Region:Global

Author(s):Dev

Product Code:KRAC0476

Pages:97

Published On:August 2025

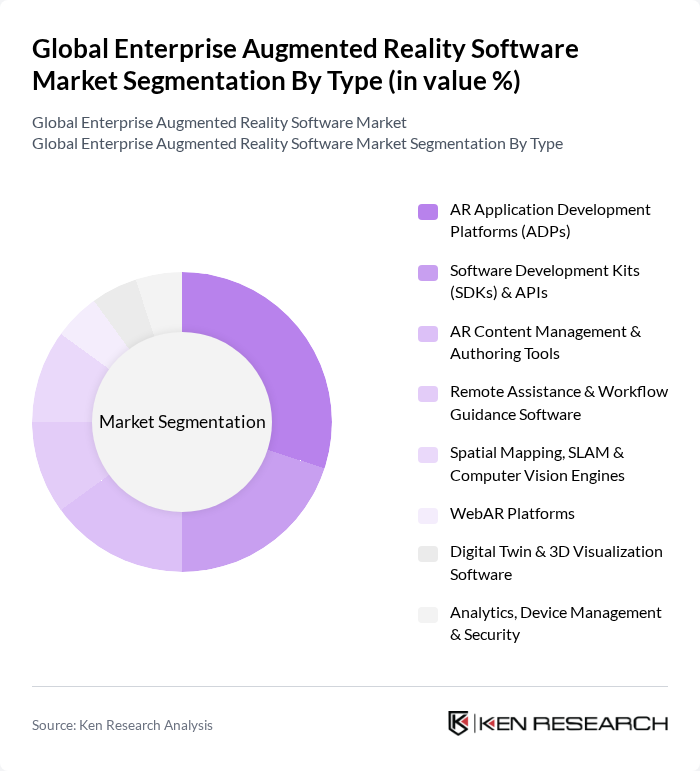

By Type:The market is segmented into various types of software solutions that cater to different needs within the enterprise environment. The subsegments include AR Application Development Platforms (ADPs), Software Development Kits (SDKs) & APIs, AR Content Management & Authoring Tools, Remote Assistance & Workflow Guidance Software, Spatial Mapping, SLAM & Computer Vision Engines, WebAR Platforms, Digital Twin & 3D Visualization Software, and Analytics, Device Management & Security. Among these, AR Application Development Platforms (ADPs) are currently dominating the market due to their ability to provide comprehensive tools for developers to create customized AR applications tailored to specific business needs .

By End-User:The end-user segmentation includes various industries that leverage augmented reality software for operational improvements. Key segments are Manufacturing & Industrial, Retail & E-commerce, Healthcare & Life Sciences, Education & Training, Logistics & Field Services, Architecture, Engineering & Construction (AEC), Automotive & Transportation, Energy, Utilities & Oil and Gas, and Others. The Manufacturing & Industrial sector is leading this segment, driven by the need for enhanced training, maintenance, and operational efficiency through AR technologies; enterprise deployments often emphasize remote assistance, workflow guidance, and training use cases in factories and field service .

The Global Enterprise Augmented Reality Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as PTC Inc. (Vuforia), Microsoft Corporation (Dynamics 365 Guides/Remote Assist), Google LLC (ARCore/Geospatial Creator/Niantic 8th Wall), Unity Technologies (Unity Industry/Unity MARS), Apple Inc. (ARKit/RealityKit), TeamViewer SE (Frontline), Scope AR, BILT Incorporated, Upskill (formerly, now part of TeamViewer), Librestream Technologies, RE’FLEKT GmbH, Magic Leap, Inc., Niantic, Inc. (8th Wall), Wikitude GmbH (an Almer company), Zappar Ltd contribute to innovation, geographic expansion, and service delivery in this space .

The future of the enterprise augmented reality software market appears promising, driven by technological advancements and increasing integration across various sectors. As 5G technology becomes more widespread, it will enhance AR experiences by providing faster data transmission and lower latency. Furthermore, the shift towards cloud-based solutions will facilitate easier access and scalability for businesses, allowing for more widespread adoption. Companies are likely to invest in tailored AR solutions that cater to specific industry needs, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | AR Application Development Platforms (ADPs) Software Development Kits (SDKs) & APIs AR Content Management & Authoring Tools Remote Assistance & Workflow Guidance Software Spatial Mapping, SLAM & Computer Vision Engines WebAR Platforms Digital Twin & 3D Visualization Software Analytics, Device Management & Security |

| By End-User | Manufacturing & Industrial Retail & E-commerce Healthcare & Life Sciences Education & Training Logistics & Field Services Architecture, Engineering & Construction (AEC) Automotive & Transportation Energy, Utilities & Oil and Gas Others |

| By Application | Training, Onboarding & Simulation Maintenance, Repair & Operations (MRO) Remote Expert Support & Collaboration Marketing, Sales Enablement & Retail Experience Product Design, Prototyping & Visualization Quality Inspection & Compliance Warehouse Picking & Workflow Guidance Customer Service & Aftermarket Support Others |

| By Deployment Mode | Cloud-Based (SaaS) On-Premises Hybrid |

| By Industry Vertical | Industrial & Manufacturing Aerospace & Defense Automotive AEC (Architecture, Engineering & Construction) Retail & Consumer Goods Healthcare Energy & Utilities Logistics & Transportation Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription (Per-User/Per-Device) Enterprise License (Annual/Multiyear) Usage-Based (Events/Views/Minutes) Freemium & Developer Tiers One-Time Perpetual License |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector AR Applications | 100 | Marketing Managers, IT Directors |

| Healthcare AR Solutions | 80 | Healthcare Administrators, Medical Technology Specialists |

| Manufacturing AR Integration | 70 | Operations Managers, Production Engineers |

| Education Sector AR Tools | 60 | Curriculum Developers, Educational Technology Coordinators |

| Real Estate AR Visualization | 90 | Real Estate Agents, Property Developers |

The Global Enterprise Augmented Reality Software Market is valued at approximately USD 10.3 billion, reflecting a comprehensive analysis of enterprise software revenues within the broader augmented reality sector, as reported by various industry trackers.