Region:Global

Author(s):Geetanshi

Product Code:KRAD0035

Pages:89

Published On:August 2025

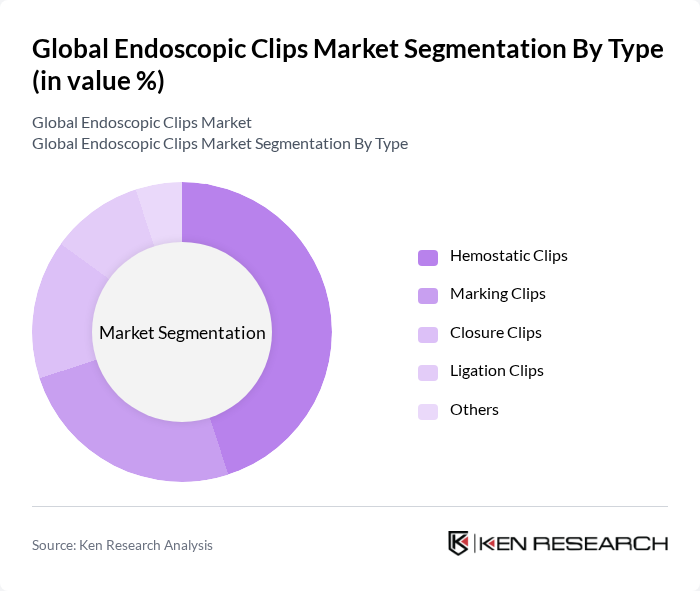

By Type:The endoscopic clips market is segmented into Hemostatic Clips, Marking Clips, Closure Clips, Ligation Clips, and Others. Hemostatic Clips are the most widely used due to their critical role in controlling bleeding during endoscopic procedures. The increasing number of gastrointestinal surgeries and the need for effective hemostasis are driving demand for this sub-segment. Marking Clips are also gaining traction as they assist in identifying lesions during procedures, contributing to their growing market share. Closure Clips are used for tissue approximation and wound closure, while Ligation Clips are primarily used for vessel ligation and other specialized applications. The "Others" category includes emerging and specialized clip types designed for unique procedural needs .

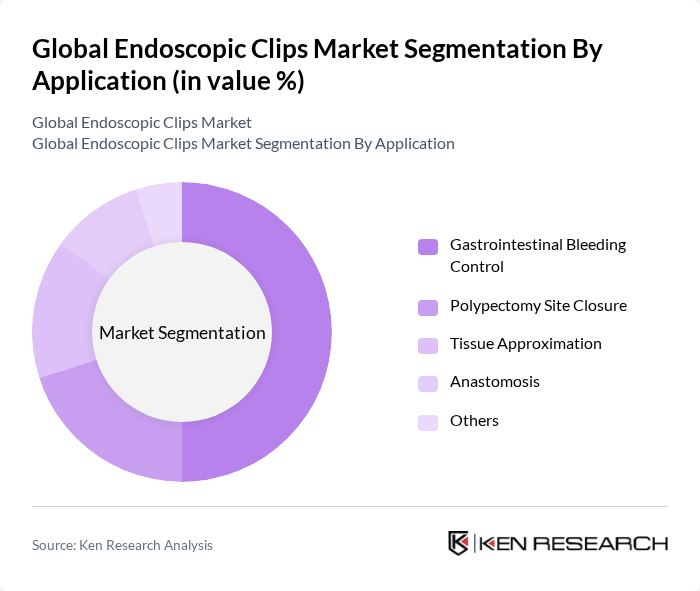

By Application:The applications of endoscopic clips include Gastrointestinal Bleeding Control, Polypectomy Site Closure, Tissue Approximation, Anastomosis, and Others. Gastrointestinal Bleeding Control remains the leading application segment, driven by the rising incidence of gastrointestinal bleeding and the need for effective management during endoscopic procedures. The increasing number of polypectomies performed also contributes to the demand for Polypectomy Site Closure applications. Tissue Approximation and Anastomosis are critical in complex endoscopic interventions, while the "Others" category covers emerging and less common applications .

The Global Endoscopic Clips Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Scientific Corporation, Medtronic plc, Olympus Corporation, Cook Medical Incorporated, Ethicon, Inc. (Johnson & Johnson), CONMED Corporation, Ovesco Endoscopy AG, STERIS plc, B. Braun Melsungen AG, Merit Medical Systems, Inc., Medline Industries, LP, Hoya Corporation (Pentax Medical), Aesculap AG (B. Braun Group), Micro-Tech Endoscopy, and Erbe Elektromedizin GmbH contribute to innovation, geographic expansion, and service delivery in this space. The competitive landscape is marked by continuous product innovation, strategic partnerships, and expansion into emerging markets .

The future of the endoscopic clips market appears promising, driven by ongoing technological advancements and a growing emphasis on patient-centered care. As healthcare systems increasingly adopt outpatient procedures, the demand for efficient and effective endoscopic solutions will likely rise. Furthermore, the integration of artificial intelligence in endoscopic practices is expected to enhance procedural accuracy and safety, paving the way for innovative applications in the field. These trends will shape the market landscape significantly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hemostatic Clips Marking Clips Closure Clips Ligation Clips Others |

| By Application | Gastrointestinal Bleeding Control Polypectomy Site Closure Tissue Approximation Anastomosis Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Academic & Research Institutes Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Material | Metal Clips (e.g., Titanium, Stainless Steel) Polymeric Clips Biodegradable Clips Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gastrointestinal Endoscopic Procedures | 100 | Gastroenterologists, Surgical Directors |

| Urological Endoscopic Applications | 60 | Urologists, Hospital Administrators |

| General Surgical Endoscopic Use | 50 | General Surgeons, Operating Room Managers |

| Endoscopic Clip Manufacturers | 40 | Product Managers, Sales Executives |

| Healthcare Procurement Specialists | 60 | Procurement Officers, Supply Chain Managers |

The Global Endoscopic Clips Market is valued at approximately USD 1.2 billion, driven by factors such as the increasing prevalence of gastrointestinal disorders and advancements in endoscopic technologies.