Region:Global

Author(s):Shubham

Product Code:KRAD0656

Pages:99

Published On:August 2025

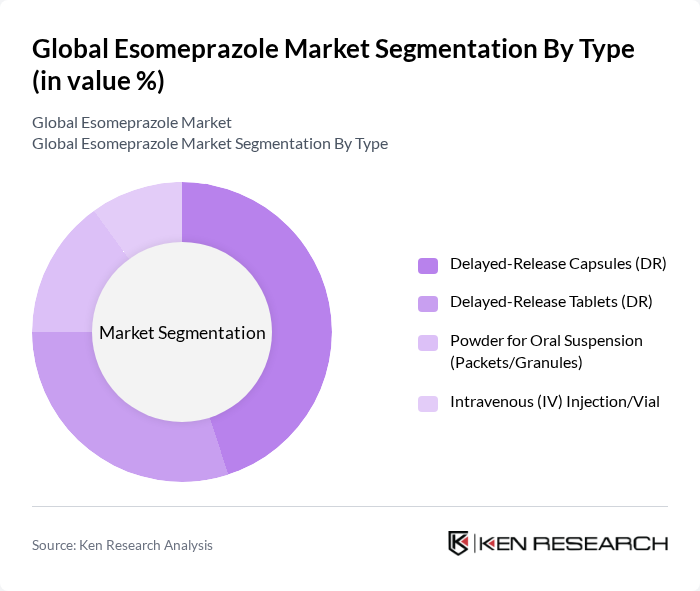

By Type:The market is segmented into various types, including Delayed-Release Capsules (DR), Delayed-Release Tablets (DR), Powder for Oral Suspension (Packets/Granules), and Intravenous (IV) Injection/Vial. Among these, Delayed-Release Capsules (DR) dominate the market due to their convenience and effectiveness in delivering the drug over an extended period, which aligns with patient preferences for ease of use and adherence to treatment regimens.

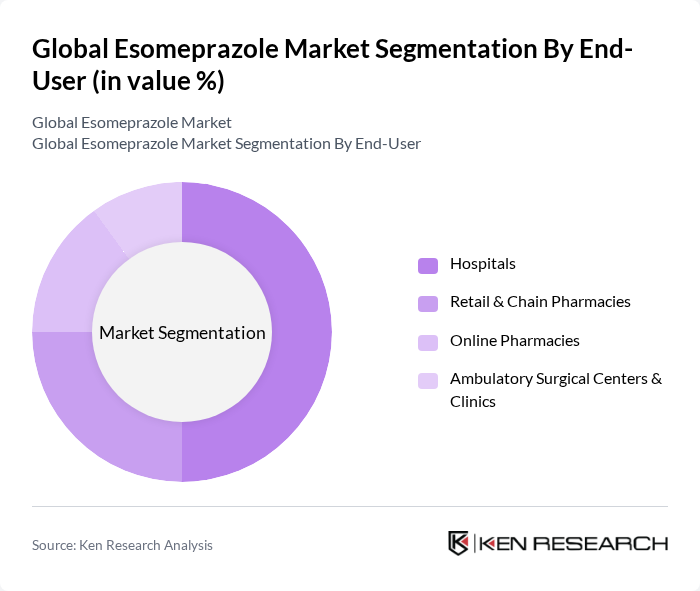

By End-User:The end-user segmentation includes Hospitals, Retail & Chain Pharmacies, Online Pharmacies, and Ambulatory Surgical Centers & Clinics. Hospitals are the leading end-user segment, primarily due to the high volume of patients requiring treatment for severe acid-related disorders, which necessitates the use of esomeprazole in clinical settings for effective management. Growing e-pharmacy penetration is expanding access for maintenance therapy and OTC purchases in certain markets.

The Global Esomeprazole Market is characterized by a dynamic mix of regional and international players. Leading participants such as AstraZeneca PLC, Viatris Inc. (includes legacy Mylan), Teva Pharmaceutical Industries Ltd., Sandoz Group AG, Sun Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd., Hikma Pharmaceuticals PLC, Aurobindo Pharma Ltd., Cipla Ltd., Zydus Lifesciences Ltd., Amneal Pharmaceuticals, Inc., Lupin Limited, Glenmark Pharmaceuticals Ltd., Pfizer Inc., GSK plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the esomeprazole market appears promising, driven by ongoing advancements in drug formulation and delivery methods. As healthcare systems increasingly adopt patient-centric approaches, the demand for personalized medicine is expected to rise. Additionally, the integration of digital health technologies into treatment plans will enhance patient engagement and adherence, further supporting the growth of esomeprazole. Companies that leverage these trends will likely gain a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Delayed-Release Capsules (DR) Delayed-Release Tablets (DR) Powder for Oral Suspension (Packets/Granules) Intravenous (IV) Injection/Vial |

| By End-User | Hospitals Retail & Chain Pharmacies Online Pharmacies Ambulatory Surgical Centers & Clinics |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online/Direct-to-Consumer |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Dosage Form | Oral Parenteral |

| By Patient Demographics | Adults Pediatrics |

| By Pricing Strategy | Branded (Rx/OTC) Pricing Generic Competitive Pricing Discount & Tender-Based Pricing |

| By Prescription Status | Prescription (Rx) Over-the-Counter (OTC) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gastroenterology Clinics | 120 | Gastroenterologists, Nurse Practitioners |

| Pharmacy Chains | 90 | Pharmacists, Pharmacy Managers |

| Patient Advocacy Groups | 60 | Patient Representatives, Health Educators |

| Healthcare Providers | 100 | General Practitioners, Internal Medicine Specialists |

| Market Analysts | 50 | Healthcare Market Analysts, Industry Consultants |

The Global Esomeprazole Market is valued at approximately USD 1.9 billion, based on a five-year historical analysis. This valuation reflects the increasing demand for esomeprazole driven by the prevalence of gastroesophageal reflux disease (GERD) and other acid-related disorders.