Global Enterprise Network Equipment Market Overview

- The Global Enterprise Network Equipment Market is valued at USD 75 billion, based on a five-year historical analysis. Growth is primarily driven by the rising demand for high-speed connectivity, rapid adoption of cloud computing, expansion of IoT devices, and heightened cybersecurity requirements. Enterprises are increasingly investing in advanced networking solutions—including software-defined networking (SDN), network functions virtualization (NFV), and secure access service edge (SASE)—to enhance operational efficiency, support distributed teams, and enable digital transformation initiatives. The adoption of Wi-Fi 6 and 5G private wireless networks is also accelerating modernization efforts and supporting bandwidth-intensive applications .

- Key players in this market include the United States, China, and Germany. The United States leads due to its advanced technological infrastructure, high adoption rates of innovative networking solutions, and strong presence of global industry leaders. China follows closely, driven by its large manufacturing base, rapid urbanization, and significant investments in digital infrastructure. Germany benefits from a robust industrial sector, a focus on Industry 4.0, and ongoing digitalization initiatives across enterprises .

- In 2023, the European Union implemented the Digital Services Act (Regulation (EU) 2022/2065), issued by the European Parliament and the Council. This binding regulation mandates stricter requirements for data privacy, cybersecurity, and transparency for digital service and network equipment providers operating within the EU. Enterprises must comply with enhanced obligations on risk management, incident reporting, and user protection, significantly influencing market dynamics and compliance strategies for network equipment vendors.

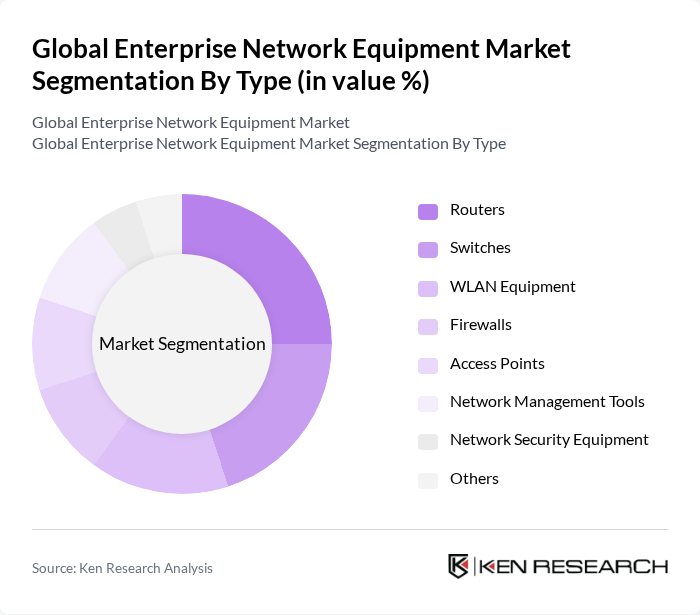

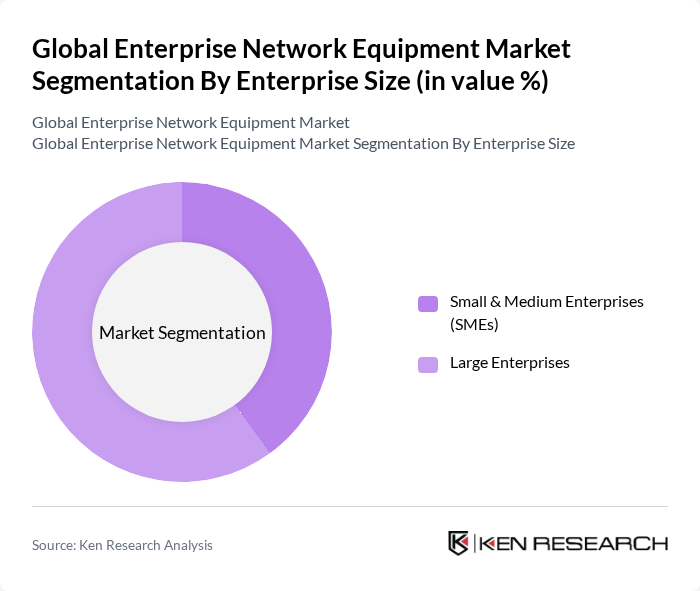

Global Enterprise Network Equipment Market Segmentation

By Type:The market is segmented into various types of network equipment, including routers, switches, WLAN equipment, firewalls, access points, network management tools, network security equipment, and others. Each of these subsegments plays a crucial role in the overall network infrastructure, addressing specific enterprise needs such as core connectivity, wireless access, security, and centralized network management. The adoption of SDN, AI-driven network management, and integrated security appliances is rising, reflecting the need for scalable and intelligent solutions .

