Global Ethylbenzene Market Overview

- The Global Ethylbenzene Market was valued at USD 25 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for styrene, which is a key derivative of ethylbenzene used in the production of plastics, resins, and synthetic rubber. The expansion of the automotive, construction, and packaging industries has further fueled the need for ethylbenzene, as it is essential in manufacturing various materials. Additionally, rising demand for consumer electronics and insulation materials is contributing to market growth.

- Key players in this market include the United States, China, and Germany. The United States maintains a leading position due to its advanced chemical manufacturing sector and significant production capacity. China follows closely, driven by rapid industrialization, strong growth in petrochemicals, and increasing demand for consumer goods. Germany’s robust automotive and construction sectors, along with its established chemical industry, also contribute to its prominence in the ethylbenzene market. The Asia Pacific region, led by China, holds the largest market share globally.

- In 2023, the European Union implemented stringent regulations on the production and use of ethylbenzene, mandating that all manufacturers adhere to updated safety and environmental standards. These regulations aim to minimize the environmental impact of chemical production and ensure the safety of workers in the industry, thereby promoting sustainable practices across the sector.

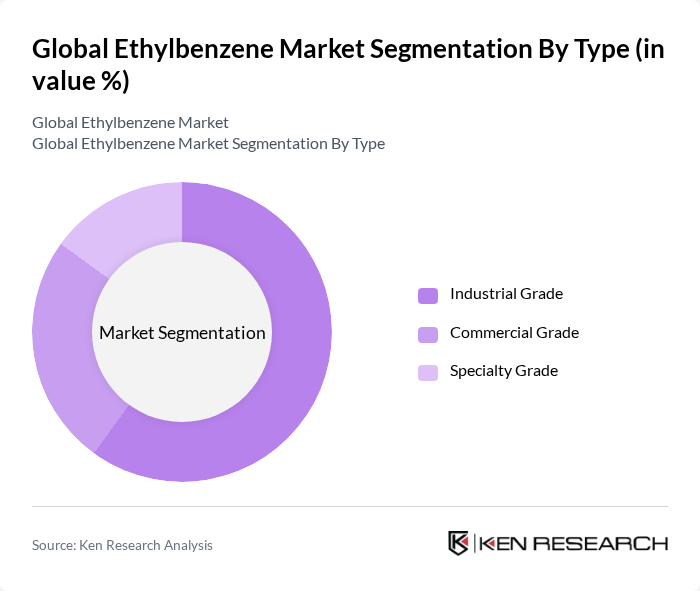

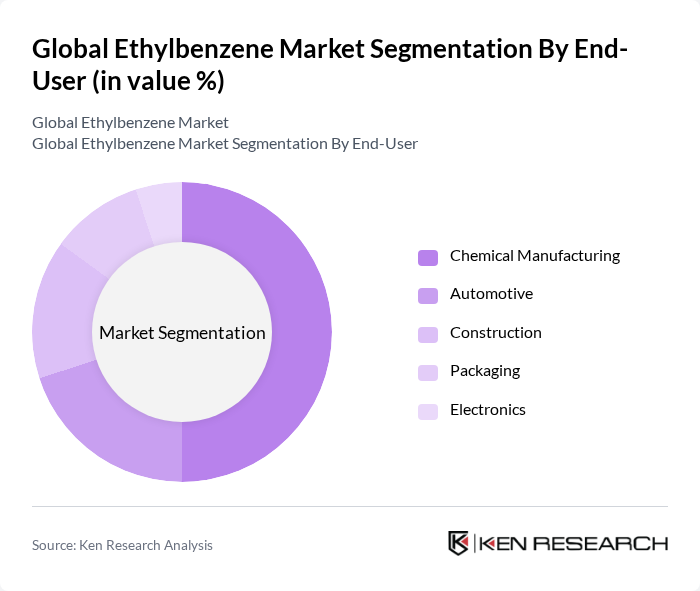

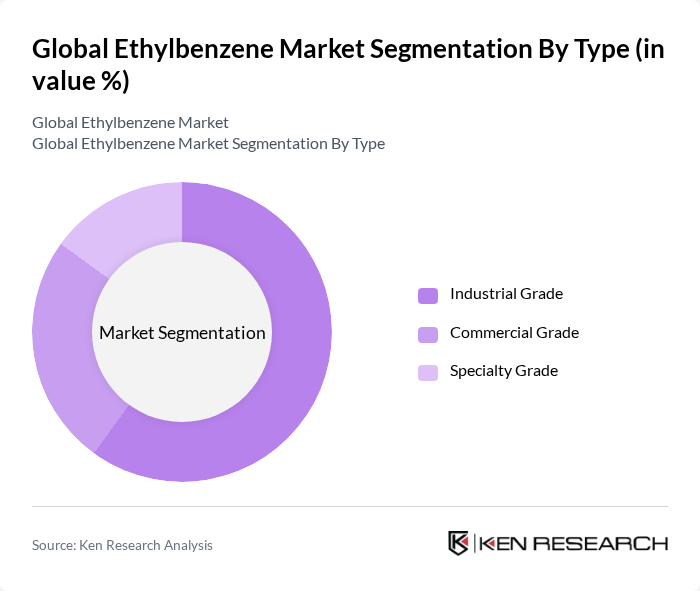

Global Ethylbenzene Market Segmentation

By Type:The market is segmented into three types: Industrial Grade, Commercial Grade, and Specialty Grade. The Industrial Grade segment is the largest, driven by its extensive use in the production of styrene and other chemicals for plastics, rubber, and resins. Commercial Grade ethylbenzene is used in consumer products, coatings, and gasoline additives. Specialty Grade is focused on niche markets requiring high purity levels, such as electronics and pharmaceuticals.

