Region:Global

Author(s):Dev

Product Code:KRAA1557

Pages:92

Published On:August 2025

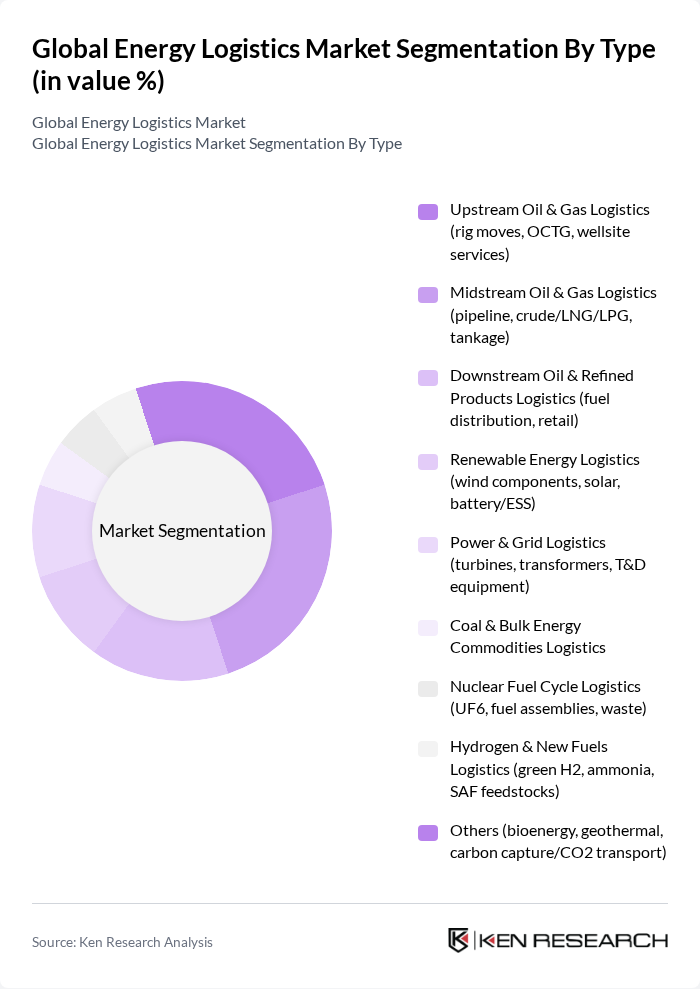

By Type:The market is segmented into various types, including upstream oil & gas logistics, midstream oil & gas logistics, downstream oil & refined products logistics, renewable energy logistics, power & grid logistics, coal & bulk energy commodities logistics, nuclear fuel cycle logistics, hydrogen & new fuels logistics, and others. Each segment plays a crucial role in the overall logistics framework, catering to specific energy needs and operational requirements .

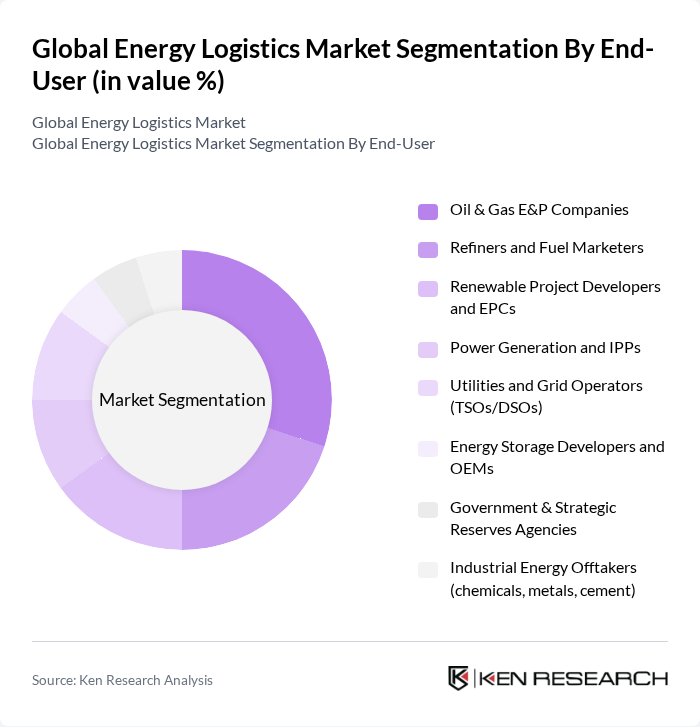

By End-User:The end-user segmentation includes oil & gas E&P companies, refiners and fuel marketers, renewable project developers and EPCs, power generation and IPPs, utilities and grid operators, energy storage developers and OEMs, government & strategic reserves agencies, and industrial energy offtakers. Each end-user category has distinct logistics requirements based on their operational needs and energy sourcing strategies, with growing needs for heavy-lift, specialized transport, and multimodal coordination for renewables and grid equipment .