By Enterprise Size:The market is categorized based on enterprise size into Small & Medium Enterprises (SMEs) and Large Enterprises. SMEs are increasingly investing in scalable, cloud-based, and wireless networking solutions to support business growth and remote work, while large enterprises prioritize robust, integrated, and secure network architectures to manage complex operations and compliance requirements .

Global Enterprise Network Equipment Market Competitive Landscape

The Global Enterprise Network Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cisco Systems, Inc., Juniper Networks, Inc., Arista Networks, Inc., Hewlett Packard Enterprise, Dell Technologies Inc., Extreme Networks, Inc., Netgear, Inc., Huawei Technologies Co., Ltd., TP-Link Technologies Co., Ltd., Broadcom Inc., VMware, Inc., Ciena Corporation, Ubiquiti Inc., Accton Technology Corporation, Tejas Networks Limited, Sterlite Technologies Limited, Fortinet, Inc., Palo Alto Networks, Inc., ZTE Corporation, Nokia Corporation contribute to innovation, geographic expansion, and service delivery in this space .

Global Enterprise Network Equipment Market Industry Analysis

Growth Drivers

- Increasing Demand for High-Speed Internet Connectivity:The global demand for high-speed internet is projected to reach 1.8 billion broadband subscriptions in future, driven by a surge in remote work and digital services. According to the International Telecommunication Union, global internet usage increased by approximately 5% in recent periods, highlighting the necessity for robust network infrastructure. This demand is particularly pronounced in regions with expanding urban populations, where reliable connectivity is essential for economic growth and social development.

- Rise in Cloud Computing and Data Center Expansion:The global cloud computing market is expected to grow to $1,200 billion in future, with data centers expanding to accommodate this growth. According to Synergy Research Group, the number of data centers worldwide increased by approximately 11% in recent periods, necessitating advanced network equipment to support increased data traffic. This trend is further fueled by businesses migrating to cloud-based solutions, which require enhanced network capabilities for optimal performance and security.

- Growing Adoption of IoT Devices:The number of connected IoT devices is projected to exceed 30 billion in future, according to Statista. This rapid proliferation of IoT technology is driving the need for advanced network equipment capable of handling increased data volumes and connectivity demands. As industries such as manufacturing and healthcare integrate IoT solutions, the requirement for reliable and scalable network infrastructure becomes critical to support real-time data processing and analytics.

Market Challenges

- High Initial Investment Costs:The initial capital expenditure for deploying advanced network equipment can be substantial, often exceeding $1 million for mid-sized enterprises. This financial barrier can deter smaller businesses from upgrading their infrastructure, limiting their competitiveness in a rapidly evolving digital landscape. According to the World Bank, many SMEs struggle to allocate sufficient budgets for technology investments, impacting their ability to adopt necessary innovations.

- Rapid Technological Changes:The pace of technological advancement in network equipment is accelerating, with new standards and protocols emerging frequently. For instance, the transition to 5G technology requires significant upgrades to existing infrastructure, which can be costly and complex. According to the OECD, organizations that fail to adapt to these changes risk obsolescence, as competitors leverage newer technologies to enhance operational efficiency and customer experience.

Global Enterprise Network Equipment Market Future Outlook

The future of the enterprise network equipment market is poised for significant transformation, driven by advancements in technology and evolving consumer demands. As organizations increasingly prioritize digital transformation, the integration of AI and machine learning into network management will enhance operational efficiency. Additionally, the expansion of 5G infrastructure will facilitate faster and more reliable connectivity, enabling new applications and services. These trends will shape the competitive landscape, compelling companies to innovate and adapt to remain relevant in a dynamic market environment.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia and Africa, present significant growth opportunities for network equipment providers. With internet penetration rates expected to rise by approximately 15% annually in recent periods, companies can capitalize on the increasing demand for connectivity solutions. This growth is supported by government initiatives aimed at improving digital infrastructure, creating a favorable environment for investment and innovation.

- Development of 5G Infrastructure:The global rollout of 5G technology is anticipated to create substantial opportunities for network equipment manufacturers. With an estimated $1.5 trillion investment required for 5G infrastructure in future, companies that specialize in advanced networking solutions will benefit from increased demand. This development will not only enhance connectivity but also enable new applications in sectors such as healthcare, transportation, and smart cities.