Region:Global

Author(s):Dev

Product Code:KRAD0540

Pages:80

Published On:August 2025

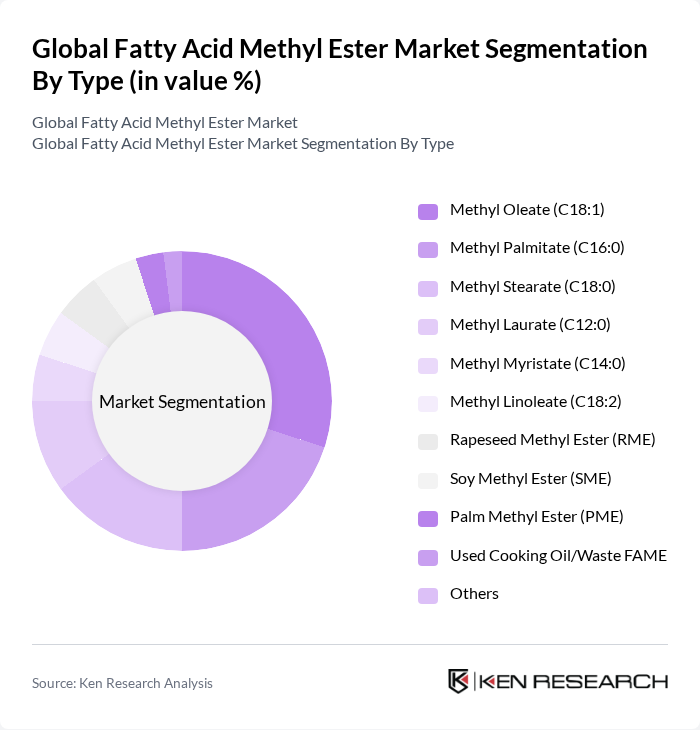

By Type:The market is segmented into various types of fatty acid methyl esters, each serving different applications and industries. The dominant sub-segment is Methyl Oleate (C18:1), which is widely used in biodiesel production due to its favorable properties. Other significant types include Methyl Palmitate (C16:0) and Methyl Stearate (C18:0), which find applications in personal care products and industrial lubricants. The diversity in applications drives the demand for these specific types, catering to both consumer and industrial needs.

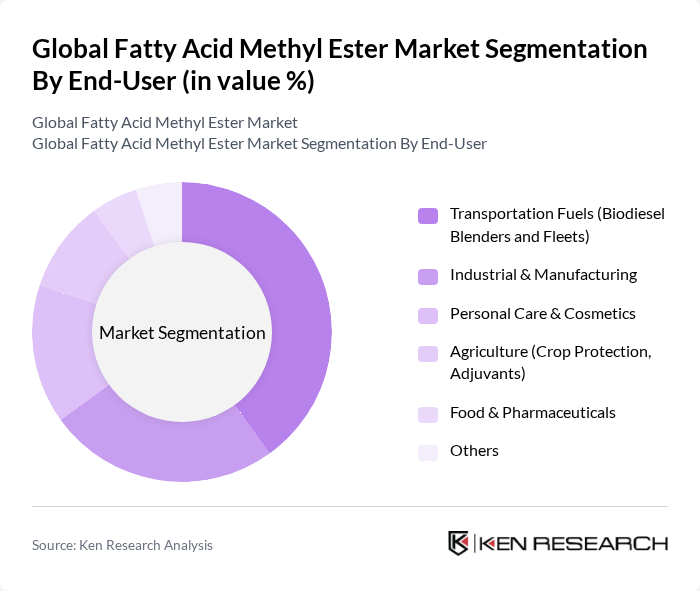

By End-User:The fatty acid methyl ester market is segmented by end-user industries, including transportation fuels, industrial manufacturing, personal care, agriculture, and food & pharmaceuticals. The transportation fuels segment, particularly biodiesel blenders and fleets, is the leading sub-segment due to the increasing adoption of biodiesel as a sustainable alternative to fossil fuels. The industrial and manufacturing sector also shows significant demand, driven by the need for eco-friendly lubricants and surfactants.

The Global Fatty Acid Methyl Ester Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wilmar International Limited, Archer Daniels Midland Company (ADM), Cargill, Incorporated, Neste Corporation, Louis Dreyfus Company B.V., Bunge Global SA, Petrobras Biofuels (PBio), PetroGreen/Apical Group (Bio-Oils Energy), Musim Mas Group, Emami Agrotech Limited, United Oilseeds/AGM (RME Supply, Europe), De Smet Engineers & Contractors (Process Technology), Verbio SE, Clean Fuels Alliance America Members (select biodiesel producers), Green Fuels Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fatty acid methyl ester market appears promising, driven by increasing global emphasis on sustainability and renewable energy. As governments worldwide implement stricter emission regulations and promote biofuel usage, the demand for FAME is expected to rise significantly. Additionally, advancements in production technologies will likely enhance efficiency and reduce costs, making FAME more competitive against traditional fossil fuels. The market is poised for growth, particularly in regions prioritizing eco-friendly energy solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Methyl Oleate (C18:1) Methyl Palmitate (C16:0) Methyl Stearate (C18:0) Methyl Laurate (C12:0) Methyl Myristate (C14:0) Methyl Linoleate (C18:2) Rapeseed Methyl Ester (RME) Soy Methyl Ester (SME) Palm Methyl Ester (PME) Used Cooking Oil/Waste FAME Others |

| By End-User | Transportation Fuels (Biodiesel Blenders and Fleets) Industrial & Manufacturing Personal Care & Cosmetics Agriculture (Crop Protection, Adjuvants) Food & Pharmaceuticals Others |

| By Application | Biodiesel (Fuel) Surfactants & Detergents Lubricants & Metalworking Fluids Solvents & Cleaners Plasticizers & Additives Personal Care (Emollients, Emulsifiers) Others |

| By Distribution Channel | Direct (B2B/Contract) Distributors & Traders Online (E-marketplaces) Retail/Dealer Networks Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| By Packaging Type | Bulk (Railcars, ISO Tanks, Tank Trucks) Intermediate (IBCs/Drums) Small Packs (Pails/Cans) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biodiesel Producers | 120 | Production Managers, Operations Directors |

| Raw Material Suppliers | 90 | Procurement Managers, Supply Chain Analysts |

| End-Users in Automotive Sector | 70 | Fleet Managers, Sustainability Officers |

| Research Institutions | 50 | Research Scientists, Policy Advisors |

| Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

The Global Fatty Acid Methyl Ester Market is valued at approximately USD 17 billion, driven by the increasing demand for biodiesel and advancements in production technologies, alongside a growing focus on environmental sustainability.