Region:Global

Author(s):Shubham

Product Code:KRAA3148

Pages:81

Published On:August 2025

Market.png)

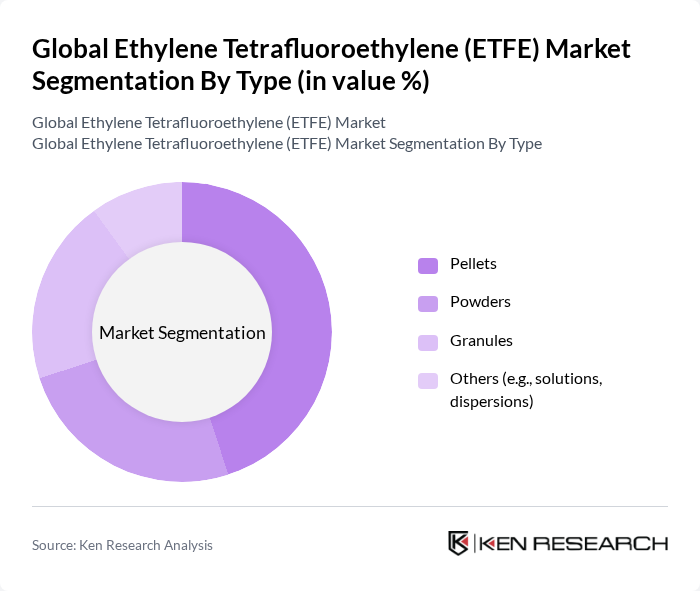

By Type:The ETFE market is segmented into pellets, powders, granules, and others (including solutions and dispersions). Pellets remain the most widely used form due to their processability and versatility in extrusion and injection molding. Powders are gaining traction, particularly in specialized coatings and additive manufacturing, while granules and dispersions serve niche applications. The demand for pellets is sustained by their compatibility with high-volume manufacturing and their ability to deliver consistent mechanical properties .

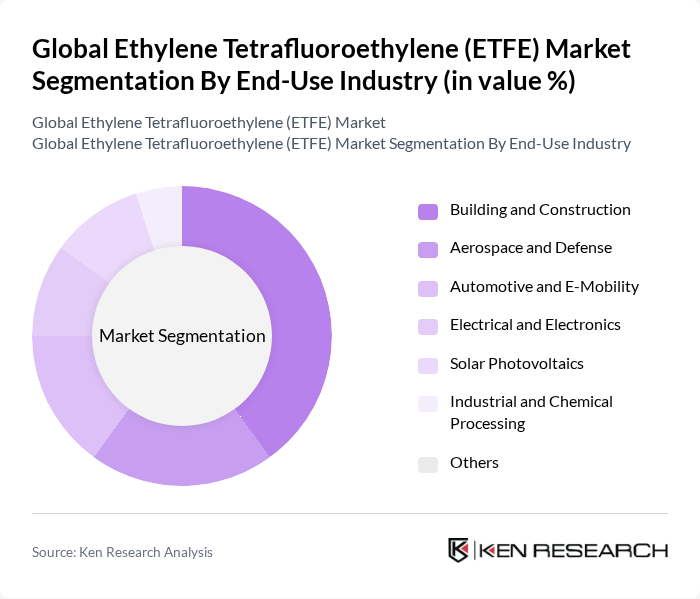

By End-Use Industry:The ETFE market serves a range of end-use industries, including building and construction, aerospace and defense, automotive and e-mobility, electrical and electronics, solar photovoltaics, and industrial and chemical processing. The building and construction sector leads due to the widespread adoption of ETFE in lightweight, transparent architectural structures and roofing. Automotive and electronics applications are expanding rapidly, driven by the need for high-performance, corrosion-resistant, and electrically insulating materials .

The Global Ethylene Tetrafluoroethylene (ETFE) Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Chemours Company, Daikin Industries, Ltd., Asahi Glass Company (AGC Inc.), Solvay S.A., 3M Company, Saint-Gobain S.A., Dongyue Group Limited, Vector Foiltec GmbH, Mitsubishi Chemical Corporation, Ensinger GmbH, BASF SE, Arkema S.A., Halopolymer OJSC, Quadrant AG (Mitsubishi Chemical Advanced Materials), Zeus Industrial Products, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ETFE market appears promising, driven by increasing adoption in architectural applications and a shift towards sustainable building materials. As governments worldwide implement stricter environmental regulations, the demand for eco-friendly materials like ETFE is expected to rise. Additionally, advancements in technology will likely enhance the material's properties, making it more appealing for various applications, including solar energy, thus expanding its market reach and potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Pellets Powders Granules Others (e.g., solutions, dispersions) |

| By End-Use Industry | Building and Construction Aerospace and Defense Automotive and E-Mobility Electrical and Electronics Solar Photovoltaics Industrial and Chemical Processing Others |

| By Application | Films and Sheets Wire and Cable Insulation Tubes Coatings Fuel Tubing Medical Components Food and Pharmaceutical Packaging Others (e.g., 3D-printed components) |

| By Technology | Extrusion Molding Injection Molding Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Russia, Nordics, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, ASEAN, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (Saudi Arabia, South Africa, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector ETFE Applications | 120 | Architects, Project Managers |

| Automotive Industry Usage of ETFE | 90 | Product Engineers, Procurement Managers |

| Aerospace Applications of ETFE | 60 | Design Engineers, Quality Assurance Managers |

| ETFE in Electronics Manufacturing | 50 | Manufacturing Engineers, Supply Chain Analysts |

| Research Institutions Focused on ETFE | 40 | Research Scientists, Materials Scientists |

The Global Ethylene Tetrafluoroethylene (ETFE) Market is valued at approximately USD 550 million, reflecting a five-year historical analysis. This valuation highlights the growing demand for ETFE in various industries, including construction and automotive.