Region:Global

Author(s):Shubham

Product Code:KRAC0685

Pages:90

Published On:August 2025

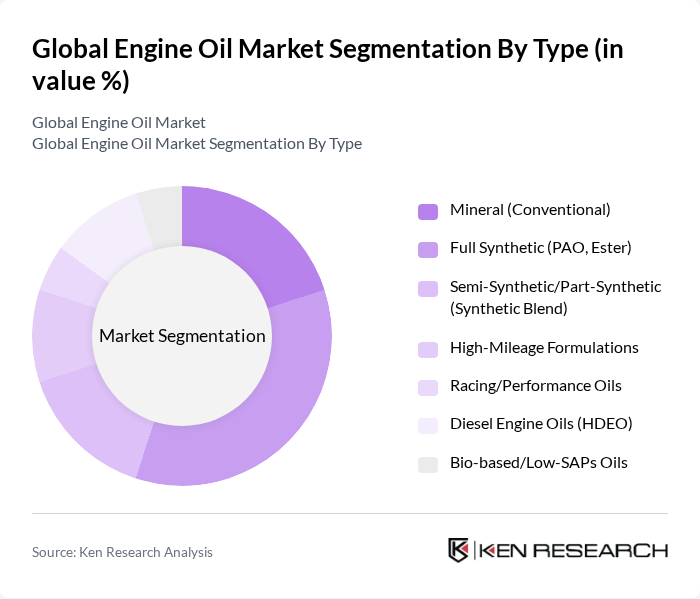

By Type:The engine oil market is segmented into various types, including Mineral (Conventional), Full Synthetic (PAO, Ester), Semi-Synthetic/Part-Synthetic (Synthetic Blend), High-Mileage Formulations, Racing/Performance Oils, Diesel Engine Oils (HDEO), and Bio-based/Low-SAPs Oils. Among these, Full Synthetic oils are gaining traction due to their superior performance, fuel economy benefits, and longer drain intervals, aligned with tighter emission/fuel-efficiency requirements and modern engine designs (e.g., turbocharged GDI).

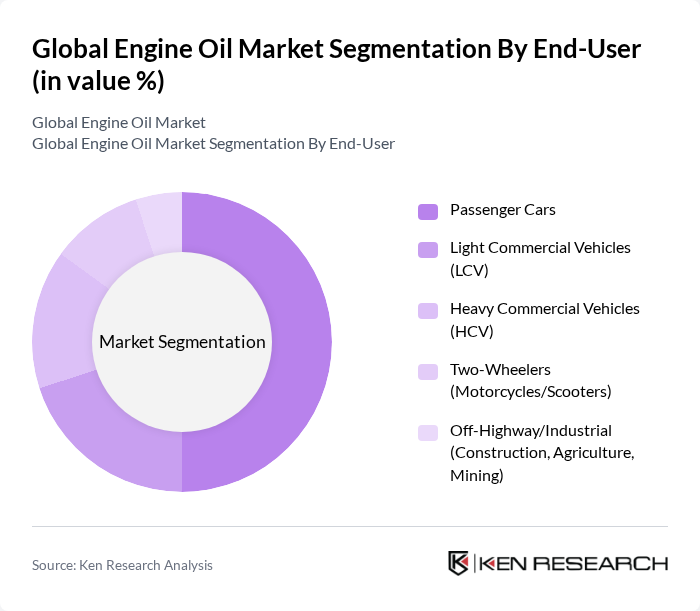

By End-User:The market is segmented by end-user into Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Two-Wheelers (Motorcycles/Scooters), and Off-Highway/Industrial (Construction, Agriculture, Mining). Passenger Cars account for the largest share, supported by the sizeable global passenger vehicle parc and maintenance demand, while commercial and off-highway segments require higher-robustness HDEO formulations for extended operations.

The Global Engine Oil Market is characterized by a dynamic mix of regional and international players. Leading participants such as Exxon Mobil Corporation (Mobil), Shell plc (Shell Helix, Rotella), BP p.l.c. (Castrol), Chevron Corporation (Havoline, Delo), TotalEnergies SE (Quartz), Valvoline Inc., FUCHS SE (FUCHS Lubricants), AMSOIL Inc., MOTUL S.A., Idemitsu Kosan Co., Ltd., PETRONAS Lubricants International (PLI), China Petrochemical Corporation (Sinopec), Indian Oil Corporation Ltd. (SERVO), PJSC LUKOIL, Eni S.p.A. (eni i-Sint, Agip), Repsol S.A., PKN ORLEN S.A. (ORLEN Oil), GS Caltex Corporation (Kixx), Phillips 66 Company (Kendall, Phillips 66 Lubricants), Gulf Oil International Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the engine oil market appears promising, driven by technological advancements and evolving consumer preferences. The shift towards synthetic oils and eco-friendly products is expected to gain momentum, with synthetic oil sales projected to account for a significant share of the market in the future. Additionally, the integration of smart oil monitoring systems will enhance maintenance practices, leading to increased oil usage. As the automotive landscape evolves, manufacturers must adapt to these trends to remain competitive and meet consumer demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Mineral (Conventional) Full Synthetic (PAO, Ester) Semi?Synthetic/Part?Synthetic (Synthetic Blend) High?Mileage Formulations Racing/Performance Oils Diesel Engine Oils (HDEO) Bio?based/Low?SAPs Oils |

| By End-User | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) Two?Wheelers (Motorcycles/Scooters) Off?Highway/Industrial (Construction, Agriculture, Mining) |

| By Application | Automotive On?road (Gasoline, Diesel) Marine Engines Aviation Piston Engines Power Generation and Heavy Equipment |

| By Distribution Channel | Retail/Aftermarket (Auto Parts Stores, Mass Retail) Online/E?commerce Service Workshops & Quick?Lube Centers OEM/Dealer Networks |

| By Viscosity Grade (SAE) | W?16/0W?20 W?20/5W?30 W?30/10W?40 W?40/20W?50 Others (e.g., 0W?40, 5W?40) |

| By Packaging Type | Bottles (1–5 Liters) Drums/IBCs Bulk/Bulk Tanker |

| By Price Tier | Economy Mid?Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Engine Oil Usage | 150 | Automotive Service Managers, Vehicle Owners |

| Commercial Fleet Oil Management | 100 | Fleet Managers, Maintenance Supervisors |

| Oil Change Service Providers | 80 | Service Station Owners, Technicians |

| Lubricant Retail Sector Insights | 70 | Retail Managers, Product Buyers |

| Automotive Industry Experts | 60 | Automotive Engineers, Industry Analysts |

The Global Engine Oil Market is valued at approximately USD 41 billion, reflecting a robust demand driven by vehicle production and maintenance needs. This valuation is based on a comprehensive five-year historical analysis of the market.