Region:Global

Author(s):Geetanshi

Product Code:KRAB0057

Pages:88

Published On:August 2025

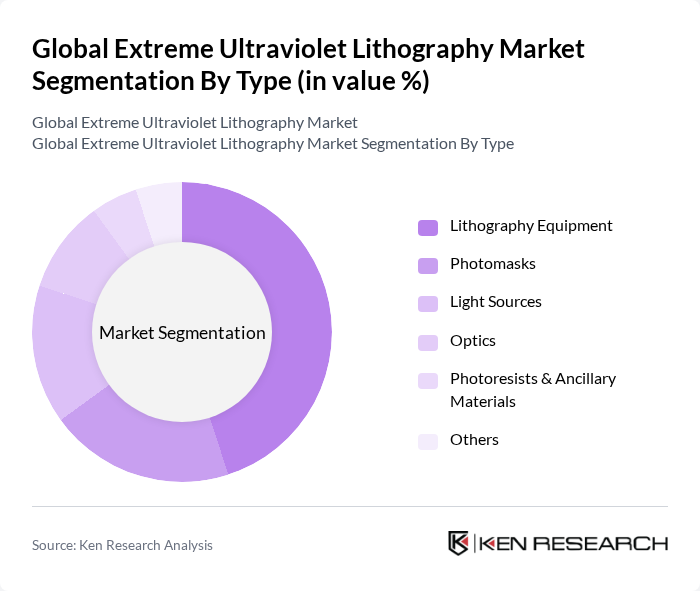

By Type:The market can be segmented into lithography equipment, photomasks, light sources, optics, photoresists & ancillary materials, and others. Among these, lithography equipment is the most significant segment, driven by the increasing demand for high-precision manufacturing in the semiconductor industry. Advancements in photomask technology and light sources also contribute to overall growth, as they are essential components in the lithography process. The adoption of high-NA (numerical aperture) EUV systems and improvements in mask and light source reliability are key trends shaping this segment .

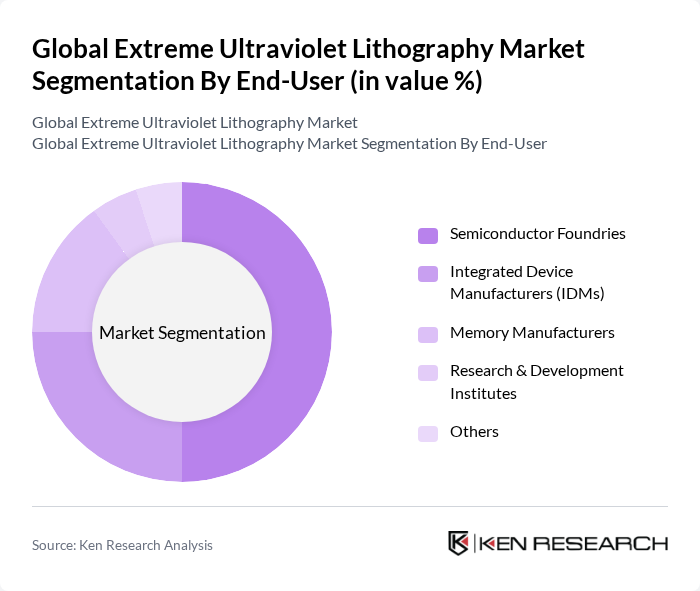

By End-User:The end-user segmentation includes semiconductor foundries, integrated device manufacturers (IDMs), memory manufacturers, research & development institutes, and others. Semiconductor foundries are the leading segment, as they require advanced lithography solutions for producing high-performance chips. The increasing demand for memory and logic devices further drives the growth of this segment, while IDMs and research institutes also contribute significantly to the market. The adoption of EUV lithography by leading foundries such as TSMC, Samsung, and Intel is a major growth driver in this segment .

The Global Extreme Ultraviolet Lithography Market is characterized by a dynamic mix of regional and international players. Leading participants such as ASML Holding N.V., Nikon Corporation, Canon Inc., Intel Corporation, Samsung Electronics Co., Ltd., Taiwan Semiconductor Manufacturing Company Limited (TSMC), GlobalFoundries Inc., Micron Technology, Inc., Advanced Micro Devices, Inc. (AMD), Texas Instruments Incorporated, STMicroelectronics N.V., Infineon Technologies AG, Broadcom Inc., NXP Semiconductors N.V., Renesas Electronics Corporation, SK hynix Inc., Lam Research Corporation, KLA Corporation, Carl Zeiss AG, Tokyo Electron Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the EUV lithography market appears promising, driven by the increasing demand for advanced semiconductor technologies and the ongoing push for miniaturization. As manufacturers continue to invest in R&D and technological advancements, the integration of EUV systems is expected to become more streamlined. Additionally, the expansion of 5G networks and the rise of AI and IoT applications will further fuel the need for high-performance chips, creating a favorable environment for EUV lithography growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithography Equipment Photomasks Light Sources Optics Photoresists & Ancillary Materials Others |

| By End-User | Semiconductor Foundries Integrated Device Manufacturers (IDMs) Memory Manufacturers Research & Development Institutes Others |

| By Application | Logic IC Manufacturing Memory IC Manufacturing Advanced Packaging MEMS & Sensors Nanotechnology Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Price Range | Premium Mid-Range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing | 100 | Manufacturing Engineers, Production Managers |

| Equipment Suppliers | 60 | Sales Directors, Product Managers |

| Research Institutions | 40 | Research Scientists, Lab Managers |

| End-user Industries | 50 | Product Development Managers, Procurement Officers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Global Extreme Ultraviolet Lithography Market is valued at approximately USD 12.0 billion, driven by the increasing demand for advanced semiconductor manufacturing technologies, particularly for sub-7nm node production, which requires high-resolution lithography solutions.