Region:Global

Author(s):Dev

Product Code:KRAD0524

Pages:93

Published On:August 2025

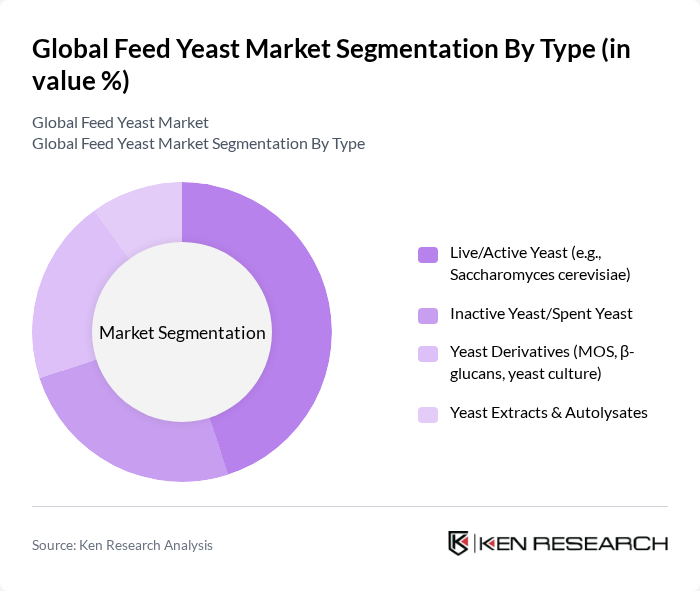

By Type:The feed yeast market is segmented into four main types: Live/Active Yeast, Inactive Yeast/Spent Yeast, Yeast Derivatives, and Yeast Extracts & Autolysates. Among these, Live/Active Yeast is the leading subsegment due to its effectiveness in stabilizing rumen and gut microbiota, improving fiber digestion, and enhancing feed efficiency across species; yeast derivatives such as mannan-oligosaccharides (MOS), ?-glucans, and yeast cultures are also gaining traction for immune support and pathogen binding, aligning with the shift to natural, antibiotic-free nutrition .

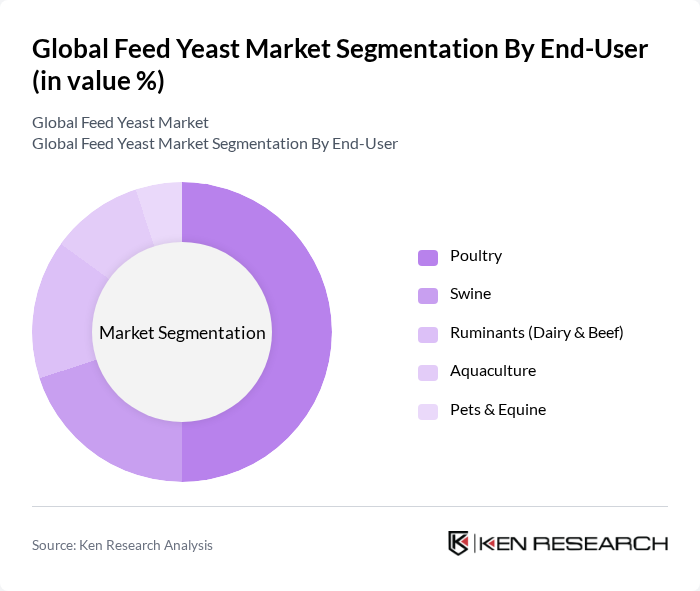

By End-User:The end-user segmentation includes Poultry, Swine, Ruminants (Dairy & Beef), Aquaculture, and Pets & Equine. The Poultry segment typically holds the largest share, supported by strong global demand for poultry protein and the role of yeast in improving feed conversion ratio, gut health, and resilience; ruminants, swine, and aquaculture also show growing adoption as producers target antibiotic reduction and performance consistency .

The Global Feed Yeast Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alltech, Inc., Archer Daniels Midland Company (ADM), Lesaffre Group (including Phileo by Lesaffre), Lallemand Inc. (Lallemand Animal Nutrition), Associated British Foods plc (AB Agri), dsm-firmenich, Kemin Industries, Inc., Nutreco N.V. (Trouw Nutrition), Cargill, Incorporated, Angel Yeast Co., Ltd., Novus International, Inc., Biorigin (Zilor), ICC Brazil (ICC Indústria e Comércio de Castanhas S.A.), Evonik Industries AG, OHLY GmbH (a subsidiary of ABF) contribute to innovation, geographic expansion, and service delivery as they expand fermentation capacity, develop new yeast strains and derivatives, and partner with premix/feed mill networks to reach producers globally .

The future of the feed yeast market in None appears promising, driven by increasing consumer demand for sustainable and nutritious animal feed. Innovations in feed yeast formulations, particularly those enhancing gut health and feed efficiency, are expected to gain traction. Additionally, the growing trend towards organic farming will likely boost the demand for organic feed yeast products. As livestock production continues to expand, the integration of advanced technologies in yeast production will further enhance market growth and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Live/Active Yeast (e.g., Saccharomyces cerevisiae) Inactive Yeast/Spent Yeast Yeast Derivatives (MOS, ?-glucans, yeast culture) Yeast Extracts & Autolysates |

| By End-User | Poultry Swine Ruminants (Dairy & Beef) Aquaculture Pets & Equine |

| By Application | Probiotic/Functional Feed Additives Performance & Health (immunity, gut health, mycotoxin management) Palatability & Protein Source Others |

| By Distribution Channel | Direct Sales (to integrators/premix & feed mills) Distributors/Dealers Online/Indirect Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Standard Premium |

| By Packaging Type | Bulk (500 kg–1,000 kg bags, totes) Industrial Sacks (20–25 kg) Customized/Premix-ready Packs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Poultry Feed Manufacturers | 120 | Production Managers, Nutritionists |

| Swine Nutrition Experts | 90 | Feed Formulators, Veterinarians |

| Ruminant Feed Suppliers | 80 | Sales Managers, Product Development Specialists |

| Livestock Producers | 110 | Farm Owners, Feed Buyers |

| Animal Health Consultants | 60 | Veterinary Nutritionists, Industry Analysts |

The Global Feed Yeast Market is valued at approximately USD 1.6 billion, driven by the increasing demand for high-quality animal feed that enhances livestock health and productivity, as well as the benefits of yeast in improving gut function and feed efficiency.