Region:Global

Author(s):Shubham

Product Code:KRAC0607

Pages:85

Published On:August 2025

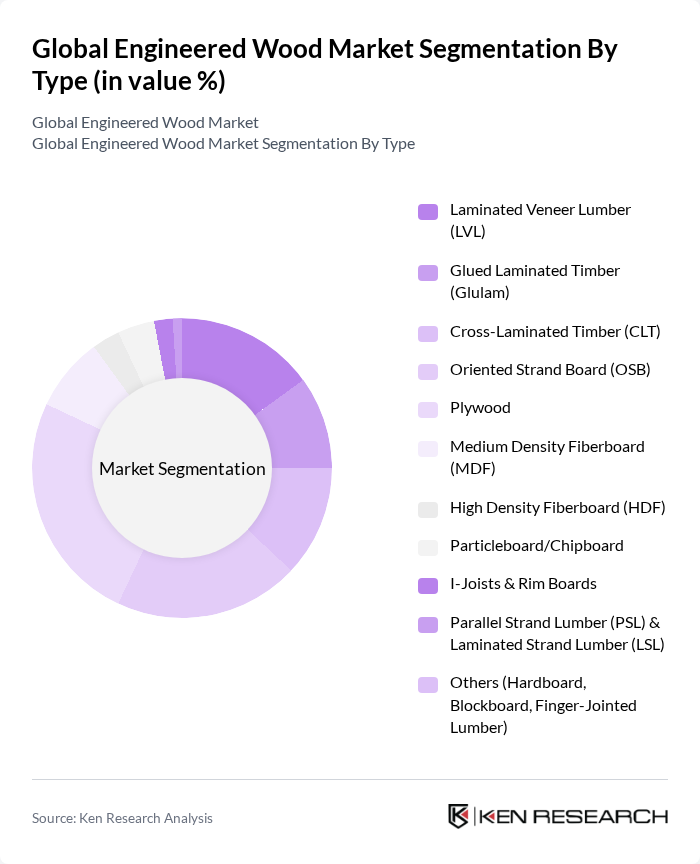

By Type:The engineered wood market is segmented into various types, including Laminated Veneer Lumber (LVL), Glued Laminated Timber (Glulam), Cross-Laminated Timber (CLT), Oriented Strand Board (OSB), Plywood, Medium Density Fiberboard (MDF), High Density Fiberboard (HDF), Particleboard/Chipboard, I-Joists & Rim Boards, Parallel Strand Lumber (PSL) & Laminated Strand Lumber (LSL), and Others (Hardboard, Blockboard, Finger-Jointed Lumber). Among these, Plywood and OSB are widely used in structural and non-structural applications owing to versatility and cost-efficiency in construction and furniture, while MDF/HDF and particleboard remain prevalent in cabinetry and interior applications. The demand for these products is driven by their strength, lightweight handling, and ease of installation across framing, sheathing, flooring, and furniture uses.

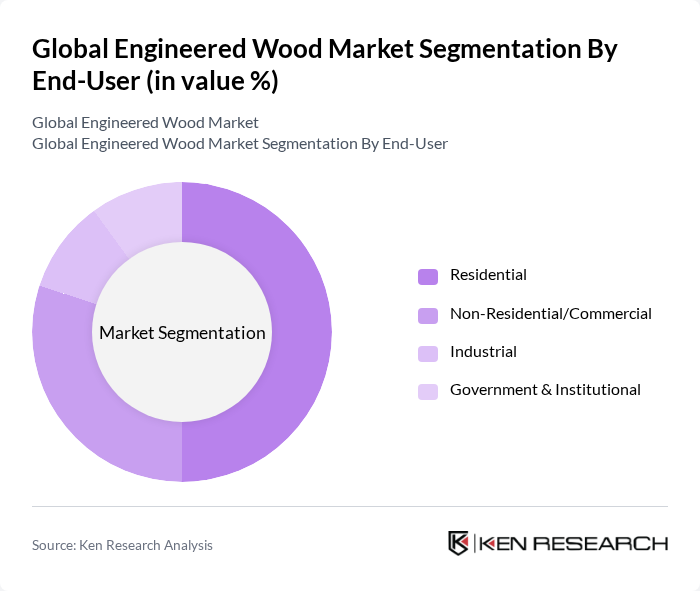

By End-User:The market is segmented by end-user into Residential, Non-Residential/Commercial, Industrial, and Government & Institutional. The residential segment dominates on the back of new housing, renovation, and remodeling activity, with growing adoption of engineered wood in framing, flooring, panels, and interiors under sustainability-focused building codes and certifications. Continued urbanization and population growth support demand in both single-family and multi-family construction, while commercial projects increasingly specify mass timber (CLT, glulam) for speed, aesthetics, and carbon benefits.

The Global Engineered Wood Market is characterized by a dynamic mix of regional and international players. Leading participants such as Weyerhaeuser Company, Georgia-Pacific LLC, West Fraser Timber Co. Ltd., UPM-Kymmene Corporation, Stora Enso Oyj, Boise Cascade Company, International Paper Company, Metsä Group, Sappi Limited, Canfor Corporation, Norbord Inc. (West Fraser Panels), Arauco (Celulosa Arauco y Constitución S.A.), Kronospan, Mercer International (Including former Drax Tembec assets), D.R. Johnson Lumber Co., EGGER Group, Louisiana-Pacific Corporation (LP Building Solutions), Roseburg Forest Products, Huber Engineered Woods LLC, Swiss Krono Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the engineered wood market appears promising, driven by increasing environmental awareness and technological advancements. As urbanization accelerates, the demand for sustainable building materials will likely rise, with engineered wood playing a crucial role. Additionally, the integration of smart building technologies is expected to enhance the functionality of engineered wood products, making them more appealing to builders and architects. The focus on circular economy practices will further support the growth of this sector, promoting recycling and sustainable sourcing.

| Segment | Sub-Segments |

|---|---|

| By Type | Laminated Veneer Lumber (LVL) Glued Laminated Timber (Glulam) Cross-Laminated Timber (CLT) Oriented Strand Board (OSB) Plywood Medium Density Fiberboard (MDF) High Density Fiberboard (HDF) Particleboard/Chipboard I-Joists & Rim Boards Parallel Strand Lumber (PSL) & Laminated Strand Lumber (LSL) Others (Hardboard, Blockboard, Finger-Jointed Lumber) |

| By End-User | Residential Non-Residential/Commercial Industrial Government & Institutional |

| By Application | Structural Applications (Beams, Columns, Floors, Roofs, Sheathing) Non-Structural Applications (Interior Panels, Wall Linings) Furniture & Cabinetry Flooring & Decking Doors, Windows & Millwork |

| By Distribution Channel | Direct Sales (Projects, OEMs) Distributors/Wholesalers Specialty Retail & Builders’ Merchants Online B2B Platforms |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Sustainability Certification | FSC Certified PEFC Certified EUTR/UKTR, SFI, and Other Certifications |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 150 | Contractors, Project Managers |

| Commercial Building Developments | 100 | Architects, Developers |

| Furniture Manufacturing | 80 | Product Designers, Manufacturing Managers |

| Retail Distribution Channels | 70 | Supply Chain Managers, Retail Buyers |

| Export Markets for Engineered Wood | 60 | Export Managers, Trade Analysts |

The Global Engineered Wood Market is valued at approximately USD 255 billion, driven by the increasing demand for sustainable building materials and urbanization, alongside rising construction activities in both residential and non-residential sectors.