Region:Global

Author(s):Rebecca

Product Code:KRAC0179

Pages:100

Published On:August 2025

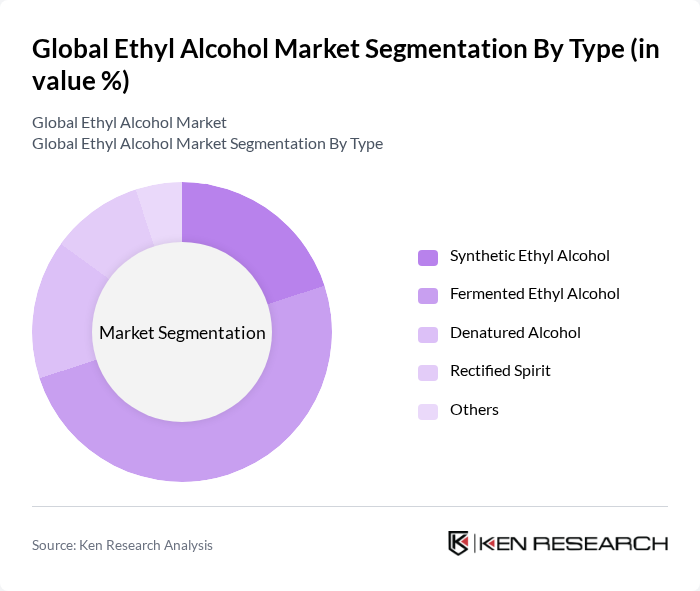

By Type:The ethyl alcohol market can be segmented into various types, including Synthetic Ethyl Alcohol, Fermented Ethyl Alcohol, Denatured Alcohol, Rectified Spirit, and Others. Among these, Fermented Ethyl Alcohol is the leading subsegment due to its widespread use in the food and beverage industry, particularly in the production of alcoholic beverages. The increasing consumer demand for organic and natural products has further propelled the growth of this subsegment. Synthetic Ethyl Alcohol, while significant, is primarily used in industrial applications, which limits its market share compared to fermented varieties .

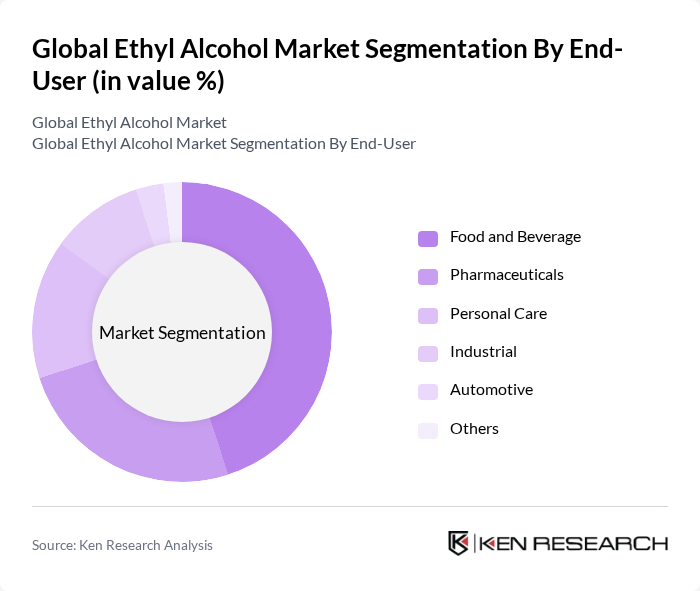

By End-User:The end-user segmentation of the ethyl alcohol market includes Food and Beverage, Pharmaceuticals, Personal Care, Industrial, Automotive, and Others. The Food and Beverage sector is the dominant end-user, driven by the increasing consumption of alcoholic beverages and the growing trend of using ethyl alcohol as a food preservative. The Pharmaceuticals sector also plays a crucial role, utilizing ethyl alcohol in the production of various medicinal products. The rising awareness of health and wellness has led to a surge in demand for personal care products containing ethyl alcohol, further diversifying the market .

The Global Ethyl Alcohol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company, Cargill, Incorporated, BASF SE, Dow Inc., Green Plains Inc., Valero Energy Corporation, Diageo plc, Pernod Ricard SA, DuPont de Nemours, Inc., Royal Dutch Shell plc, AkzoNobel N.V., Merck KGaA, Tereos S.A., Aemetis, Inc., POET, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ethyl alcohol market in None appears promising, driven by increasing consumer awareness of sustainability and health. As the demand for biofuels and natural products rises, manufacturers are likely to innovate in production technologies to enhance efficiency and reduce environmental impact. Additionally, the growth of e-commerce platforms is expected to facilitate wider distribution of ethyl alcohol products, catering to the evolving preferences of consumers seeking quality and purity in their purchases.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Ethyl Alcohol Fermented Ethyl Alcohol Denatured Alcohol Rectified Spirit Others |

| By End-User | Food and Beverage Pharmaceuticals Personal Care Industrial Automotive Others |

| By Application | Solvent Fuel / Fuel Additive Preservative Bactericide / Disinfectant Others |

| By Distribution Channel | Direct Sales Online Retail Wholesale Others |

| By Packaging Type | Bulk Packaging Bottled Packaging Canned Packaging Others |

| By Grade | Food Grade Industrial Grade Pharmaceutical Grade Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa United States Canada Brazil Germany China |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Industry | 100 | Production Managers, Quality Assurance Heads |

| Pharmaceutical Sector | 80 | Regulatory Affairs Specialists, R&D Managers |

| Industrial Applications | 60 | Operations Directors, Supply Chain Managers |

| Cosmetics and Personal Care | 50 | Product Development Managers, Marketing Executives |

| Biofuels and Renewable Energy | 40 | Energy Analysts, Sustainability Officers |

The Global Ethyl Alcohol Market is valued at approximately USD 110 billion, reflecting a robust growth trajectory driven by increasing demand for biofuels, alcoholic beverages, and applications in the pharmaceutical sector.