Region:Global

Author(s):Geetanshi

Product Code:KRAA1209

Pages:92

Published On:August 2025

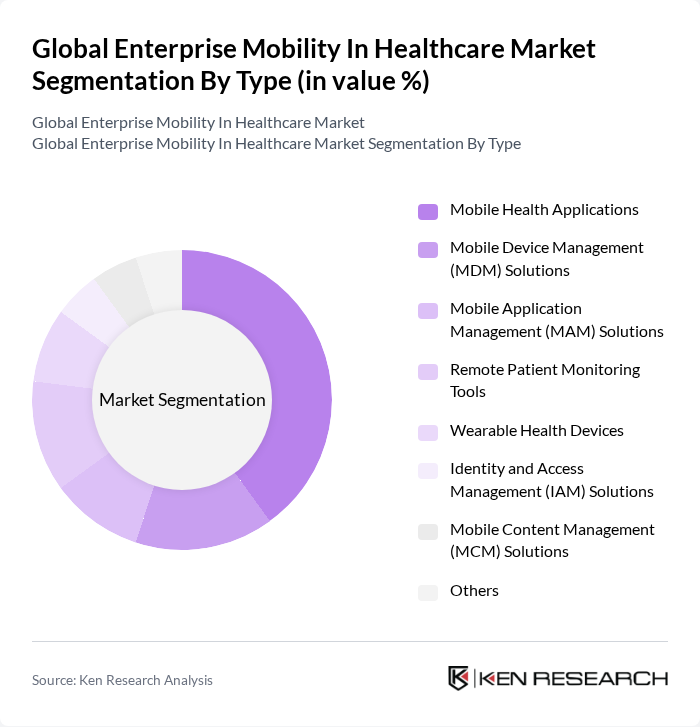

By Type:The market is segmented into various types, including Mobile Health Applications, Mobile Device Management (MDM) Solutions, Mobile Application Management (MAM) Solutions, Remote Patient Monitoring Tools, Wearable Health Devices, Identity and Access Management (IAM) Solutions, Mobile Content Management (MCM) Solutions, and Others. Among these, Mobile Health Applications are leading the market due to their widespread adoption by healthcare providers and patients for managing health data, scheduling appointments, and facilitating telemedicine services. The increasing smartphone penetration, the growing trend of personalized healthcare, and the integration of electronic health records (EHR) are driving the demand for these applications.

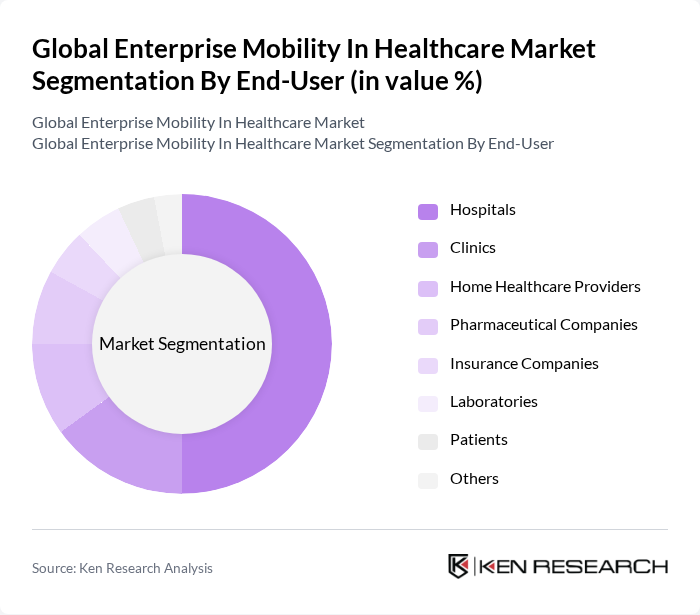

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare Providers, Pharmaceutical Companies, Insurance Companies, Laboratories, Patients, and Others. Hospitals are the dominant end-user segment, driven by the increasing need for efficient patient management systems and the integration of mobile solutions in clinical workflows. The growing trend of digital health initiatives, real-time data access, and workflow optimization in hospitals further enhance the adoption of enterprise mobility solutions.

The Global Enterprise Mobility In Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Cerner Corporation, Allscripts Healthcare Solutions, Inc., McKesson Corporation, Philips Healthcare, GE Healthcare, Qualcomm Life, Inc., Medtronic plc, Siemens Healthineers, Epic Systems Corporation, AT&T Inc., Verizon Communications Inc., VMware, Inc., Citrix Systems, Inc., Zebra Technologies Corporation, BlackBerry Limited, MobileIron (Ivanti) contribute to innovation, geographic expansion, and service delivery in this space.

The future of enterprise mobility in healthcare appears promising, driven by technological advancements and changing patient expectations. As healthcare providers increasingly adopt patient-centric care models, the integration of AI and machine learning will enhance decision-making and operational efficiency. Additionally, the rise of mobile health applications will continue to empower patients, fostering greater engagement and adherence to treatment plans. These trends indicate a transformative shift in how healthcare is delivered and experienced, paving the way for innovative solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Health Applications Mobile Device Management (MDM) Solutions Mobile Application Management (MAM) Solutions Remote Patient Monitoring Tools Wearable Health Devices Identity and Access Management (IAM) Solutions Mobile Content Management (MCM) Solutions Others |

| By End-User | Hospitals Clinics Home Healthcare Providers Pharmaceutical Companies Insurance Companies Laboratories Patients Others |

| By Application | Chronic Disease Management Fitness and Wellness Monitoring Medication Management Emergency Response Clinical Workflow Automation Patient Engagement & Communication Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| By Service Type | Consulting Services Implementation Services Maintenance and Support Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital IT Departments | 60 | IT Managers, Chief Information Officers |

| Healthcare Mobile Application Users | 50 | Healthcare Professionals, Patients |

| Telemedicine Service Providers | 40 | Operations Managers, Service Delivery Heads |

| Healthcare Compliance Officers | 40 | Compliance Managers, Risk Assessment Officers |

| Mobile Device Management Solutions | 45 | Product Managers, Technical Support Leads |

The Global Enterprise Mobility in Healthcare Market is valued at approximately USD 15 billion, driven by the increasing adoption of mobile health applications, efficient patient management systems, and remote patient monitoring solutions.