Region:Global

Author(s):Rebecca

Product Code:KRAA1445

Pages:97

Published On:August 2025

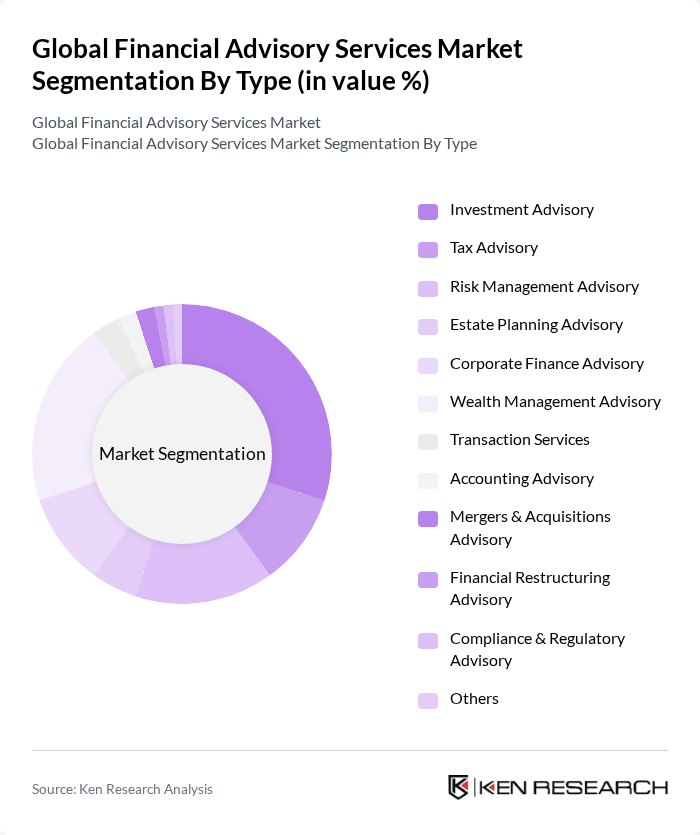

By Type:The financial advisory services market is segmented into Investment Advisory, Tax Advisory, Risk Management Advisory, Estate Planning Advisory, Corporate Finance Advisory, Wealth Management Advisory, Transaction Services, Accounting Advisory, Mergers & Acquisitions Advisory, Financial Restructuring Advisory, Compliance & Regulatory Advisory, and Others. Among these, Investment Advisory and Wealth Management Advisory are particularly prominent, driven by the rising number of high-net-worth individuals seeking personalized investment strategies, the adoption of digital advisory platforms, and the growing need for holistic portfolio management and tax optimization .

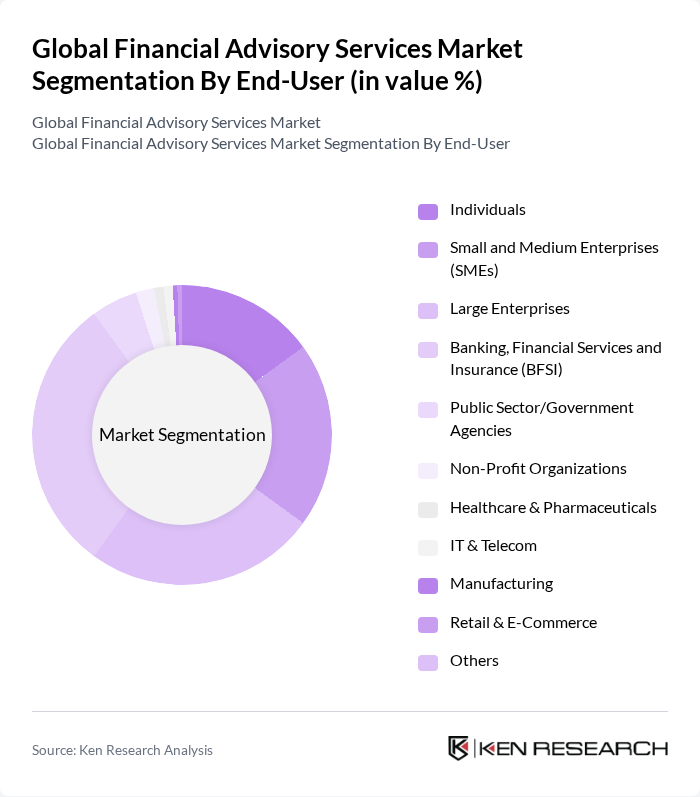

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Large Enterprises, Banking, Financial Services and Insurance (BFSI), Public Sector/Government Agencies, Non-Profit Organizations, Healthcare & Pharmaceuticals, IT & Telecom, Manufacturing, Retail & E-Commerce, and Others. The BFSI sector is a significant contributor to the market, driven by the need for compliance, risk management, and strategic financial planning in a highly regulated environment. Additionally, the increasing complexity of financial products and the adoption of digital advisory models are expanding the reach of advisory services to SMEs and individuals .

The Global Financial Advisory Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deloitte, PricewaterhouseCoopers (PwC), Ernst & Young (EY), KPMG, McKinsey & Company, Boston Consulting Group (BCG), Accenture, Bain & Company, Oliver Wyman, Grant Thornton, RSM International, Baker Tilly, Protiviti, Alvarez & Marsal, FTI Consulting, UBS Group AG, Morgan Stanley, Bank of America Corporation, Raymond James Financial, Charles Schwab Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the financial advisory services market appears promising, driven by technological advancements and evolving client expectations. The integration of artificial intelligence and machine learning is expected to enhance service delivery, allowing firms to offer more personalized solutions. Additionally, as clients increasingly prioritize sustainable investments, advisory firms will need to adapt their strategies to align with these values. The focus on enhancing client experience will also shape service offerings, ensuring firms remain competitive in a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Investment Advisory Tax Advisory Risk Management Advisory Estate Planning Advisory Corporate Finance Advisory Wealth Management Advisory Transaction Services Accounting Advisory Mergers & Acquisitions Advisory Financial Restructuring Advisory Compliance & Regulatory Advisory Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Enterprises Banking, Financial Services and Insurance (BFSI) Public Sector/Government Agencies Non-Profit Organizations Healthcare & Pharmaceuticals IT & Telecom Manufacturing Retail & E-Commerce Others |

| By Service Model | Fee-Only Commission-Based Hybrid |

| By Client Type | High-Net-Worth Individuals (HNWIs) Ultra-High-Net-Worth Individuals (UHNWIs) Retail Clients Institutional Clients Small and Medium Enterprises Large Corporations |

| By Geographic Focus | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Advisory Focus | Financial Planning Investment Management Tax Strategy Risk & Compliance M&A and Restructuring |

| By Pricing Structure | Hourly Rate Flat Fee Percentage of Assets Under Management (AUM) Performance-Based Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| M&A Advisory Services | 100 | Investment Bankers, Corporate Development Executives |

| Risk Management Consulting | 80 | Risk Analysts, Compliance Officers |

| Financial Restructuring | 70 | Turnaround Specialists, Financial Advisors |

| Valuation Services | 50 | Valuation Analysts, CFOs |

| Corporate Finance Advisory | 60 | Financial Consultants, Business Strategists |

The Global Financial Advisory Services Market is valued at approximately USD 218 billion, reflecting a significant growth driven by the increasing demand for strategic financial planning, risk management, and investment advisory services.