Region:Global

Author(s):Dev

Product Code:KRAD0498

Pages:85

Published On:August 2025

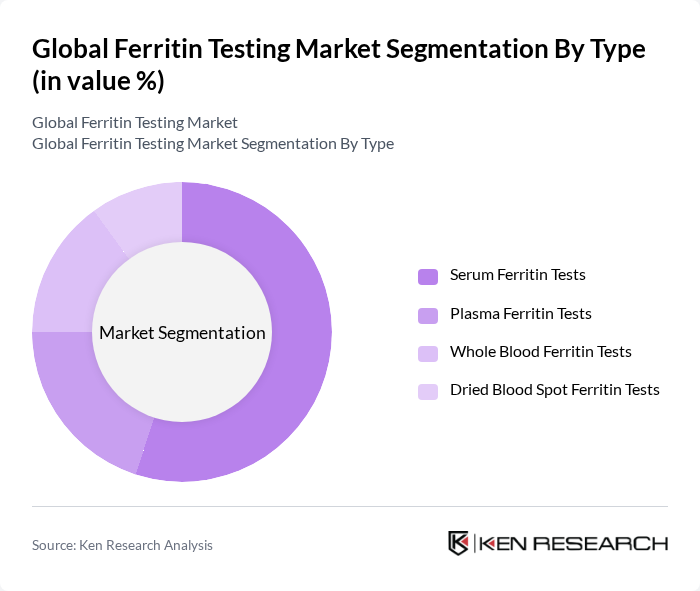

By Type:The market is segmented into four types of ferritin tests: Serum Ferritin Tests, Plasma Ferritin Tests, Whole Blood Ferritin Tests, and Dried Blood Spot Ferritin Tests. Among these, Serum Ferritin Tests dominate the market due to their widespread acceptance in diagnosing iron deficiency and overload conditions and integration on high-throughput automated immunoassay analyzers used in clinical labs. The ease of standardization, established clinical cutoffs, and broad availability of serum-based reagents on core lab platforms underpin this preference; whole blood and dried blood spot formats are primarily used in select point-of-care and resource-limited settings.

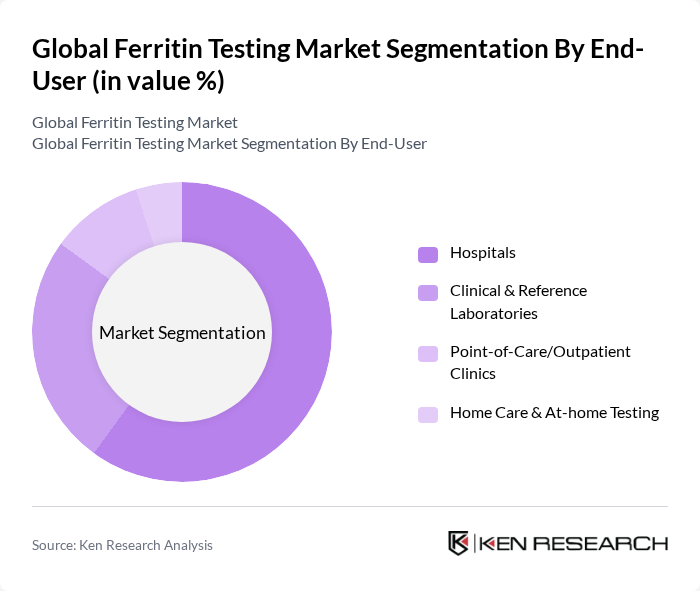

By End-User:The market is segmented into Hospitals, Clinical & Reference Laboratories, Point-of-Care/Outpatient Clinics, and Home Care & At-home Testing. Hospitals are the leading end-user segment due to comprehensive diagnostic capabilities, consolidated laboratory services, and high inpatient and outpatient testing volumes. Clinical reference labs also contribute substantially as send-out hubs for primary and specialty care; point-of-care and at-home use remains smaller but is expanding with emerging POC immunoassay systems and decentralized screening initiatives.

The Global Ferritin Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Siemens Healthineers, Roche Diagnostics (F. Hoffmann-La Roche Ltd.), Beckman Coulter, Inc. (a Danaher company), Ortho Clinical Diagnostics (QuidelOrtho Corporation), Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., DiaSorin S.p.A., PerkinElmer, Inc. (Revvity, Inc.), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (Mindray), Sysmex Corporation, FUJIFILM Holdings Corporation, Randox Laboratories Ltd, bioMérieux SA, Sekisui Diagnostics, LLC contribute to innovation, geographic expansion, and service delivery in this space. Market leadership is supported by broad immunoassay analyzer installed bases, availability of ferritin reagents across chemistry/immunoassay platforms, and growing offerings in point-of-care modalities.

The future of the ferritin testing market in None is poised for significant transformation, driven by technological advancements and changing consumer preferences. The integration of artificial intelligence in diagnostic processes is expected to enhance testing accuracy and efficiency. Additionally, the growing trend of telemedicine and remote testing will facilitate access to ferritin testing, particularly in underserved areas. These developments will likely create a more inclusive healthcare environment, fostering market growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Serum Ferritin Tests Plasma Ferritin Tests Whole Blood Ferritin Tests Dried Blood Spot Ferritin Tests |

| By End-User | Hospitals Clinical & Reference Laboratories Point-of-Care/Outpatient Clinics Home Care & At-home Testing |

| By Application | Iron Deficiency Anemia Diagnosis & Monitoring Chronic Kidney Disease–Related Anemia Management Maternal & Pediatric Screening Hemochromatosis & Iron Overload Disorders |

| By Distribution Channel | Direct Sales to Healthcare Providers Distributor/Wholesale Online B2B Portals Retail & DTC (Direct-to-Consumer) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Chemiluminescence Immunoassay (CLIA) Enzyme-Linked Immunosorbent Assay (ELISA) Turbidimetry/Immunoturbidimetry Lateral Flow/Point-of-Care Immunoassays |

| By Pricing Strategy | Instrument-Reagent Bundled Pricing Per-Test Reagent Pricing Subscription/Analyzer Lease Models Value-Based & Outcome-Linked Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 120 | Laboratory Managers, Clinical Pathologists |

| Healthcare Providers | 100 | Endocrinologists, General Practitioners |

| Medical Device Manufacturers | 80 | Product Managers, R&D Directors |

| Health Insurance Companies | 60 | Policy Analysts, Claims Managers |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Global Ferritin Testing Market is valued at approximately USD 900 million, with estimates suggesting it could reach between USD 900950 million. This valuation reflects the increasing demand for ferritin assays in various healthcare settings, particularly for diagnosing iron-related disorders.