Region:Global

Author(s):Geetanshi

Product Code:KRAA2834

Pages:85

Published On:August 2025

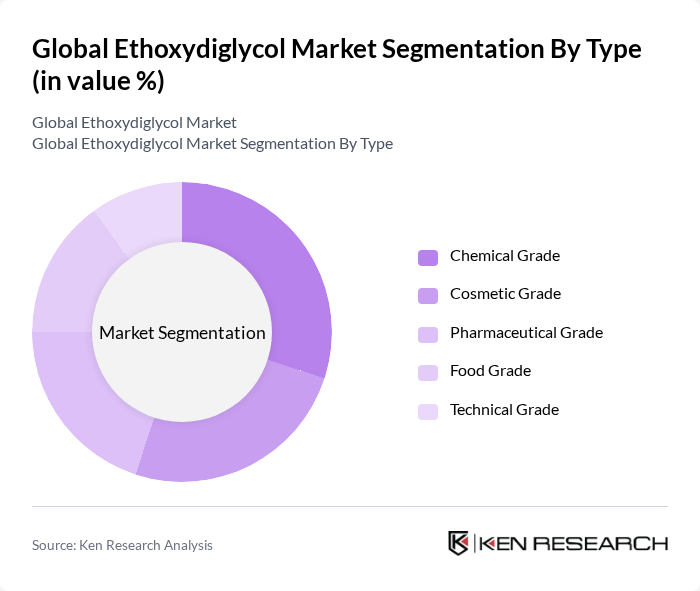

By Type:The market is segmented into Chemical Grade, Cosmetic Grade, Pharmaceutical Grade, Food Grade, and Technical Grade. Each grade serves distinct industries and applications, with specific quality and purity standards .

The Chemical Grade segment leads the market due to its extensive use in industrial applications, particularly as a solvent in chemical processes. The demand for Chemical Grade ethoxydiglycol is driven by its effectiveness in enhancing product formulations across paints, coatings, and cleaning agents. Additionally, the shift toward sustainable and eco-friendly products has increased focus on chemical-grade materials that comply with environmental regulations. This segment’s versatility and adaptability to various industrial needs solidify its leading position .

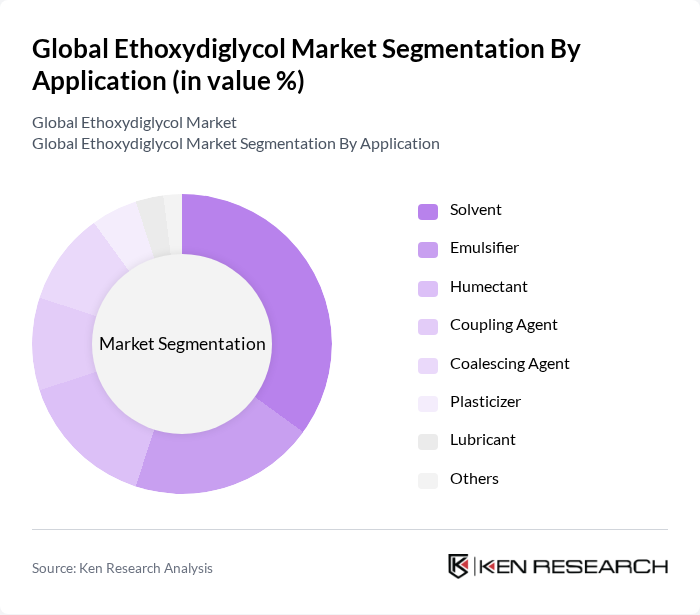

By Application:Ethoxydiglycol is used as a Solvent, Emulsifier, Humectant, Coupling Agent, Coalescing Agent, Plasticizer, Lubricant, and in other specialized roles. Each application serves specific functions across industries, contributing to overall market growth .

The Solvent application segment leads the market, accounting for the largest share due to its critical role in formulations for paints, coatings, and personal care products. Ethoxydiglycol’s solvent properties enhance the solubility of active ingredients, making it a preferred choice for manufacturers. The demand for high-performance, environmentally friendly solvents continues to rise as industries seek to meet regulatory requirements and maintain product efficacy .

The Global Ethoxydiglycol Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow, Eastman Chemical Company, Solvay S.A., Huntsman Corporation, AkzoNobel N.V., Croda International Plc, Evonik Industries AG, Oxiteno S.A., Mitsubishi Chemical Corporation, Clariant AG, INEOS Oxide, LyondellBasell Industries Holdings B.V., Merck KGaA, Gattefossé, Thermo Fisher Scientific Inc., Alzo International Inc., Finetech Industry Limited contribute to innovation, geographic expansion, and service delivery in this space.

The ethoxydiglycol market is poised for significant transformation as sustainability becomes a central focus for industries. Innovations in bio-based ethoxydiglycol are expected to gain traction, driven by consumer demand for eco-friendly products. Additionally, the rise of e-commerce platforms is likely to enhance distribution channels, making ethoxydiglycol more accessible to various sectors. As industries adapt to regulatory changes, the emphasis on multi-functional ingredients will further shape product development, creating a dynamic landscape for market participants.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Grade Cosmetic Grade Pharmaceutical Grade Food Grade Technical Grade |

| By Application | Solvent Emulsifier Humectant Coupling Agent Coalescing Agent Plasticizer Lubricant Others |

| By End-User | Cosmetics and Personal Care Pharmaceuticals Industrial Cleaners Paints and Coatings Flavor and Fragrances Food & Beverage Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Bulk Packaging Small Containers Drums Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetics and Personal Care Applications | 100 | Product Development Managers, Brand Managers |

| Pharmaceutical Industry Usage | 80 | Regulatory Affairs Specialists, Quality Control Managers |

| Industrial Solvent Applications | 60 | Procurement Managers, Production Supervisors |

| Research and Development Insights | 50 | R&D Scientists, Technical Directors |

| Market Trends and Consumer Insights | 70 | Market Analysts, Consumer Behavior Researchers |

The Global Ethoxydiglycol Market is valued at approximately USD 580 million, reflecting a five-year historical analysis. This growth is driven by increasing demand in cosmetics, pharmaceuticals, and industrial cleaners, highlighting the compound's versatility as a solvent and humectant.