Region:Global

Author(s):Dev

Product Code:KRAB0512

Pages:81

Published On:August 2025

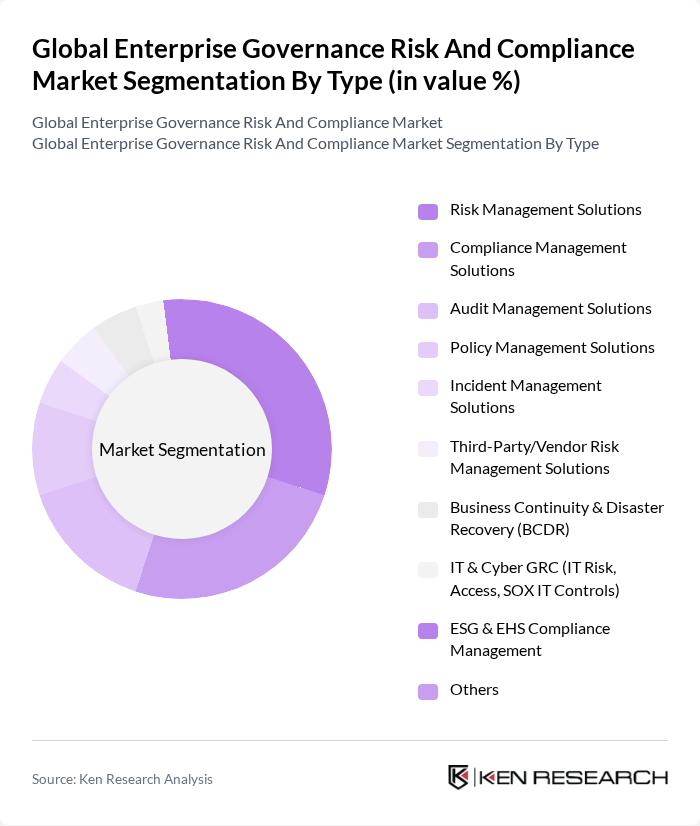

By Type:The market is segmented into various types, including Risk Management Solutions, Compliance Management Solutions, Audit Management Solutions, Policy Management Solutions, Incident Management Solutions, Third-Party/Vendor Risk Management Solutions, Business Continuity & Disaster Recovery (BCDR), IT & Cyber GRC (IT Risk, Access, SOX IT Controls), ESG & EHS Compliance Management, and Others. Among these, Risk Management Solutions are currently leading the market due to the increasing need for organizations to identify, assess, and mitigate risks effectively. The growing awareness of potential threats and the need for proactive measures have driven demand for these solutions. Adoption is further supported by integration of AI/ML in GRC platforms for real-time risk analytics and continuous control monitoring.

By End-User:The end-user segmentation includes Financial Services, Healthcare and Life Sciences, Manufacturing, Government and Public Sector, IT and Telecom, Energy and Utilities, Retail and Consumer Goods, Transportation and Logistics, and Others. The Financial Services sector is the largest end-user of governance, risk, and compliance solutions, driven by stringent regulatory requirements and the need for robust risk management frameworks to protect sensitive financial data. Recent regulations such as DORA in the EU and ongoing enforcement of SOX, GDPR, HIPAA, PCI-DSS, and sector-specific cyber mandates reinforce demand in BFSI.

The Global Enterprise Governance Risk And Compliance Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation (OpenPages), SAP SE (SAP GRC), Oracle Corporation (Oracle Risk Management Cloud), RSA Security LLC (RSA Archer), MetricStream, Inc., LogicManager, Inc., SAI360 (formerly SAI Global), Wolters Kluwer N.V. (TeamMate, OneSumX), Diligent Corporation (Galvanize/HighBond), NAVEX Global, Inc. (NAVEX One), Riskonnect, Inc., OneTrust, LLC, ServiceNow, Inc. (Risk and Compliance), Thomson Reuters (Thomson Reuters Risk & Compliance), Archer Technologies LLC contribute to innovation, geographic expansion, and service delivery in this space. Recent product innovation focuses on AI-enabled controls testing, continuous monitoring, and integrated ESG/EHS compliance within GRC suites.

The future of the enterprise governance risk and compliance landscape is poised for transformation, driven by technological advancements and evolving regulatory demands. As organizations increasingly adopt AI and machine learning, GRC solutions will become more efficient and effective in managing compliance risks. Additionally, the emphasis on integrated GRC solutions will facilitate a holistic approach to risk management, enabling businesses to respond proactively to emerging threats and regulatory changes, ultimately fostering a culture of compliance and resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Risk Management Solutions Compliance Management Solutions Audit Management Solutions Policy Management Solutions Incident Management Solutions Third-Party/Vendor Risk Management Solutions Business Continuity & Disaster Recovery (BCDR) IT & Cyber GRC (IT Risk, Access, SOX IT Controls) ESG & EHS Compliance Management Others |

| By End-User | Financial Services Healthcare and Life Sciences Manufacturing Government and Public Sector IT and Telecom Energy and Utilities Retail and Consumer Goods Transportation and Logistics Others |

| By Industry Vertical | Banking and Financial Services (BFS) Insurance Energy and Utilities Retail Construction & Engineering Telecom & IT Government Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Compliance Framework | ISO Standards (e.g., ISO 27001, ISO 31000) NIST Cybersecurity Framework COBIT SOC 2/Type II PCI DSS HIPAA Others |

| By Service Type | Consulting Services Implementation & Integration Services Managed Services Support and Maintenance Services Training & Advisory Others |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Component | Software Services |

| By Application | Audit Management Policy & Compliance Management Risk Management Incident & Case Management Environment, Health & Safety (EHS) ESG Reporting & Disclosure Legal & Regulatory Change Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Compliance | 150 | Compliance Officers, Risk Managers |

| Healthcare Regulatory Adherence | 100 | Healthcare Administrators, Compliance Specialists |

| Manufacturing Risk Management | 80 | Operations Managers, Quality Assurance Leads |

| IT Security Governance | 120 | IT Security Officers, Governance Analysts |

| Energy Sector Compliance Strategies | 70 | Environmental Compliance Managers, Risk Assessment Officers |

The Global Enterprise Governance Risk and Compliance Market is valued at approximately USD 63 billion, reflecting a significant growth driven by increasing regulatory complexities, rising cyber threats, and the need for organizations to ensure compliance with various standards.