Region:Global

Author(s):Dev

Product Code:KRAB0418

Pages:99

Published On:August 2025

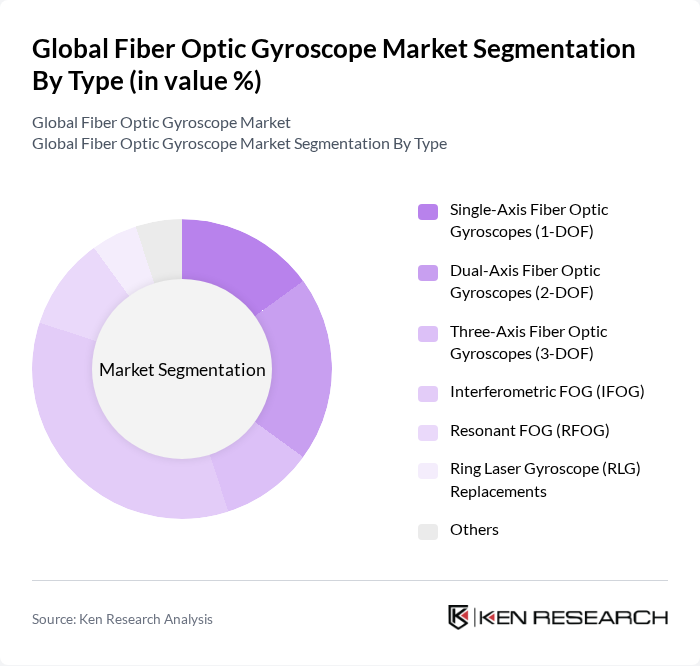

By Type:The market is segmented into various types of fiber optic gyroscopes, including Single-Axis Fiber Optic Gyroscopes (1-DOF), Dual-Axis Fiber Optic Gyroscopes (2-DOF), Three-Axis Fiber Optic Gyroscopes (3-DOF), Interferometric FOG (IFOG), Resonant FOG (RFOG), Ring Laser Gyroscope (RLG) Replacements, and Others. Among these, the Interferometric FOG (IFOG) segment is leading the market due to its high precision and reliability in navigation and stabilization applications. IFOG’s maturity, scale manufacturing, and widespread integration in IMUs/INS for aerospace, defense, and industrial robotics underpin its leadership; RFOG remains an area of active development for low-drift performance but with narrower commercial deployment today.

