Global Enterprise Asset Management Market Overview

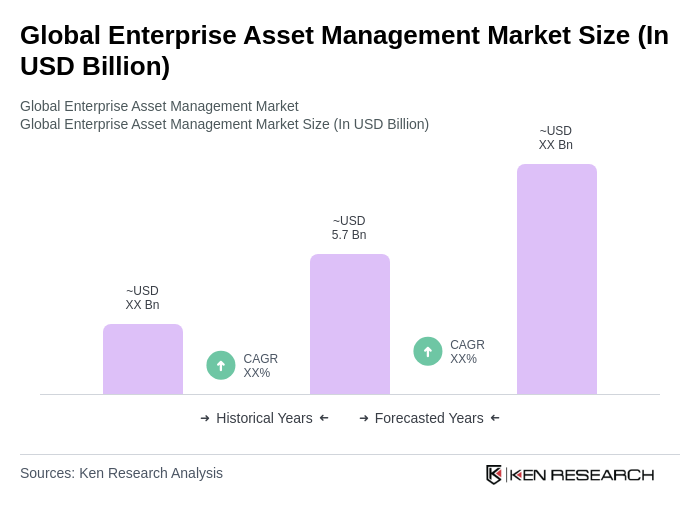

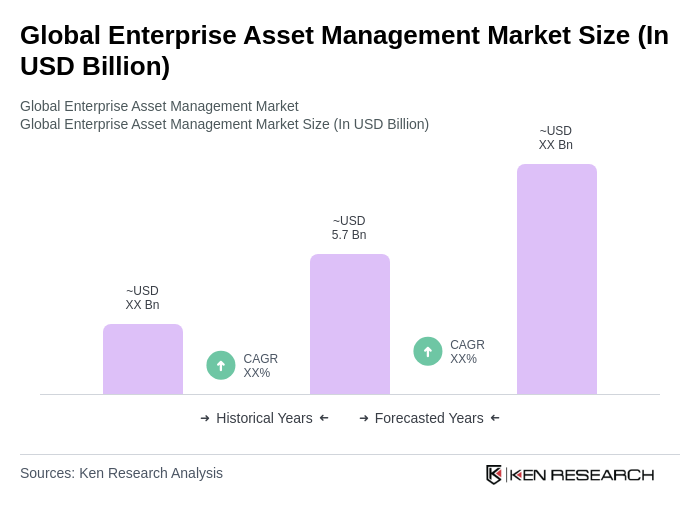

- The Global Enterprise Asset Management Market is valued at USD 5.7 billion, based on a five-year historical analysis. Growth is primarily driven by the increasing need for organizations to optimize asset utilization, reduce operational costs, and enhance productivity through advanced technologies such as IoT, artificial intelligence, and real-time analytics. The integration of digital twins, predictive maintenance, and cloud-based platforms is further accelerating adoption, while the focus on sustainability and regulatory compliance continues to propel demand for robust asset management solutions.

- Key players in this market include the United States, Germany, and the United Kingdom, which lead due to their strong industrial base, advanced technology adoption, and significant investments in infrastructure. The presence of major enterprise software vendors and a rapid shift toward digital transformation in these regions further reinforce their market leadership.

- The Digital Operational Resilience Act (DORA), issued by the European Union in 2023, mandates that financial institutions strengthen operational resilience through comprehensive asset management practices. DORA requires organizations to implement effective risk management, maintain ICT continuity, and ensure rapid recovery from operational disruptions, thereby increasing the demand for advanced enterprise asset management solutions.

Global Enterprise Asset Management Market Segmentation

By Component:The market is segmented into Software and Services. The Software segment includes Asset Lifecycle Management, Inventory Management, Facility Management, Predictive Maintenance, Labor Management, and Others. The Services segment encompasses Integration & Deployment, Advisory & Consulting, and Support & Maintenance. The Software segment maintains the largest share, driven by the widespread adoption of digital solutions that enhance asset visibility, predictive analytics, and management efficiency.

