Region:Global

Author(s):Geetanshi

Product Code:KRAA1269

Pages:81

Published On:August 2025

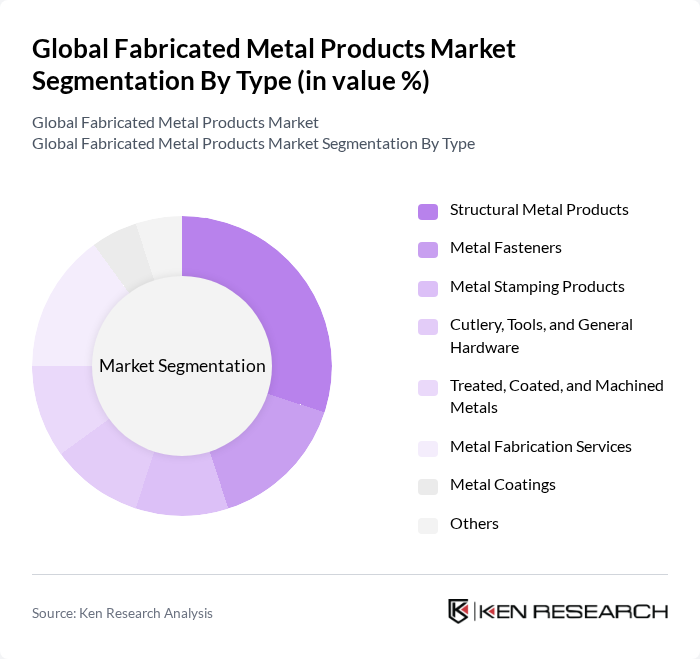

By Type:The fabricated metal products market is segmented into structural metal products, metal fasteners, metal stamping products, cutlery, tools, and general hardware, treated, coated, and machined metals, metal fabrication services, metal coatings, and others. Among these, structural metal products lead due to their extensive use in construction and infrastructure projects, which are driven by global urbanization, infrastructure upgrades, and investments in smart cities. Metal fasteners and fabrication services are also experiencing growth due to the rising demand for customized and precision-engineered components in automotive, aerospace, and industrial manufacturing .

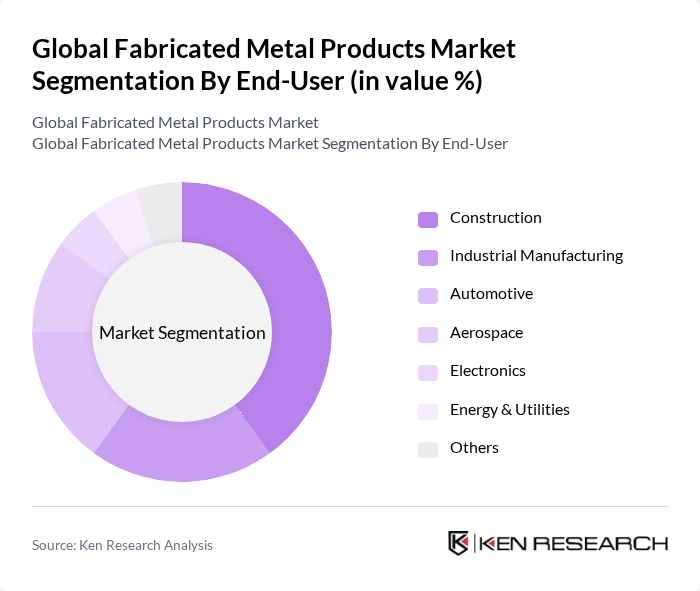

By End-User:The end-user segmentation of the fabricated metal products market includes construction, industrial manufacturing, automotive, aerospace, electronics, energy & utilities, and others. The construction sector remains the dominant end-user, propelled by ongoing infrastructure projects, urban development, and the increasing need for residential and commercial buildings globally. Industrial manufacturing and automotive sectors are also significant contributors, with demand supported by trends in automation, lightweight materials, and sustainability initiatives .

The Global Fabricated Metal Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as ArcelorMittal, Nucor Corporation, Steel Dynamics, Inc., thyssenkrupp AG, United States Steel Corporation, Alcoa Corporation, POSCO, JFE Holdings, Inc., Ternium S.A., Novelis Inc., Sumitomo Metal Industries, Ltd., voestalpine AG, Gerdau S.A., Outokumpu Oyj, Tenaris S.A., Tata Steel Limited, SSAB AB, Severstal PJSC, China Baowu Steel Group Corporation Limited, Nippon Steel Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fabricated metal products market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt automation and digital manufacturing, efficiency and productivity are expected to improve significantly. Additionally, the rising demand for sustainable practices will likely lead to innovations in eco-friendly materials and processes, positioning companies to capitalize on emerging trends while addressing environmental concerns effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Structural Metal Products Metal Fasteners Metal Stamping Products Cutlery, Tools, and General Hardware Treated, Coated, and Machined Metals Metal Fabrication Services Metal Coatings Others |

| By End-User | Construction Industrial Manufacturing Automotive Aerospace Electronics Energy & Utilities Others |

| By Application | Building and Infrastructure Machinery and Equipment Automotive Components Consumer Goods Renewable Energy Systems Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Material Type | Steel Aluminum Copper Alloys Others |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, United Kingdom, France, Italy, Russia, Others) Asia-Pacific (China, India, Japan, South Korea, Others) Latin America Middle East & Africa |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Fabricated Components | 120 | Manufacturing Engineers, Procurement Managers |

| Construction Metal Products | 100 | Project Managers, Architects |

| Aerospace Metal Fabrication | 80 | Quality Assurance Managers, Supply Chain Analysts |

| Industrial Equipment Manufacturing | 70 | Operations Managers, Product Development Engineers |

| Consumer Goods Metal Products | 90 | Marketing Managers, Sales Directors |

The Global Fabricated Metal Products Market is valued at approximately USD 1,200 billion, driven by increasing demand across various industries such as construction, automotive, aerospace, and electronics, along with technological advancements in manufacturing processes.