Region:Global

Author(s):Rebecca

Product Code:KRAB0192

Pages:96

Published On:August 2025

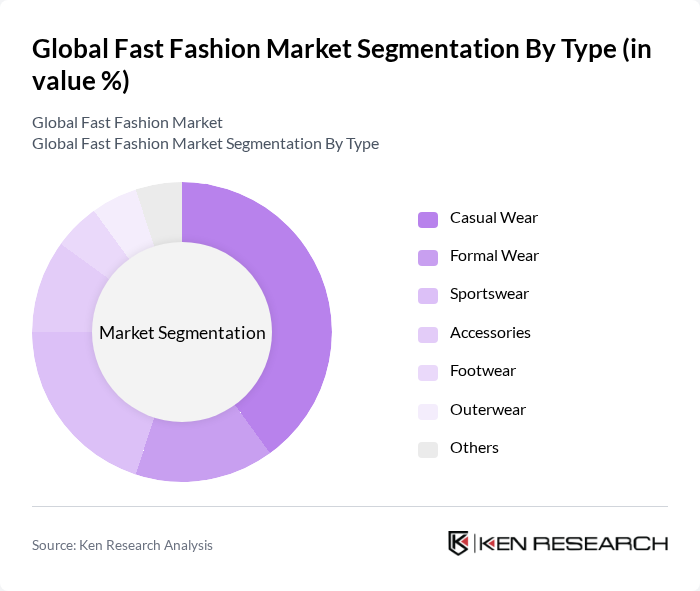

By Type:The fast fashion market is segmented into various types, including Casual Wear, Formal Wear, Sportswear, Accessories, Footwear, Outerwear, and Others. Among these,Casual Wearis the most dominant segment, driven by the increasing preference for comfortable and versatile clothing suitable for everyday use. The trend towards athleisure and relaxed styles, heavily influenced by social media and celebrity endorsements, has further propelled the demand for casual apparel, making it a staple in consumers' wardrobes .

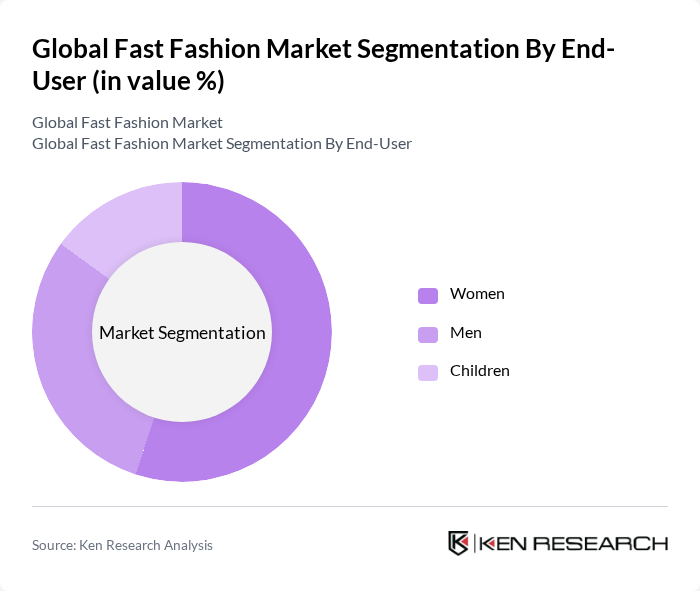

By End-User:The fast fashion market is segmented by end-user into Women, Men, and Children. TheWomensegment holds the largest share, driven by a higher propensity for fashion consumption, a wider variety of styles available, and a strong influence from social media and digital marketing. Women are more likely to purchase clothing frequently, influenced by trends and online content, which significantly boosts the demand in this segment .

The Global Fast Fashion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zara (Industria de Diseño Textil, S.A.), H&M (Hennes & Mauritz AB), Forever 21, ASOS Plc, Uniqlo (Fast Retailing Co., Ltd.), Primark Stores Ltd., Boohoo Group plc, Shein, Mango (Punto Fa, S.L.), Gap Inc., American Eagle Outfitters, Lulus, Urban Outfitters, Next plc, Abercrombie & Fitch, C&A Mode GmbH & Co KG, Cotton On Group, Aditya Birla Fashion & Retail Ltd., Bestseller A/S, New Look Retailers Ltd., River Island, Victoria's Secret & Co., Esprit Holdings Ltd., ARCADIA SRL, Reliance Industries Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The fast fashion market is poised for transformation as brands increasingly focus on sustainability and digital innovation. With consumer preferences shifting towards eco-friendly products, companies are likely to invest in sustainable materials and ethical production practices. Additionally, the integration of advanced technologies, such as AI and data analytics, will enhance inventory management and customer engagement. As the market adapts to these trends, brands that prioritize sustainability and technological advancements will likely gain a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Casual Wear Formal Wear Sportswear Accessories Footwear Outerwear Others |

| By End-User | Women Men Children |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale |

| By Price Range | Budget Mid-Range Premium |

| By Material | Cotton Polyester Blends Manmade Fibers |

| By Distribution Mode | Direct Sales Indirect Sales |

| By Consumer Demographics | Age Group (Teens, Adults, Kids) Income Level Lifestyle Preferences Urban vs Rural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fast Fashion Retailers | 100 | Brand Managers, Marketing Directors |

| Consumer Purchase Behavior | 120 | Fashion Consumers, Online Shoppers |

| Sustainability Practices in Fashion | 80 | Sustainability Officers, CSR Managers |

| Supply Chain Dynamics | 60 | Supply Chain Managers, Logistics Coordinators |

| Market Trends and Innovations | 90 | Fashion Analysts, Trend Forecasters |

The Global Fast Fashion Market is valued at approximately USD 150 billion, driven by the increasing demand for trendy and affordable clothing, particularly among millennials and Gen Z consumers. This growth reflects a significant shift in consumer purchasing behavior over recent years.