Region:Global

Author(s):Rebecca

Product Code:KRAB0218

Pages:83

Published On:August 2025

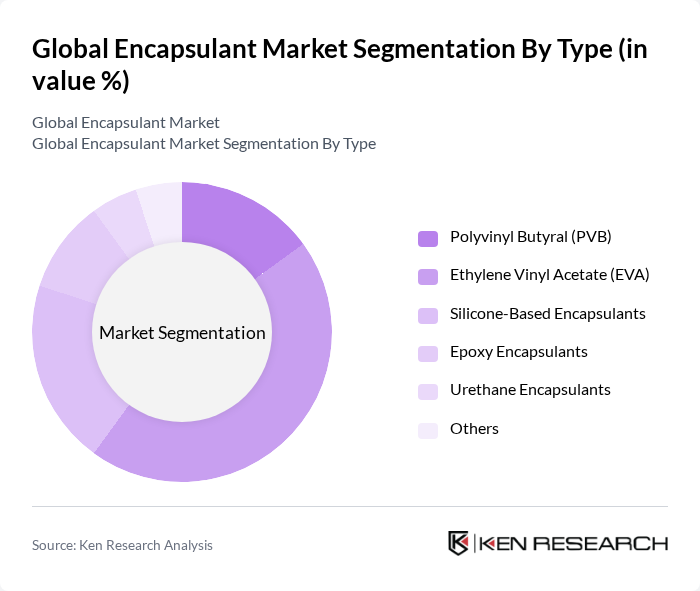

By Type:The encapsulant market is segmented into Polyvinyl Butyral (PVB), Ethylene Vinyl Acetate (EVA), Silicone-Based Encapsulants, Epoxy Encapsulants, Urethane Encapsulants, and Others. Among these, Ethylene Vinyl Acetate (EVA) is the leading subsegment due to its excellent optical clarity, adhesion properties, and thermal stability, making it ideal for solar panel applications. The expanding solar energy sector has significantly increased the demand for EVA encapsulants, which are essential for protecting photovoltaic cells from environmental factors.

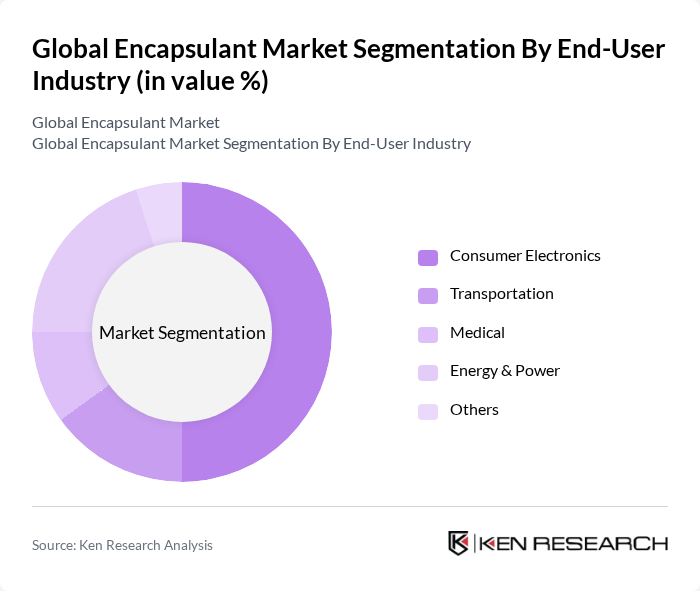

By End-User Industry:The encapsulant market is also segmented by end-user industries, including Consumer Electronics, Transportation, Medical, Energy & Power, and Others. The Consumer Electronics segment is a major subsegment, driven by the increasing demand for smartphones, tablets, and other electronic devices that require effective encapsulation for protection against moisture and dust. Rapid technological advancements and the trend toward miniaturization in electronics further fuel the growth of this segment. The Energy & Power segment, particularly solar energy, is also a significant contributor due to the rising adoption of photovoltaic modules and renewable energy infrastructure.

The Global Encapsulant Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, Huntsman Corporation, Dow Inc., 3M Company, Shin-Etsu Chemical Co., Ltd., Sumitomo Bakelite Co., Ltd., PARKER HANNIFIN CORP, Momentive Performance Materials Inc., LG Chem Ltd., BASF SE, Solvay S.A., Mitsubishi Chemical Corporation, Covestro AG, Sika AG, SABIC, JinkoSolar Holding Co., Ltd., Encapsulant Technologies, LLC, Wacker Chemie AG, TPI Composites, Inc., Hanwha Q CELLS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the encapsulant market appears promising, driven by the ongoing transition towards renewable energy and technological advancements. As governments worldwide implement stricter renewable energy targets, the demand for high-quality encapsulants will likely increase. Additionally, the integration of smart technologies in energy solutions will further enhance the performance of solar panels, creating new avenues for growth. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the encapsulant market.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyvinyl Butyral (PVB) Ethylene Vinyl Acetate (EVA) Silicone-Based Encapsulants Epoxy Encapsulants Urethane Encapsulants Others |

| By End-User Industry | Consumer Electronics Transportation Medical Energy & Power Others |

| By Application | Solar Panels LED Lighting Electronics Packaging Construction Automobile Others |

| By Curing Type | Room Temperature Cure Heat Cure UV Cure |

| By Region | North America Europe Asia-Pacific Middle East & Africa Latin America |

| By Price Range | Low Medium High |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Solar Panel Encapsulants | 100 | Product Managers, R&D Engineers |

| Electronics Encapsulation Solutions | 80 | Manufacturing Engineers, Quality Assurance Managers |

| Automotive Encapsulants | 60 | Procurement Managers, Design Engineers |

| Pharmaceutical Encapsulation Applications | 50 | Regulatory Affairs Specialists, Production Supervisors |

| Construction and Building Materials | 40 | Architects, Project Managers |

The Global Encapsulant Market is valued at approximately USD 1.8 billion, driven by the increasing demand for renewable energy solutions, particularly in solar energy applications, and advancements in consumer electronics requiring durable encapsulation materials.