Region:Global

Author(s):Rebecca

Product Code:KRAD0190

Pages:87

Published On:August 2025

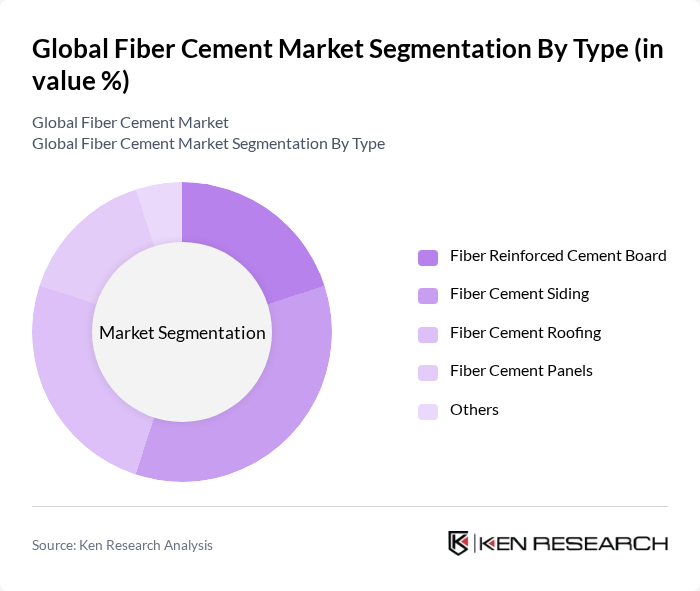

By Type:The fiber cement market is segmented into several product categories, including Fiber Reinforced Cement Board, Fiber Cement Siding, Fiber Cement Roofing, Fiber Cement Panels, and Others. Among these, Fiber Cement Siding is the leading sub-segment due to its widespread use in both residential and commercial buildings. This dominance is driven by consumer preferences for aesthetic appeal, superior durability, and resistance to fire and moisture, making it a top choice for exterior cladding and façade applications.

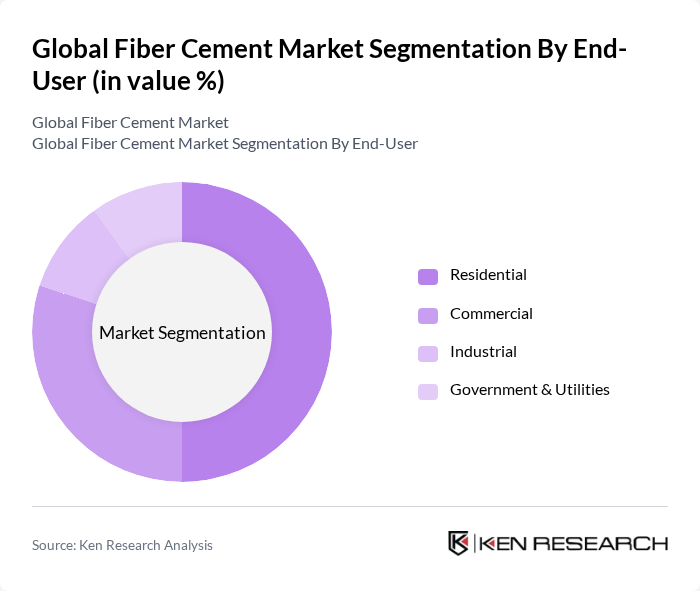

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is the most significant contributor, as homeowners increasingly opt for fiber cement products for their durability, low maintenance, and enhanced fire and weather resistance, particularly in siding and roofing applications. The Commercial segment also shows robust growth, driven by demand for sustainable materials in office buildings, retail spaces, and institutional projects.

The Global Fiber Cement Market is characterized by a dynamic mix of regional and international players. Leading participants such as James Hardie Industries plc, Etex Group, Nichiha Corporation, Cembrit Holding A/S, BGC Fibre Cement, Saint-Gobain, CSR Limited, Siam Cement Group (SCG), Everest Industries Limited, Hume Cemboard Industries Sdn Bhd, Atermit, Swisspearl Group, Sika AG, Shera, Ramco Industries Limited, and Gyproc contribute to innovation, geographic expansion, and service delivery in this space. These companies are actively investing in new product development, expanding production capacities, and adopting sustainable manufacturing practices to strengthen their market presence.

The future of the fiber cement market appears promising, driven by increasing construction activities and a growing emphasis on sustainable building practices. As governments worldwide implement stricter regulations on building materials, the demand for fiber cement is expected to rise. Additionally, advancements in production technologies will likely enhance product quality and reduce costs, making fiber cement more accessible. The trend towards energy-efficient buildings will further bolster the market, as fiber cement aligns with these eco-friendly initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Fiber Reinforced Cement Board Fiber Cement Siding Fiber Cement Roofing Fiber Cement Panels Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Exterior Cladding Interior Walls Flooring Roofing Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Price Range | Economy Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Product Form | Sheets Blocks Tiles Others |

| By Raw Material | Portland Cement Silica Cellulosic Fiber Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 120 | Contractors, Builders, Architects |

| Commercial Building Developments | 90 | Project Managers, Developers, Engineers |

| Infrastructure Projects | 60 | Government Officials, Urban Planners |

| Fiber Cement Product Distributors | 50 | Sales Managers, Distribution Heads |

| End-User Feedback on Fiber Cement | 70 | Homeowners, Property Managers, Facility Managers |

The Global Fiber Cement Market is valued at approximately USD 18.9 billion, driven by the increasing demand for sustainable building materials and the expansion of the construction industry. This market is expected to grow significantly in the coming years.