Region:Global

Author(s):Geetanshi

Product Code:KRAC0097

Pages:89

Published On:August 2025

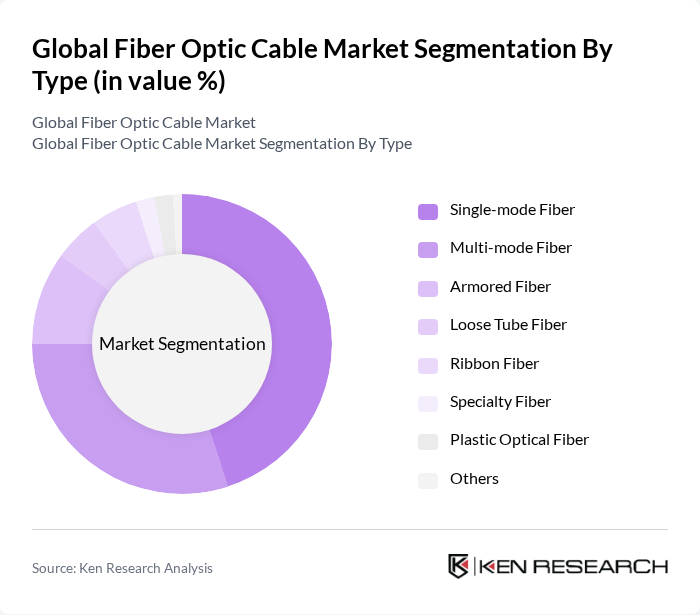

By Type:The fiber optic cable market is segmented into Single-mode Fiber, Multi-mode Fiber, Armored Fiber, Loose Tube Fiber, Ribbon Fiber, Specialty Fiber, Plastic Optical Fiber, and Others. Among these,Single-mode Fiberis the most dominant segment due to its superior ability to transmit data over long distances with minimal signal loss, making it the preferred choice for telecommunications and data center applications.Multi-mode Fiberis also significant, particularly for short-distance and local area network applications, but Single-mode Fiber's efficiency and performance in high-speed networks give it a competitive edge.

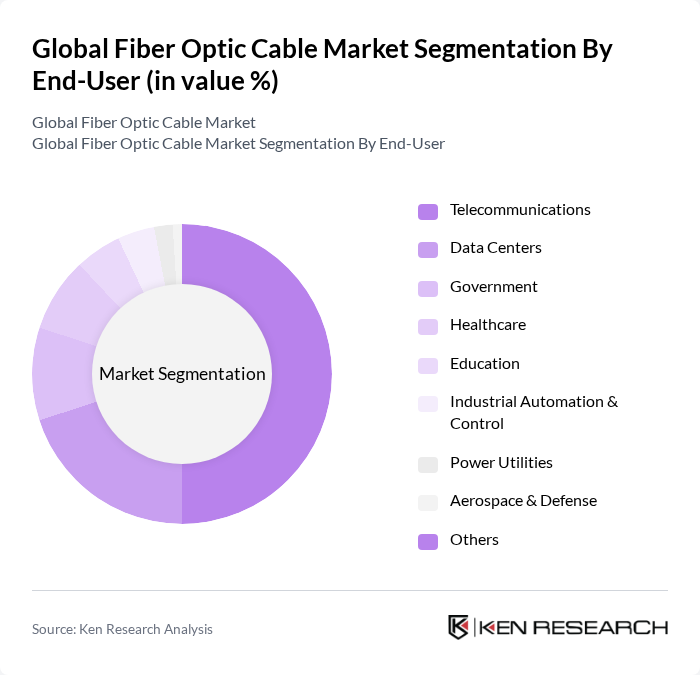

By End-User:The market is also segmented by end-user applications, including Telecommunications, Data Centers, Government, Healthcare, Education, Industrial Automation & Control, Power Utilities, Aerospace & Defense, and Others. TheTelecommunicationssegment holds the largest share, driven by the surging demand for high-speed internet and mobile data services, as well as the deployment of 5G networks.Data Centersare a significant end-user, requiring robust fiber optic solutions to support increasing data transmission needs. Thehealthcaresector is emerging as a key user due to the adoption of telemedicine, advanced imaging technologies, and digital health infrastructure.

The Global Fiber Optic Cable Market is characterized by a dynamic mix of regional and international players. Leading participants such as Corning Incorporated, Prysmian Group, OFS Fitel, LLC, Sumitomo Electric Industries, Ltd., Fujikura Ltd., CommScope Holding Company, Inc., Sterlite Technologies Limited, Nexans S.A., Leviton Manufacturing Co., Inc., Belden Inc., TE Connectivity Ltd., 3M Company, ZTT International Limited, Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC), Hengtong Optic-Electric Co., Ltd., Furukawa Electric Co., Ltd., LS Cable & System Ltd., Hexatronic Group AB, Optical Cable Corporation, AFL (A subsidiary of Fujikura Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fiber optic cable market appears promising, driven by technological advancements and increasing connectivity demands. As smart city initiatives gain momentum, the integration of fiber optics will be crucial for efficient urban infrastructure. Additionally, the rise of IoT devices is expected to further propel the need for high-speed connectivity, creating new opportunities for fiber optic deployment. With ongoing government support and investments, the market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-mode Fiber Multi-mode Fiber Armored Fiber Loose Tube Fiber Ribbon Fiber Specialty Fiber Plastic Optical Fiber Others |

| By End-User | Telecommunications Data Centers Government Healthcare Education Industrial Automation & Control Power Utilities Aerospace & Defense Others |

| By Application | Telecommunications Networks Broadband Networks Enterprise Networks Cable Television Military and Aerospace Medical Imaging Oil & Gas Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Medium High |

| By Technology | Passive Optical Networks (PON) Active Optical Networks (AON) Dense Wavelength Division Multiplexing (DWDM) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Network Infrastructure | 100 | Network Engineers, Infrastructure Managers |

| Fiber Optic Cable Manufacturing | 60 | Production Managers, Quality Control Specialists |

| Installation and Maintenance Services | 50 | Field Technicians, Service Managers |

| Government and Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

| End-User Industries (e.g., Data Centers) | 40 | IT Managers, Operations Directors |

The Global Fiber Optic Cable Market is valued at approximately USD 8.1 billion, driven by the increasing demand for high-speed internet, telecommunications infrastructure expansion, and the adoption of fiber optics across various industries, including healthcare and data centers.