By End-User:The end-user segmentation includes Chemical Manufacturing, Automotive, Construction, Packaging, and Electronics. Chemical Manufacturing is the largest consumer of ethylbenzene, primarily for styrene production, which is used in polystyrene, ABS, and SBR manufacturing. The Automotive and Construction sectors also significantly contribute to demand, utilizing ethylbenzene in adhesives, coatings, and insulation materials. Packaging and Electronics are emerging segments, driven by increased use of plastics and high-purity chemicals.

Global Ethylbenzene Market Competitive Landscape

The Global Ethylbenzene Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, The Dow Chemical Company, LyondellBasell Industries N.V., INEOS Group Holdings S.A., ExxonMobil Chemical Company, Chevron Phillips Chemical Company LLC, Reliance Industries Limited, Shell Chemicals, Mitsubishi Chemical Corporation, TPC Group Inc., Formosa Plastics Corporation, Westlake Chemical Corporation, Clariant AG, Huntsman Corporation, SABIC, Sinopec (China Petroleum & Chemical Corporation), TotalEnergies SE, LG Chem Ltd., Versalis S.p.A., JXTG Nippon Oil & Energy Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Global Ethylbenzene Market Industry Analysis

Growth Drivers

- Increasing Demand from End-User Industries:The ethylbenzene market is significantly driven by the growing demand from end-user industries such as automotive, construction, and consumer goods. In future, the automotive sector alone accounted for approximately 30% of the total ethylbenzene consumption, translating to around 1.6 million tons. This demand is expected to rise as global vehicle production is projected to reach 92 million units in future, further boosting the need for styrene-based products derived from ethylbenzene.

- Expansion of Petrochemical Production:The expansion of petrochemical production facilities is a crucial growth driver for the ethylbenzene market. In future, global petrochemical production capacity reached 420 million tons, with ethylbenzene production contributing significantly. Countries like the United States and China are leading this expansion, with investments exceeding $55 billion in new facilities in future. This increase in production capacity is expected to enhance the availability of ethylbenzene, meeting the rising demand from various industries.

- Technological Advancements in Production Processes:Technological advancements in ethylbenzene production processes are enhancing efficiency and reducing costs. Innovations such as the use of advanced catalysts and process optimization techniques have improved yield rates by up to 16%. In future, companies invested approximately $11 billion in R&D for these technologies, which are expected to further streamline production in future, making ethylbenzene more accessible and cost-effective for manufacturers.

Market Challenges

- Volatility in Raw Material Prices:The ethylbenzene market faces significant challenges due to the volatility in raw material prices, particularly benzene. In future, benzene prices fluctuated between $850 and $1,250 per ton, impacting production costs for ethylbenzene manufacturers. This volatility is primarily driven by geopolitical tensions and supply chain disruptions, which are expected to persist into future, creating uncertainty for producers and potentially leading to increased prices for end consumers.

- Stringent Environmental Regulations:Stringent environmental regulations pose a challenge to the ethylbenzene market, particularly in developed regions. In future, the European Union implemented new regulations that require a 32% reduction in emissions from chemical manufacturing in future. Compliance with these regulations necessitates significant investment in cleaner technologies, estimated at $16 billion across the industry, which could strain the financial resources of smaller manufacturers and impact overall market growth.

Global Ethylbenzene Market Future Outlook

The future outlook for the ethylbenzene market appears promising, driven by increasing demand from emerging markets and ongoing technological innovations. As countries in Asia-Pacific and Latin America continue to industrialize, the demand for ethylbenzene is expected to rise significantly. Additionally, advancements in production technologies will likely enhance efficiency and sustainability, aligning with global trends towards greener practices. Companies that adapt to these changes will be well-positioned to capitalize on the evolving market landscape, ensuring long-term growth and profitability.

Market Opportunities

- Growth in Emerging Markets:Emerging markets, particularly in Asia-Pacific, present significant growth opportunities for the ethylbenzene market. With a projected GDP growth rate of 5.7% in future, these regions are expected to increase their consumption of ethylbenzene, driven by expanding manufacturing sectors and urbanization, which will enhance demand for styrene-based products.

- Innovations in Production Technologies:Innovations in production technologies, such as the development of bio-based ethylbenzene, offer new market opportunities. With the global bio-based chemicals market expected to reach $32 billion in future, companies investing in sustainable production methods can tap into this growing segment, appealing to environmentally conscious consumers and meeting regulatory demands.