Region:Global

Author(s):Rebecca

Product Code:KRAA2143

Pages:88

Published On:August 2025

By Type:The market is segmented into various types of factoring services, including Domestic Factoring, International Factoring, Recourse Factoring, Non-Recourse Factoring, Invoice Discounting, Reverse Factoring (Supply Chain Finance), Spot Factoring, Full-Service Factoring, and Others. Each of these sub-segments addresses distinct business needs and risk profiles. Domestic factoring remains the most widely adopted due to its simplicity and lower risk, while international factoring is increasingly important for businesses engaged in cross-border trade. Recourse and non-recourse factoring differ in risk allocation, with non-recourse factoring offering protection against debtor default. Invoice discounting and reverse factoring are favored by companies seeking flexible working capital solutions, and spot factoring is used for occasional or single-invoice transactions. Full-service factoring provides comprehensive receivables management, including collections and credit protection .

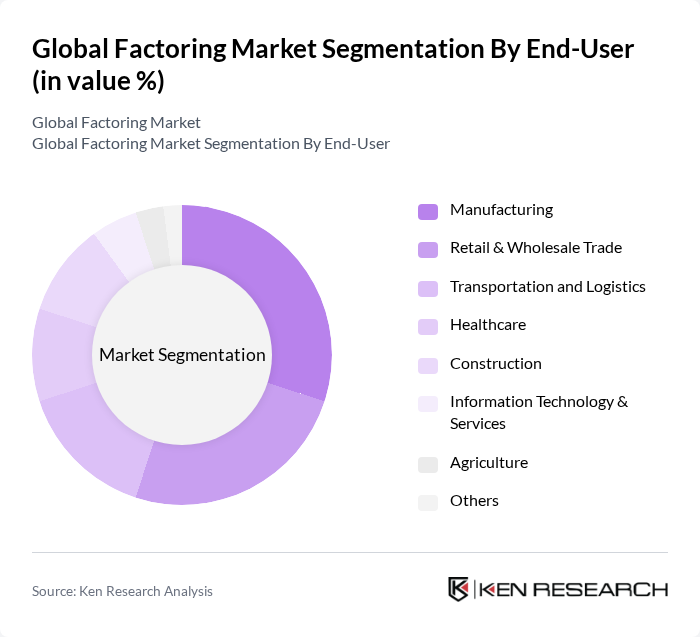

By End-User:The end-user segmentation includes Manufacturing, Retail & Wholesale Trade, Transportation and Logistics, Healthcare, Construction, Information Technology & Services, Agriculture, and Others. Manufacturing and retail sectors are the largest users of factoring services, leveraging these solutions to manage working capital and mitigate payment delays. Transportation and logistics companies benefit from factoring to address long receivable cycles, while healthcare and construction sectors use factoring to stabilize cash flow amid complex billing and payment structures. Information technology and agriculture sectors are emerging users, driven by increasing adoption of digital platforms and the need for flexible financing .

The Global Factoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as BNP Paribas, Deutsche Factoring Bank GmbH & Co. KG, Aldermore Bank PLC, Hitachi Capital Corporation, Wells Fargo & Company, HSBC Holdings plc, Bibby Financial Services, Eurobank Ergasias Services and Holdings S.A., Mizuho Factors, Limited, BlueVine Capital Inc., Fundbox, Inc., Triumph Business Capital, Société Générale S.A., Banco Santander S.A., KUKE Finance S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the factoring market appears promising, driven by technological advancements and increasing demand for flexible financing solutions. As businesses continue to seek efficient cash flow management, the adoption of digital factoring platforms is expected to rise significantly. Additionally, the integration of artificial intelligence and machine learning will enhance risk assessment and streamline operations, positioning factoring as a vital financial tool for SMEs and larger enterprises alike in the evolving economic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Factoring International Factoring Recourse Factoring Non-Recourse Factoring Invoice Discounting Reverse Factoring (Supply Chain Finance) Spot Factoring Full-Service Factoring Others |

| By End-User | Manufacturing Retail & Wholesale Trade Transportation and Logistics Healthcare Construction Information Technology & Services Agriculture Others |

| By Industry | Service Industry Manufacturing & Industrial E-commerce Automotive Food & Beverage Others |

| By Region | Europe Asia-Pacific North America Latin America Middle East & Africa |

| By Service Model | Bank Factoring Non-Bank Factoring (Fintech/Independent) Online Factoring Platforms Hybrid Factoring Others |

| By Client Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Payment Terms | Short-Term Medium-Term Long-Term Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Factoring Utilization | 120 | Business Owners, Financial Managers |

| Corporate Factoring Solutions | 90 | CFOs, Treasury Managers |

| International Trade Financing | 60 | Export Managers, Trade Finance Specialists |

| Factoring in Emerging Markets | 50 | Market Analysts, Regional Managers |

| Technology Adoption in Factoring | 70 | IT Managers, Digital Transformation Leads |

The Global Factoring Market is valued at approximately USD 4.1 trillion, driven by the increasing demand for alternative financing solutions, particularly among small and medium-sized enterprises (SMEs), and the expansion of cross-border trade.