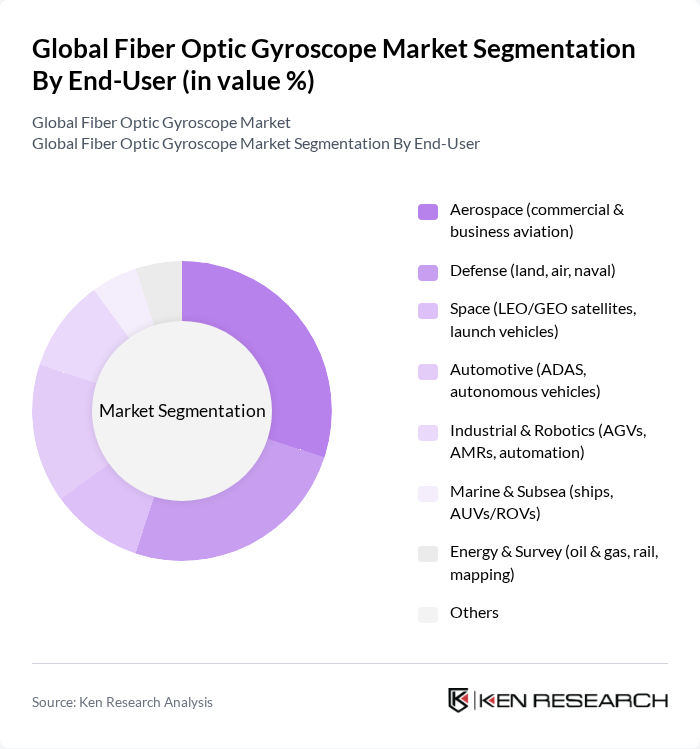

By End-User:The market is segmented by end-user applications, including Aerospace (commercial & business aviation), Defense (land, air, naval), Space (LEO/GEO satellites, launch vehicles), Automotive (ADAS, autonomous vehicles), Industrial & Robotics (AGVs, AMRs, automation), Marine & Subsea (ships, AUVs/ROVs), Energy & Survey (oil & gas, rail, mapping), and Others. The Aerospace segment is currently prominent due to continued demand for advanced navigation and stabilization in commercial and military aircraft; defense programs for guided munitions, ISR platforms, and naval systems also represent a substantial share, while industrial/robotics and unmanned systems adoption continues to expand as automation and autonomy increase.

The Global Fiber Optic Gyroscope Market is characterized by a dynamic mix of regional and international players. Leading participants such as Northrop Grumman Corporation (FOG/INS, navigation-grade), Honeywell International Inc. (FOG and RLG portfolios), Safran S.A. (Safran Electronics & Defense), Thales Group (Thales Alenia Space; inertial systems), Teledyne Technologies Incorporated (Teledyne CDL), EMCORE Corporation, KVH Industries, Inc., iXblue (now Exail Technologies), Tamagawa Seiki Co., Ltd., Fizoptika (Fizoptika Malta), Optolink LLC, Collins Aerospace (Raytheon Technologies), Inertial Labs, Inc., VectorNav Technologies, LLC, and Safran Colibrys (MEMS & inertial components) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fiber optic gyroscope market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of fiber optic gyroscopes with IoT devices is expected to enhance data collection and analytics capabilities, leading to improved performance optimization. Additionally, the expansion into emerging markets presents significant growth potential, as industries in these regions begin to adopt advanced navigation technologies to enhance operational efficiency and safety.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Axis Fiber Optic Gyroscopes (1-DOF) Dual-Axis Fiber Optic Gyroscopes (2-DOF) Three-Axis Fiber Optic Gyroscopes (3-DOF) Interferometric FOG (IFOG) Resonant FOG (RFOG) Ring Laser Gyroscope (RLG) Replacements Others |

| By End-User | Aerospace (commercial & business aviation) Defense (land, air, naval) Space (LEO/GEO satellites, launch vehicles) Automotive (ADAS, autonomous vehicles) Industrial & Robotics (AGVs, AMRs, automation) Marine & Subsea (ships, AUVs/ROVs) Energy & Survey (oil & gas, rail, mapping) Others |

| By Application | Inertial Navigation Systems (INS) and IMUs Platform Stabilization (gimbals, EO/IR, antennas) Guidance & Control (missiles, UAVs, UGVs) Dead-Reckoning & GNSS Aiding Surveying & Mapping (LiDAR, marine gyrocompass) Robotics Localization & SLAM Others |

| By Component | Optical Fiber Coil (flanged, hubbed, freestanding) Light Source & Photodetectors Optics (couplers, modulators, polarizers) Control Electronics & DSP Software/Firmware (calibration, filtering) Packaging & Ruggedization Others |

| By Sales Channel | Direct (OEM & government programs) Authorized Distributors/Integrators System Integrators (INS/IMU vendors) Online/Inside Sales Others |

| By Distribution Mode | B2G (defense & space procurement) B2B (OEMs, Tier-1s, integrators) B2B2G (through primes/contractors) Others |

| By Price Range | Entry/Tactical Grade Navigation Grade Strategic Grade Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Applications | 100 | Systems Engineers, Aerospace Project Managers |

| Automotive Navigation Systems | 80 | Automotive Engineers, Product Development Managers |

| Marine and Subsea Applications | 70 | Marine Engineers, R&D Specialists |

| Defense and Military Use | 90 | Defense Contractors, Military Technology Experts |

| Consumer Electronics Integration | 40 | Product Managers, Electronics Engineers |

The Global Fiber Optic Gyroscope Market is valued at approximately USD 1.25 billion, driven by the demand for high-precision inertial navigation and stabilization in sectors such as aerospace, defense, and industrial automation.