By Deployment Model:The market is categorized into On-Premises, Cloud-Based, and Hybrid deployment models. The Cloud-Based model is gaining significant traction due to its scalability, cost-effectiveness, and ease of access. Organizations are increasingly adopting cloud solutions to improve collaboration, enable real-time data sharing, and support remote asset management, making it the leading deployment model in the market.

Global Enterprise Asset Management Market Competitive Landscape

The Global Enterprise Asset Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, SAP SE, Oracle Corporation, Infor, Inc., AssetWorks, LLC, ABB Ltd., Siemens AG, Schneider Electric SE, Hexagon AB, IFS AB, CGI, Inc., Aptean, Sage Group PLC, PcsInfinity (Asset Infinity), eMaint Enterprises, LLC, UpKeep Technologies, Inc., Dude Solutions, Inc., and Fiix Software, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Global Enterprise Asset Management Market Industry Analysis

Growth Drivers

- Increased Focus on Operational Efficiency:Organizations are increasingly prioritizing operational efficiency to enhance productivity and reduce costs. According to the World Bank, global productivity growth is projected to reach 2.5% in future, driving companies to adopt enterprise asset management (EAM) solutions. This shift is evident as businesses invest approximately $1.7 trillion annually in technology to streamline operations, thereby improving asset utilization and minimizing downtime, which is crucial for maintaining competitive advantage.

- Rising Demand for Predictive Maintenance:The global predictive maintenance market is expected to reach $14 billion by future, reflecting a growing trend among organizations to leverage data analytics for asset management. This demand is fueled by the need to reduce unplanned downtime, which costs industries an estimated $60 billion annually. By implementing predictive maintenance strategies, companies can enhance asset longevity and operational reliability, leading to significant cost savings and improved service delivery.

- Adoption of IoT and Smart Technologies:The integration of Internet of Things (IoT) technologies in asset management is projected to grow significantly, with an estimated 75 billion connected devices by future. This technological advancement allows for real-time monitoring and data collection, enhancing decision-making processes. The global IoT market is expected to reach $1.5 trillion by future, providing organizations with the tools necessary to optimize asset performance and improve overall operational efficiency.

Market Challenges

- High Implementation Costs:The initial investment required for implementing enterprise asset management systems can be substantial, often exceeding $600,000 for mid-sized companies. This financial barrier can deter organizations from adopting EAM solutions, especially in regions with limited budgets. Additionally, ongoing maintenance and training costs can further strain financial resources, making it challenging for companies to justify the expenditure against potential returns.

- Complexity of Integration with Existing Systems:Many organizations face significant hurdles when integrating EAM solutions with legacy systems. Approximately 65% of companies report integration issues, which can lead to operational disruptions and increased costs. The complexity of aligning new technologies with existing workflows often results in extended implementation timelines, which can hinder the overall effectiveness of asset management initiatives and delay expected benefits.

Global Enterprise Asset Management Market Future Outlook

The future of enterprise asset management is poised for transformative growth, driven by advancements in technology and increasing operational demands. As organizations continue to embrace digital transformation, the integration of AI and machine learning will enhance predictive capabilities, allowing for more informed decision-making. Furthermore, the emphasis on sustainability will push companies to adopt greener practices, aligning asset management strategies with environmental goals, thereby fostering innovation and efficiency in asset utilization.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present significant growth opportunities for EAM solutions, with an expected increase in infrastructure spending projected to reach $6 trillion by future. This investment will drive demand for efficient asset management practices, enabling companies to optimize resources and improve service delivery in rapidly developing regions.

- Development of Cloud-Based Solutions:The shift towards cloud-based EAM solutions is gaining momentum, with the market expected to grow to $10 billion by future. This trend allows organizations to reduce IT costs and enhance scalability, making asset management more accessible for businesses of all sizes. Cloud solutions also facilitate real-time data access, improving collaboration and decision-making across teams.