Region:Global

Author(s):Dev

Product Code:KRAA2230

Pages:100

Published On:August 2025

Market.png)

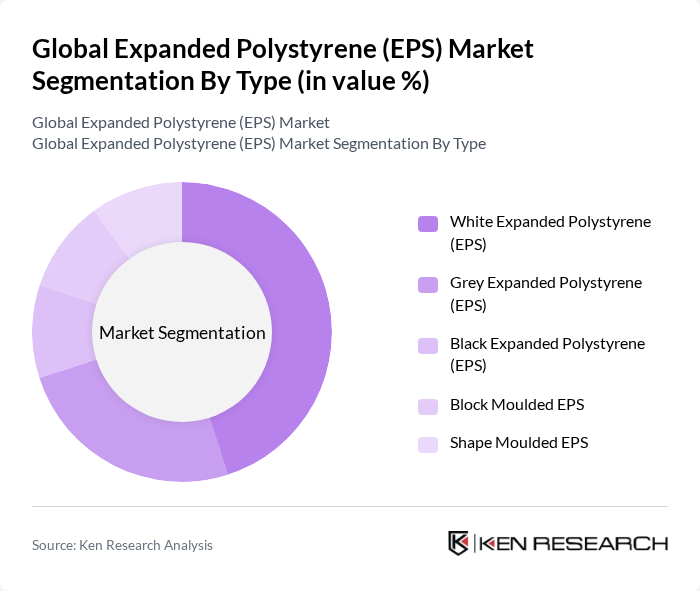

By Type:The EPS market is segmented into White Expanded Polystyrene (EPS), Grey Expanded Polystyrene (EPS), Black Expanded Polystyrene (EPS), Block Moulded EPS, and Shape Moulded EPS. White EPS remains the most widely used type due to its excellent insulation properties and cost-effectiveness, making it a preferred choice in construction and packaging. Grey EPS, recognized for enhanced thermal performance, is increasingly utilized in energy-efficient building projects. Block Moulded and Shape Moulded EPS are also seeing rising demand, especially in construction and automotive applications, due to their versatility and design flexibility .

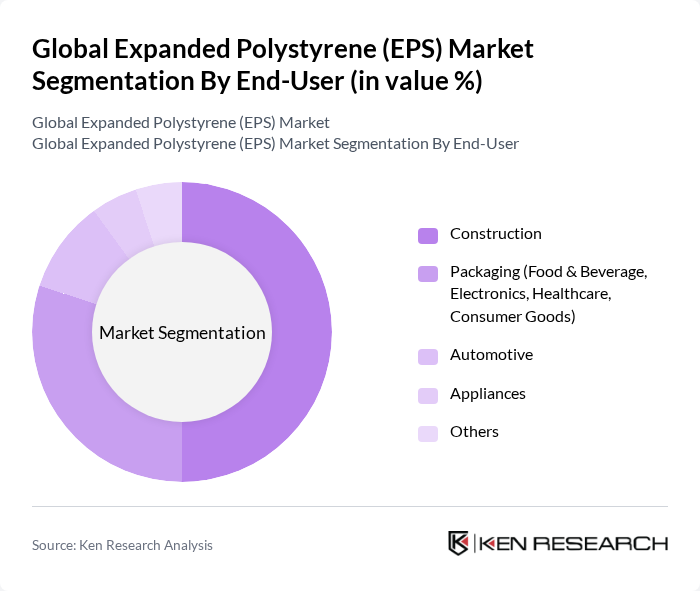

By End-User:The EPS market is segmented by end-user industries, including Construction, Packaging (Food & Beverage, Electronics, Healthcare, Consumer Goods), Automotive, Appliances, and Others. The construction sector is the largest consumer of EPS, driven by its lightweight nature and insulation properties, which are essential for energy-efficient buildings. The packaging industry also significantly contributes to the market, particularly in food and electronics, where protective packaging is crucial. The automotive sector is increasingly adopting EPS for lightweight components that enhance fuel efficiency and performance .

The Global Expanded Polystyrene (EPS) Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, The Dow Chemical Company, Saint-Gobain S.A., Knauf Insulation, ACH Foam Technologies (now part of Atlas Roofing Corporation), Styrochem Canada, Ltd., Sika AG, Unipol Holland BV, Insulfoam (a division of Carlisle Construction Materials), NOVA Chemicals Corporation, Cellofoam North America, Inc., Sunpor Kunststoff GmbH, Synthos S.A., Alpek S.A.B. de C.V., Versalis S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the EPS market appears promising, driven by increasing demand for sustainable solutions and innovative applications. As regulations tighten around plastic use, companies are likely to invest in recycling technologies and bio-based alternatives. Additionally, the growth of e-commerce will continue to fuel demand for efficient packaging solutions. The market is expected to adapt to these trends, focusing on sustainability while maintaining performance, which will be crucial for long-term viability in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | White Expanded Polystyrene (EPS) Grey Expanded Polystyrene (EPS) Black Expanded Polystyrene (EPS) Block Moulded EPS Shape Moulded EPS |

| By End-User | Construction Packaging (Food & Beverage, Electronics, Healthcare, Consumer Goods) Automotive Appliances Others |

| By Application | Insulation (Thermal & Acoustic) Protective Packaging Solutions Building & Construction Materials Cold Chain Logistics Decorative & Specialty Elements |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Retail Outlets Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Rest of APAC) Latin America Middle East & Africa |

| By Price Range | Low Price Mid Price High Price Others |

| By Sustainability Level | Conventional EPS Recycled EPS Bio-based EPS Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector EPS Usage | 120 | Project Managers, Architects, Contractors |

| Packaging Industry Insights | 90 | Product Managers, Packaging Engineers |

| Automotive Applications of EPS | 60 | Design Engineers, Procurement Managers |

| Insulation Market Analysis | 50 | Building Inspectors, Energy Efficiency Consultants |

| EPS Recycling Initiatives | 40 | Sustainability Managers, Waste Management Experts |

The Global Expanded Polystyrene (EPS) Market is valued at approximately USD 18 billion, driven by increasing demand in construction, packaging, and automotive sectors, along with a focus on energy efficiency and sustainable practices.