Region:Global

Author(s):Geetanshi

Product Code:KRAB0023

Pages:89

Published On:August 2025

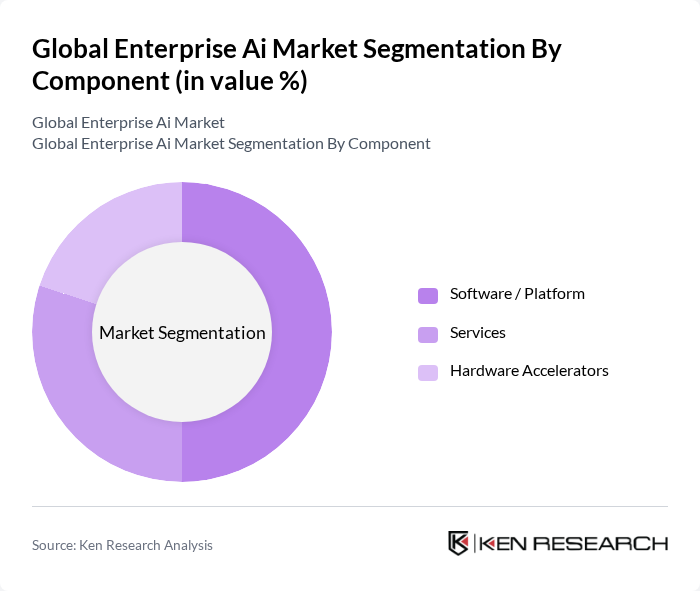

By Component:The components of the market include Software / Platform, Services, and Hardware Accelerators. The Software / Platform segment leads the market, driven by the increasing demand for AI-driven applications that streamline business processes and support digital transformation. Services are significant as organizations seek expert guidance for AI integration and lifecycle management. Hardware Accelerators are experiencing rapid growth due to rising demand for specialized AI chips and efficient processing power for large-scale enterprise deployments.

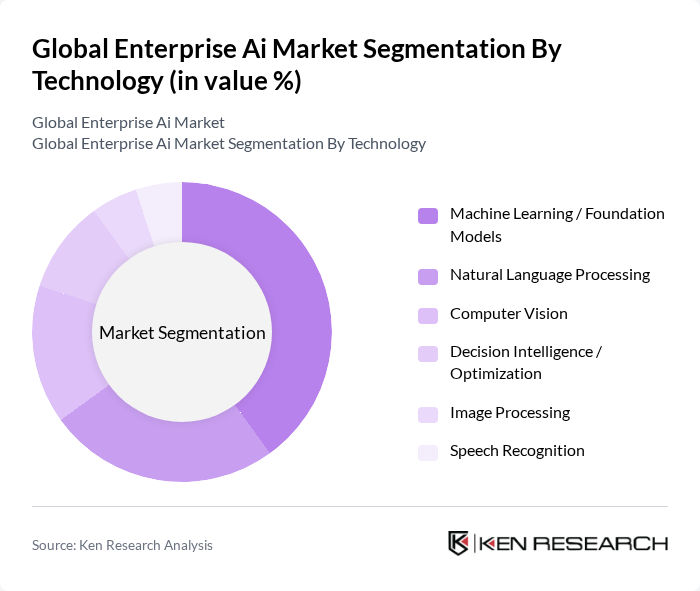

By Technology:The technology segments include Machine Learning / Foundation Models, Natural Language Processing, Computer Vision, Decision Intelligence / Optimization, Image Processing, and Speech Recognition. Machine Learning remains the dominant technology due to its versatility and broad applicability across industries such as healthcare, finance, and manufacturing. Natural Language Processing is rapidly expanding, propelled by the surge in demand for chatbots, virtual assistants, and language-based analytics. Computer Vision and Decision Intelligence are also gaining traction as enterprises leverage AI for automation, predictive analytics, and real-time insights.

The Global Enterprise AI Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Google LLC (Alphabet Inc.), Amazon Web Services, Inc., Salesforce, Inc., SAP SE, Oracle Corporation, NVIDIA Corporation, Intel Corporation, Accenture plc, Cognizant Technology Solutions Corporation, Infosys Limited, Tata Consultancy Services Limited (TCS), HCL Technologies Limited, Capgemini SE, Wipro Limited, Apple Inc., MicroStrategy Incorporated, Verint Systems Inc., and IPsoft Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the enterprise AI market appears promising, driven by technological advancements and increasing investments in AI research and development. As organizations prioritize digital transformation, the integration of AI with emerging technologies like IoT and blockchain will enhance operational efficiencies. Furthermore, the shift towards explainable AI will address ethical concerns, fostering greater trust in AI systems. This evolving landscape will likely lead to innovative applications and a more competitive market environment.

| Segment | Sub-Segments |

|---|---|

| By Component | Software / Platform Services Hardware Accelerators |

| By Technology | Machine Learning / Foundation Models Natural Language Processing Computer Vision Decision Intelligence / Optimization Image Processing Speech Recognition |

| By Application | Customer Service Automation Marketing and Sales Fraud Detection Supply Chain Optimization Product Development Predictive Maintenance Research and Development Risk Management Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid / Edge |

| By Organization Size | Large Enterprises (?1,000 Employees) Mid-market (100-999 Employees) Small Enterprises (<100 Employees) |

| By End-User Industry | BFSI Manufacturing Automotive and Mobility IT and Telecom Media and Advertising Healthcare and Life Sciences Retail and E-Commerce Energy and Utilities Education Government Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare AI Solutions | 100 | Healthcare IT Managers, Clinical Data Analysts |

| Financial Services AI Applications | 80 | Risk Management Officers, Financial Analysts |

| Manufacturing AI Integration | 60 | Operations Managers, Production Engineers |

| Retail AI Customer Experience | 70 | Marketing Directors, Customer Experience Managers |

| AI in Supply Chain Management | 50 | Supply Chain Analysts, Logistics Coordinators |

The Global Enterprise AI Market is valued at approximately USD 97 billion, reflecting significant growth driven by the increasing adoption of AI technologies across various industries to enhance operational efficiency and automate complex workflows.