Region:Global

Author(s):Dev

Product Code:KRAA1544

Pages:94

Published On:August 2025

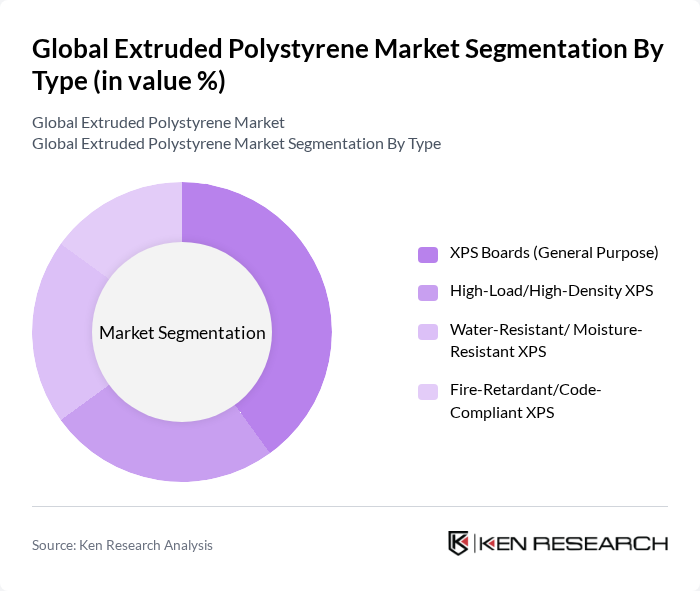

By Type:The extruded polystyrene market is segmented into four main types: XPS Boards (General Purpose), High-Load/High-Density XPS, Water-Resistant/Moisture-Resistant XPS, and Fire-Retardant/Code-Compliant XPS. Among these, XPS Boards (General Purpose) dominate the market due to their versatility and widespread application in various insulation projects. The increasing demand for energy-efficient solutions in both residential and commercial sectors has led to a significant rise in the adoption of these boards.

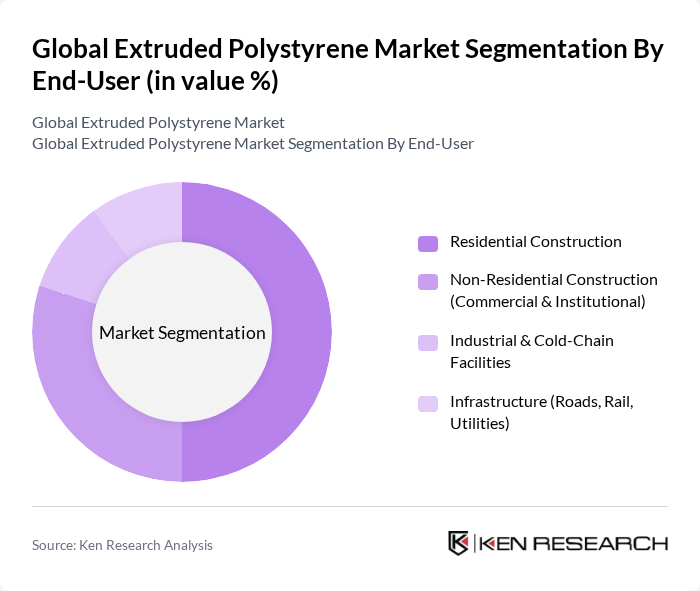

By End-User:The end-user segmentation includes Residential Construction, Non-Residential Construction (Commercial & Institutional), Industrial & Cold-Chain Facilities, and Infrastructure (Roads, Rail, Utilities). The Residential Construction segment leads the market, driven by the growing trend of energy-efficient homes and the increasing focus on sustainable building practices. The demand for insulation materials in residential projects has surged, making this segment a key driver of market growth.

The Global Extruded Polystyrene Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Saint-Gobain, Kingspan Group plc, Owens Corning, Ravago Group (Ravatherm XPS), SOPREMA Group, URSA Insulation, S.A. (XPS), Austrotherm GmbH, Jackon Insulation (Part of BEWI Group), BEWI ASA, Cellofoam North America, Inc., Knauf Insulation, Rmax (a Sika Company), Carlisle Construction Materials (Hunter Panels) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the extruded polystyrene market in future appears promising, driven by a combination of technological advancements and evolving consumer preferences. The shift towards sustainable building materials is expected to accelerate, with manufacturers increasingly focusing on eco-friendly production methods. Additionally, the integration of smart insulation technologies will likely enhance the performance of XPS, making it more appealing to builders and architects. As these trends unfold, the market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | XPS Boards (General Purpose) High-Load/High-Density XPS Water-Resistant/ Moisture-Resistant XPS Fire-Retardant/Code-Compliant XPS |

| By End-User | Residential Construction Non-Residential Construction (Commercial & Institutional) Industrial & Cold-Chain Facilities Infrastructure (Roads, Rail, Utilities) |

| By Application | Roof Insulation (Flat & Inverted Roofs) Wall & Façade Insulation (Cavity, ETICS) Floor & Foundation/Below-Grade Insulation Cold Storage & Refrigeration (Buildings, Transport) Geofoam & Civil Engineering Applications |

| By Distribution Channel | Direct Sales to Contractors/Developers Building Materials Distributors/Dealers Retail & E-commerce OEM Supply (Panelizers/Prefab, Cold-chain OEMs) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Boards/Sheets Blocks Tapered/Custom-Cut Shapes Accessories (Tapes, Adhesives, Fasteners) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Insulation | 140 | Architects, Project Managers |

| Manufacturing of Extruded Polystyrene | 100 | Production Managers, Quality Control Supervisors |

| Retail Distribution of Insulation Products | 80 | Supply Chain Managers, Sales Directors |

| Environmental Impact Assessments | 70 | Environmental Consultants, Regulatory Affairs Specialists |

| End-user Feedback on Insulation Performance | 90 | Homeowners, Commercial Property Managers |

The Global Extruded Polystyrene Market is valued at approximately USD 5.5 billion, driven by the increasing demand for insulation materials in the construction sector, particularly for residential and commercial buildings.