Region:Global

Author(s):Shubham

Product Code:KRAA1770

Pages:90

Published On:August 2025

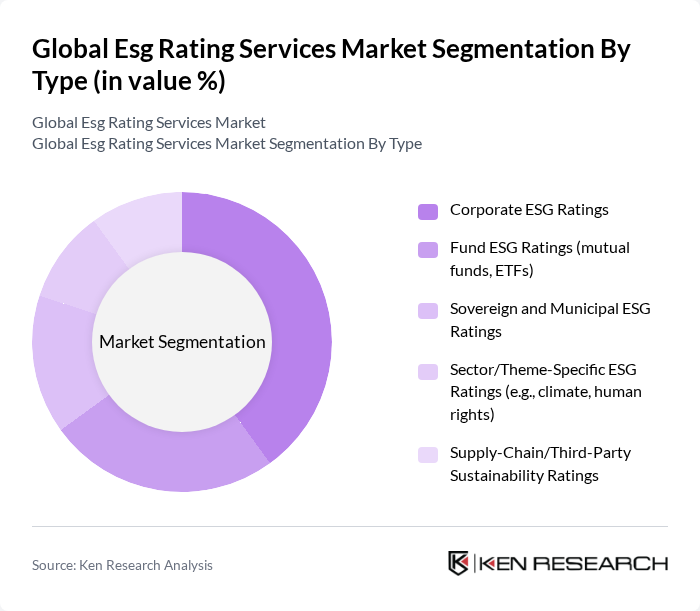

By Type:The market is segmented into various types of ESG ratings, including Corporate ESG Ratings, Fund ESG Ratings, Sovereign and Municipal ESG Ratings, Sector/Theme-Specific ESG Ratings, and Supply-Chain/Third-Party Sustainability Ratings. Among these, Corporate ESG Ratings dominate the market due to the increasing focus of companies on sustainability practices and the need for transparent reporting to attract investors. Fund ESG Ratings are also gaining traction as investors seek to align their portfolios with sustainable practices. Continuing regulatory alignment (e.g., EU CSRD and fund disclosure regimes) and demand from asset managers for decision?useful, comparable data support these segments’ growth .

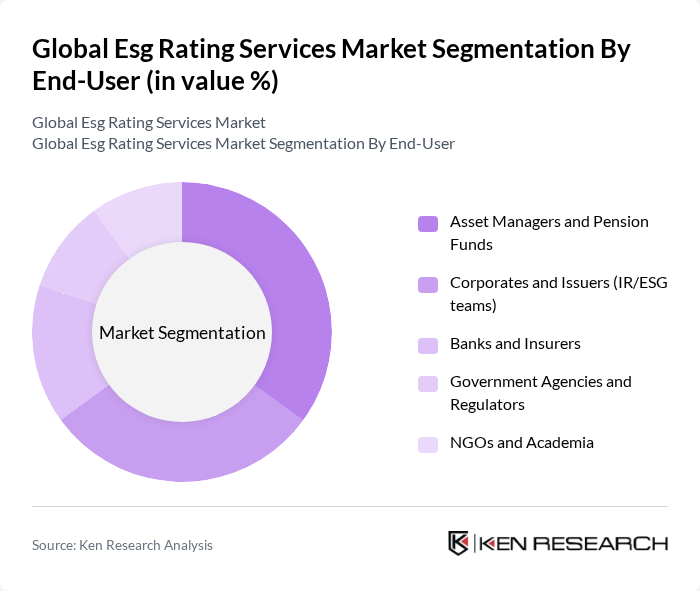

By End-User:The end-users of ESG rating services include Asset Managers and Pension Funds, Corporates and Issuers, Banks and Insurers, Government Agencies and Regulators, and NGOs and Academia. Asset Managers and Pension Funds are the leading end-users, driven by the need to integrate ESG factors into investment decisions and risk assessments. Corporates and Issuers are also significant users as they seek to improve their sustainability profiles and attract responsible investment. Increased supervisory expectations and disclosure rules in key markets continue to anchor demand among financial institutions and corporates .

The Global Esg Rating Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as MSCI Inc. (MSCI ESG Research), Sustainalytics (a Morningstar company), S&P Global Sustainable1, Moody’s ESG Solutions, LSEG (Refinitiv) — LSEG Data & Analytics, V.E (formerly Vigeo Eiris, part of Moody’s), ISS ESG (Institutional Shareholder Services), Bloomberg L.P., EcoVadis, Arabesque S-Ray (Arabesque ESG Book), CDP (Carbon Disclosure Project), FTSE Russell (FTSE4Good), S&P Global Trucost, GRESB, and RepRisk contribute to innovation, geographic expansion, and service delivery in this space. Independent industry coverage identifies MSCI, Sustainalytics, and S&P Global among the largest providers by market presence and client penetration within ESG data and ratings .

Additional validated insights to enhance growth drivers and context

The future of ESG rating services in future is poised for significant transformation, driven by technological advancements and increasing regulatory scrutiny. As companies adopt integrated reporting frameworks, the demand for comprehensive ESG assessments will rise. Furthermore, the focus on climate risk assessment will intensify, compelling organizations to enhance their sustainability practices. This evolving landscape presents opportunities for innovative rating methodologies and strategic partnerships, positioning ESG rating services as essential tools for investors and companies alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Corporate ESG Ratings Fund ESG Ratings (mutual funds, ETFs) Sovereign and Municipal ESG Ratings Sector/Theme-Specific ESG Ratings (e.g., climate, human rights) Supply-Chain/Third-Party Sustainability Ratings |

| By End-User | Asset Managers and Pension Funds Corporates and Issuers (IR/ESG teams) Banks and Insurers Government Agencies and Regulators NGOs and Academia |

| By Application | Investment and Asset Allocation Credit and Risk Management Regulatory Reporting and Disclosure (e.g., SFDR, CSRD) Corporate Sustainability/Integrated Reporting Supply Chain Due Diligence and Vendor Risk |

| By Service Type | ESG Assessment and Ratings ESG Data Provision and Analytics ESG Reporting and Disclosure Support Verification, Assurance, and Compliance Services ESG Strategy and Advisory/Consulting |

| By Distribution Channel | Direct Enterprise Sales Data Platforms and Marketplaces (APIs, terminals) Partnerships with Index/Benchmark Providers Channel Partners and System Integrators |

| By Pricing Model | Subscription (seat-based or enterprise license) Usage-Based/API Consumption Per-Report/Project-Based Custom/Managed Service Contracts |

| By Geographic Focus | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate ESG Strategy Implementation | 130 | Sustainability Officers, ESG Analysts |

| Investment Decision-Making Processes | 100 | Portfolio Managers, Investment Analysts |

| Regulatory Compliance and Reporting | 80 | Compliance Officers, Legal Advisors |

| Stakeholder Engagement Practices | 70 | Corporate Communication Heads, Investor Relations Managers |

| ESG Rating Methodology Insights | 90 | Rating Agency Executives, Research Analysts |

The Global ESG Rating Services Market is valued at approximately USD 7 billion, reflecting significant adoption of ESG assessments by issuers and investors, particularly in the early to mid-2020s.