The Global Energy Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain & Global Forwarding, Kuehne+Nagel, DB Schenker, C.H. Robinson, GXO Logistics, Expeditors International of Washington, GEODIS, CEVA Logistics, DSV, A.P. Møller – Maersk, SNCF Geodis (Rail & Logistics), Bolloré Logistics, UPS Supply Chain Solutions, Agility Logistics, Tidewater, Mammoet, Sarens, Pacific Drilling Logistics (Transocean/Offshore support), GAC Group, Hellmann Worldwide Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the energy logistics market is poised for transformative growth, driven by the increasing integration of digital technologies and a strong focus on sustainability. As companies adopt smart logistics solutions, operational efficiencies will improve, reducing costs and enhancing service delivery. Furthermore, the ongoing global push for decarbonization will necessitate innovative logistics strategies, ensuring that energy logistics remains a critical component of the renewable energy supply chain, adapting to evolving market demands and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Upstream Oil & Gas Logistics (rig moves, OCTG, wellsite services) Midstream Oil & Gas Logistics (pipeline, crude/LNG/LPG, tankage) Downstream Oil & Refined Products Logistics (fuel distribution, retail) Renewable Energy Logistics (wind components, solar, battery/ESS) Power & Grid Logistics (turbines, transformers, T&D equipment) Coal & Bulk Energy Commodities Logistics Nuclear Fuel Cycle Logistics (UF6, fuel assemblies, waste) Hydrogen & New Fuels Logistics (green H2, ammonia, SAF feedstocks) Others (bioenergy, geothermal, carbon capture/CO2 transport) |

| By End-User | Oil & Gas E&P Companies Refiners and Fuel Marketers Renewable Project Developers and EPCs Power Generation and IPPs Utilities and Grid Operators (TSOs/DSOs) Energy Storage Developers and OEMs Government & Strategic Reserves Agencies Industrial Energy Offtakers (chemicals, metals, cement) |

| By Mode of Transport | Road (heavy-haul, last-mile fuels) Rail (unit trains, project cargo) Maritime & Inland Waterways (tankers, heavy-lift, Ro-Ro, barges) Air (time-critical spares, remote sites) Pipeline (crude, products, gas, CO2, hydrogen) |

| By Service Type | Freight Forwarding & Project Logistics Contract Logistics & Warehousing (laydown yards, spares hubs) Marine Services (chartering, port agency, offshore support) Supply Chain Management & Control Tower Customs, Compliance & Dangerous Goods Handling Consulting & Engineering (route surveys, rigging, decommissioning) |

| By Geographic Coverage | Domestic Logistics International & Cross-Border Logistics |

| By Technology Integration | Automation & Robotics (ports, warehouses, inspection) Advanced Analytics & Digital Twins IoT/Telematics & Real-time Visibility Platforms Blockchain & E-documentation Emissions Monitoring & Optimization (MRV, route optimization) |

| By Policy Support | Subsidies for Renewable & Grid Logistics Tax Incentives for Low-Carbon Transport (LNG/e-fuels) Regulatory Support for Hydrogen/LNG/Battery Supply Chains Safety & Dangerous Goods Regulations (IMO/ADR/IATA/ICAO/NRC) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Logistics | 120 | Logistics Coordinators, Supply Chain Managers |

| Renewable Energy Supply Chains | 100 | Project Managers, Operations Directors |

| Energy Storage Solutions | 80 | Technical Managers, Product Development Leads |

| Coal Transportation Logistics | 60 | Procurement Managers, Logistics Analysts |

| Natural Gas Distribution | 90 | Distribution Managers, Regulatory Affairs Specialists |

The Global Energy Logistics Market is valued at approximately USD 490 billion, based on a five-year historical analysis. This valuation reflects a consolidation of various industry estimates, indicating significant growth driven by increasing energy demand and advancements in logistics technology.