful substances, especially in diesel applications. The automotive sector’s reliance on platinum for catalytic converters remains strong.Palladium-based Catalystsare gaining share, particularly in gasoline engines, due to their cost-effectiveness and robust performance.Rhodium-based Catalysts, while more expensive, are essential for reducing nitrogen oxides, especially in diesel engines and selective catalytic reduction systems. Other metal-based catalysts are used in specialized industrial and stationary applications, supporting compliance with emission standards in power generation and chemical processing .

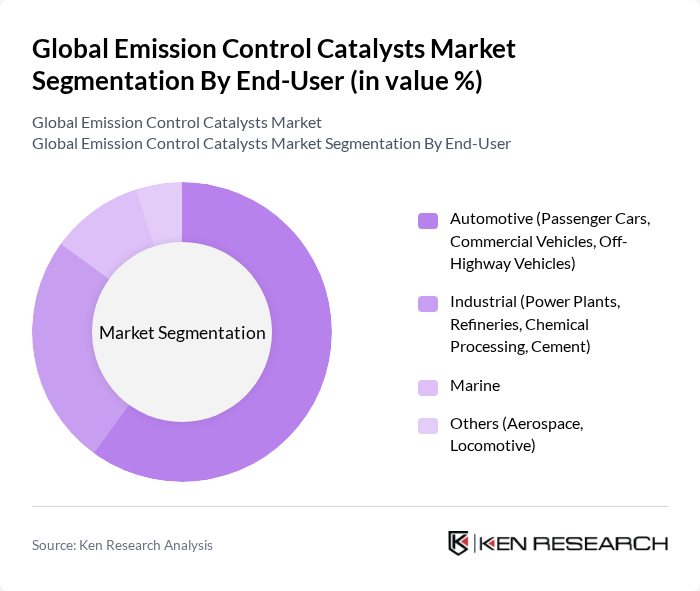

By End-User:The market is segmented by end-user into Automotive (Passenger Cars, Commercial Vehicles, Off-Highway Vehicles), Industrial (Power Plants, Refineries, Chemical Processing, Cement), Marine, and Others (Aerospace, Locomotive). Theautomotive sectoris the largest end-user, driven by increasing vehicle production, stricter emission regulations (such as Euro 6/7, China 6, and US Tier 3), and the need for advanced catalytic converters. Theindustrial segmentfollows, as power plants, refineries, and chemical processing facilities adopt emission control technologies to comply with tightening environmental standards. Themarine sectoris experiencing growth due to international regulations targeting emissions from ships, whileaerospace and locomotiveapplications contribute through specialized emission control systems .

The Global Emission Control Catalysts Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Johnson Matthey Plc, Umicore S.A., Clariant AG, Haldor Topsoe A/S, Albemarle Corporation, Heraeus Holding GmbH, Tenneco Inc., Solvay S.A., Cataler Corporation, Corning Incorporated, Mitsui Chemicals, Inc., Cormetech Inc., DCL International Inc., Johnson Controls International plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the emission control catalysts market appears promising, driven by ongoing advancements in technology and increasing regulatory pressures. As governments worldwide continue to enforce stricter emission standards, the demand for innovative catalysts will rise. Additionally, the integration of digital technologies, such as IoT and AI, is expected to enhance catalyst performance monitoring, leading to improved efficiency. Companies that invest in research and development will likely gain a competitive edge, positioning themselves favorably in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Platinum-based Catalysts Palladium-based Catalysts Rhodium-based Catalysts Other Metal-based Catalysts (e.g., Vanadium, Ruthenium, Iridium) |

| By End-User | Automotive (Passenger Cars, Commercial Vehicles, Off-Highway Vehicles) Industrial (Power Plants, Refineries, Chemical Processing, Cement) Marine Others (Aerospace, Locomotive) |

| By Application | Exhaust Systems (Three-way Catalysts, Diesel Oxidation Catalysts, Selective Catalytic Reduction, Lean NOx Trap) Chemical Processing Power Generation Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Regulatory Compliance Level | Tier 1 Compliance Tier 2 Compliance Tier 3 Compliance |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Emission Control Catalysts | 100 | Product Managers, Compliance Officers |

| Industrial Catalyst Applications | 80 | Process Engineers, Operations Managers |

| Power Generation Emission Solutions | 60 | Environmental Engineers, Project Managers |

| Research and Development in Catalysis | 50 | R&D Scientists, Technical Directors |

| Regulatory Compliance and Policy Impact | 40 | Policy Analysts, Regulatory Affairs Managers |

The Global Emission Control Catalysts Market is valued at approximately USD 48 billion, driven by stringent environmental regulations, technological advancements, and the demand for cleaner automotive technologies.