Region:Global

Author(s):Dev

Product Code:KRAA1530

Pages:98

Published On:August 2025

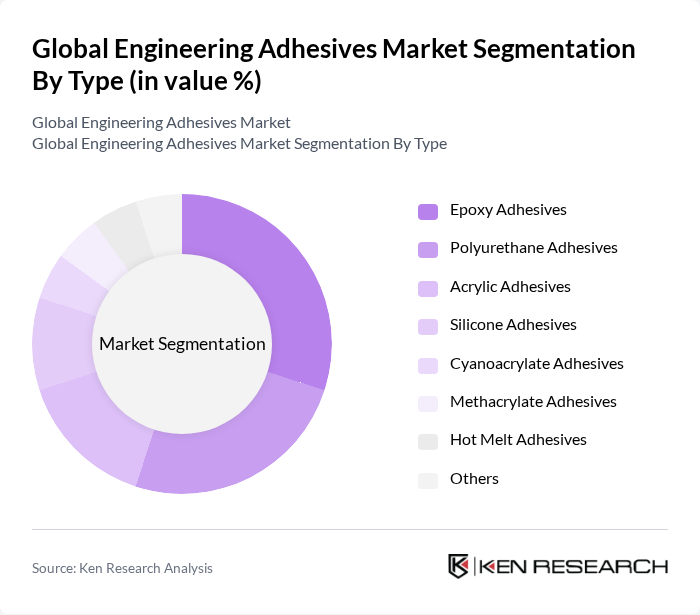

By Type:The engineering adhesives market is segmented into epoxy adhesives, polyurethane adhesives, acrylic adhesives, silicone adhesives, cyanoacrylate adhesives, methacrylate adhesives, hot melt adhesives, and others. Each type serves specific applications and industries, with varying performance characteristics and bonding capabilities. Epoxy adhesives hold the largest share due to their superior strength and chemical resistance, making them widely used in automotive, construction, and electronics applications. Polyurethane adhesives are favored for their flexibility and impact resistance, while acrylic adhesives offer fast curing and strong adhesion to a variety of substrates. Silicone adhesives are preferred in applications requiring high temperature and weather resistance. Cyanoacrylate and methacrylate adhesives are used for rapid bonding and structural applications, respectively. Hot melt adhesives are commonly used in packaging and assembly operations .

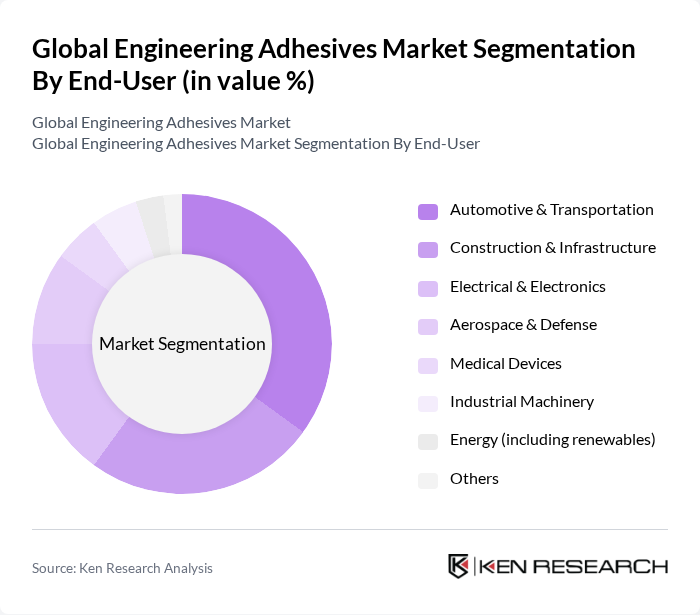

By End-User:The market is also segmented by end-user industries, including automotive & transportation, construction & infrastructure, electrical & electronics, aerospace & defense, medical devices, industrial machinery, energy (including renewables), and others. Automotive & transportation is the dominant end-user segment, driven by the shift toward lightweight vehicles and the replacement of mechanical fasteners with adhesives for improved performance and fuel efficiency. Construction & infrastructure follows, with adhesives playing a critical role in flooring, panel bonding, and facade assembly. Electrical & electronics applications are expanding due to miniaturization and the need for reliable bonding in complex assemblies. Aerospace & defense, medical devices, industrial machinery, and energy sectors each have specialized requirements for adhesive performance, influencing the choice of adhesive types used .

The Global Engineering Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, Sika AG, H.B. Fuller Company, BASF SE, Dow Inc., Arkema S.A., Huntsman Corporation, ITW (Illinois Tool Works Inc.), LORD Corporation (Parker Hannifin Corporation), Avery Dennison Corporation, Momentive Performance Materials Inc., RPM International Inc., Wacker Chemie AG, Bostik SA (Arkema Group), Ashland Global Holdings Inc., Dymax Corporation, Permabond LLC, Hexion Inc., DuPont de Nemours, Inc., Huitian Adhesive Enterprise contribute to innovation, geographic expansion, and service delivery in this space .

The future of the engineering adhesives market appears promising, driven by ongoing innovations and a shift towards sustainable practices. As industries increasingly adopt eco-friendly adhesives, the demand for bio-based formulations is expected to rise. Additionally, the integration of smart technologies, such as sensors in adhesive applications, will likely enhance product functionality. These trends indicate a dynamic market landscape, with opportunities for growth in various sectors, particularly automotive and construction, as they adapt to evolving consumer preferences and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Adhesives Polyurethane Adhesives Acrylic Adhesives Silicone Adhesives Cyanoacrylate Adhesives Methacrylate Adhesives Hot Melt Adhesives Others |

| By End-User | Automotive & Transportation Construction & Infrastructure Electrical & Electronics Aerospace & Defense Medical Devices Industrial Machinery Energy (including renewables) Others |

| By Application | Structural Bonding Surface Bonding Assembly Coating Sealing Potting & Encapsulation Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Specialty Stores Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Price Mid Price High Price |

| By Brand Loyalty | High Loyalty Medium Loyalty Low Loyalty |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Adhesives | 100 | Product Development Engineers, Quality Assurance Managers |

| Construction Adhesives | 80 | Project Managers, Procurement Specialists |

| Consumer Adhesives | 60 | Marketing Managers, Retail Buyers |

| Industrial Adhesives | 90 | Operations Managers, Supply Chain Analysts |

| Specialty Adhesives | 50 | Research Scientists, Technical Sales Representatives |

The Global Engineering Adhesives Market is valued at approximately USD 21 billion, driven by increasing demand for high-performance adhesives across various industries, including automotive, construction, and electronics.